- Hong Kong

- /

- Renewable Energy

- /

- SEHK:8326

Does Tonking New Energy Group Holdings (HKG:8326) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Tonking New Energy Group Holdings Limited (HKG:8326) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Tonking New Energy Group Holdings

What Is Tonking New Energy Group Holdings's Net Debt?

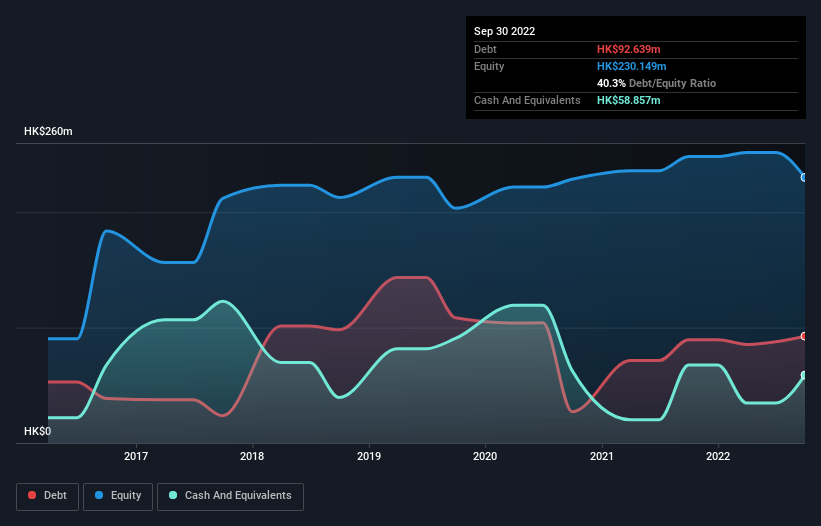

The chart below, which you can click on for greater detail, shows that Tonking New Energy Group Holdings had HK$92.6m in debt in September 2022; about the same as the year before. However, because it has a cash reserve of HK$58.9m, its net debt is less, at about HK$33.8m.

How Healthy Is Tonking New Energy Group Holdings' Balance Sheet?

We can see from the most recent balance sheet that Tonking New Energy Group Holdings had liabilities of HK$215.3m falling due within a year, and liabilities of HK$2.07m due beyond that. On the other hand, it had cash of HK$58.9m and HK$237.1m worth of receivables due within a year. So it can boast HK$78.6m more liquid assets than total liabilities.

This excess liquidity is a great indication that Tonking New Energy Group Holdings' balance sheet is almost as strong as Fort Knox. Having regard to this fact, we think its balance sheet is as strong as an ox.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a debt to EBITDA ratio of 2.1, Tonking New Energy Group Holdings uses debt artfully but responsibly. And the alluring interest cover (EBIT of 8.8 times interest expense) certainly does not do anything to dispel this impression. Pleasingly, Tonking New Energy Group Holdings is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 142% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Tonking New Energy Group Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Tonking New Energy Group Holdings burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Tonking New Energy Group Holdings's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. Taking all this data into account, it seems to us that Tonking New Energy Group Holdings takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for Tonking New Energy Group Holdings you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Tonking New Energy Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8326

Tonking New Energy Group Holdings

An investment holding company, engages in the renewable energy business in the People’s Republic of China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.