- Hong Kong

- /

- Water Utilities

- /

- SEHK:6136

Kangda International Environmental (HKG:6136) sheds HK$225m, company earnings and investor returns have been trending downwards for past five years

It is a pleasure to report that the Kangda International Environmental Company Limited (HKG:6136) is up 38% in the last quarter. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 63% in the period. Some might say the recent bounce is to be expected after such a bad drop. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

If the past week is anything to go by, investor sentiment for Kangda International Environmental isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Kangda International Environmental

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

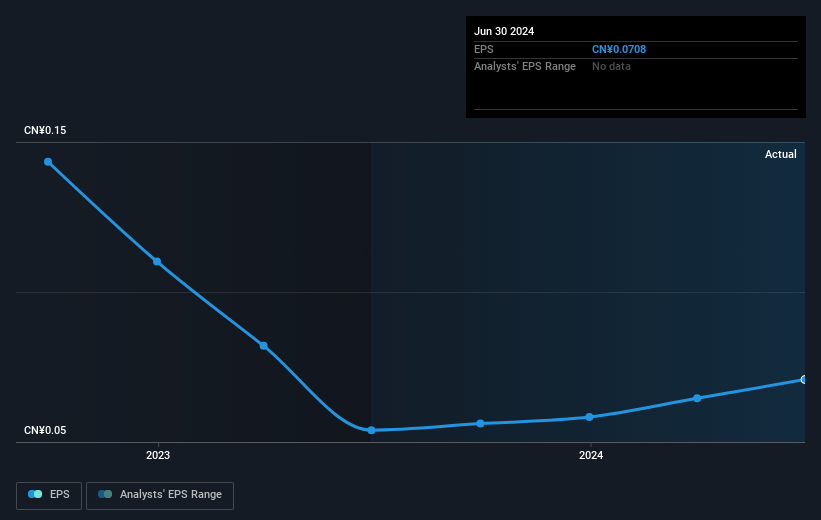

During the five years over which the share price declined, Kangda International Environmental's earnings per share (EPS) dropped by 14% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 18% per year, over the period. So it seems the market was too confident about the business, in the past. The low P/E ratio of 3.68 further reflects this reticence.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Kangda International Environmental's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Kangda International Environmental's TSR for the year was broadly in line with the market average, at 19%. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 10%, which was endured over half a decade. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. It's always interesting to track share price performance over the longer term. But to understand Kangda International Environmental better, we need to consider many other factors. Take risks, for example - Kangda International Environmental has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kangda International Environmental might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6136

Kangda International Environmental

An investment holding company, engages in the urban water treatment, water environment comprehensive remediation, and rural water improvement businesses in Mainland China.

Good value with proven track record.

Market Insights

Community Narratives