- Hong Kong

- /

- Water Utilities

- /

- SEHK:371

Most Shareholders Will Probably Agree With Beijing Enterprises Water Group Limited's (HKG:371) CEO Compensation

Key Insights

- Beijing Enterprises Water Group will host its Annual General Meeting on 3rd of June

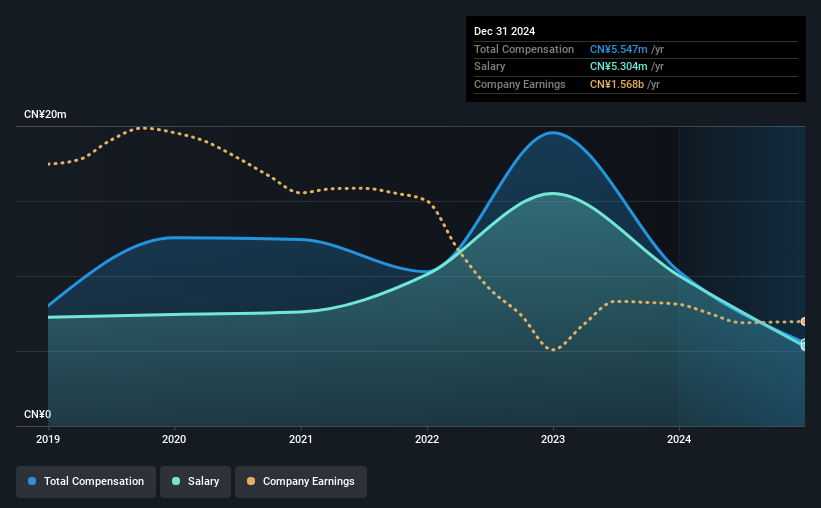

- CEO Min Zhou's total compensation includes salary of CN¥5.30m

- The overall pay is 34% below the industry average

- Beijing Enterprises Water Group's total shareholder return over the past three years was 25% while its EPS was down 23% over the past three years

Performance at Beijing Enterprises Water Group Limited (HKG:371) has been rather uninspiring recently and shareholders may be wondering how CEO Min Zhou plans to fix this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 3rd of June. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

Check out our latest analysis for Beijing Enterprises Water Group

Comparing Beijing Enterprises Water Group Limited's CEO Compensation With The Industry

Our data indicates that Beijing Enterprises Water Group Limited has a market capitalization of HK$26b, and total annual CEO compensation was reported as CN¥5.5m for the year to December 2024. That's a notable decrease of 46% on last year. We note that the salary portion, which stands at CN¥5.30m constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the Hong Kong Water Utilities industry with market caps ranging from HK$16b to HK$50b, we found that the median CEO total compensation was CN¥8.4m. That is to say, Min Zhou is paid under the industry median. Moreover, Min Zhou also holds HK$972m worth of Beijing Enterprises Water Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥5.3m | CN¥10m | 96% |

| Other | CN¥243k | CN¥284k | 4% |

| Total Compensation | CN¥5.5m | CN¥10m | 100% |

On an industry level, roughly 93% of total compensation represents salary and 7% is other remuneration. Beijing Enterprises Water Group has gone down a largely traditional route, paying Min Zhou a high salary, giving it preference over non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Beijing Enterprises Water Group Limited's Growth

Over the last three years, Beijing Enterprises Water Group Limited has shrunk its earnings per share by 23% per year. In the last year, its revenue is down 1.0%.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Beijing Enterprises Water Group Limited Been A Good Investment?

With a total shareholder return of 25% over three years, Beijing Enterprises Water Group Limited shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Min receives almost all of their compensation through a salary. While it's true that shareholders have seen decent returns, it's hard to overlook the lack of earnings growth and this makes us wonder if the current returns can continue. These are are some concerns that shareholders may want to address the board when they revisit their investment thesis.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for Beijing Enterprises Water Group that investors should look into moving forward.

Important note: Beijing Enterprises Water Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Beijing Enterprises Water Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:371

Beijing Enterprises Water Group

An investment holding company, provides water treatment services.

Second-rate dividend payer and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion