- Hong Kong

- /

- Gas Utilities

- /

- SEHK:603

China Oil And Gas Group (HKG:603) Takes On Some Risk With Its Use Of Debt

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, China Oil And Gas Group Limited (HKG:603) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for China Oil And Gas Group

What Is China Oil And Gas Group's Debt?

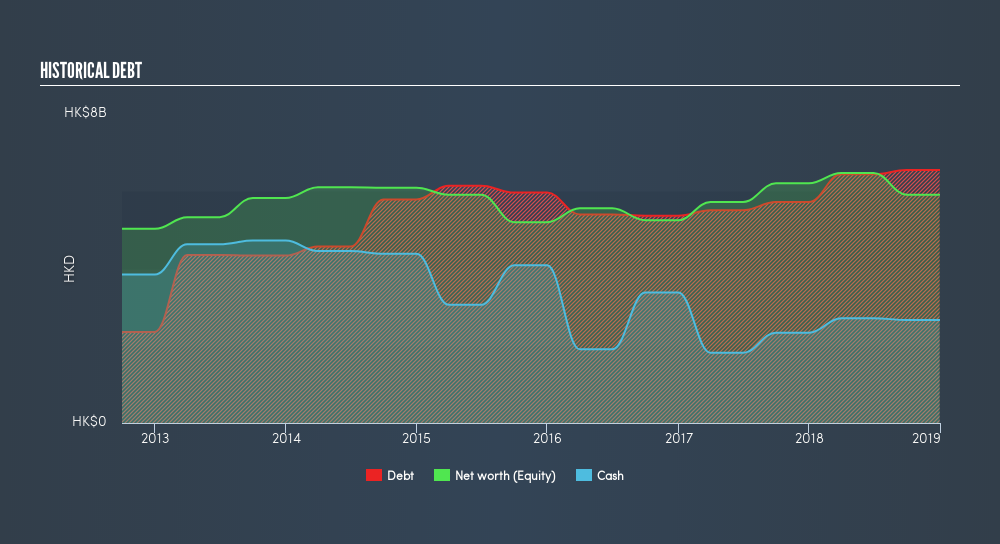

As you can see below, at the end of December 2018, China Oil And Gas Group had HK$6.55b of debt, up from HK$5.72b a year ago. Click the image for more detail. On the flip side, it has HK$2.67b in cash leading to net debt of about HK$3.88b.

How Healthy Is China Oil And Gas Group's Balance Sheet?

We can see from the most recent balance sheet that China Oil And Gas Group had liabilities of HK$4.61b falling due within a year, and liabilities of HK$5.50b due beyond that. Offsetting these obligations, it had cash of HK$2.67b as well as receivables valued at HK$1.76b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$5.69b.

This deficit casts a shadow over the HK$1.95b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, China Oil And Gas Group would probably need a major re-capitalization if its creditors were to demand repayment. Either way, since China Oil And Gas Group does have more debt than cash, it's worth keeping an eye on its balance sheet.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

China Oil And Gas Group's net debt is 2.68 times its EBITDA, which is a significant but still reasonable amount of leverage. But its EBIT was about 16.6 times its interest expense, implying the company isn't really paying full freight on that debt. Even if not sustainable, that is a good sign. We saw China Oil And Gas Group grow its EBIT by 9.2% in the last twelve months. That's far from incredible but it is a good thing, when it comes to paying off debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is China Oil And Gas Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, China Oil And Gas Group's free cash flow amounted to 45% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

We'd go so far as to say China Oil And Gas Group's level of total liabilities was disappointing. But on the bright side, its interest cover is a good sign, and makes us more optimistic. It's also worth noting that China Oil And Gas Group is in the Gas Utilities industry, which is often considered to be quite defensive. Once we consider all the factors above, together, it seems to us that China Oil And Gas Group's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Given our hesitation about the stock, it would be good to know if China Oil And Gas Group insiders have sold any shares recently. You click here to find out if insiders have sold recently.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:603

China Oil And Gas Group

An investment holding company, engages in natural gas and energy-related businesses in Hong Kong, China, and Canada.

Good value with mediocre balance sheet.

Market Insights

Community Narratives