- Hong Kong

- /

- Water Utilities

- /

- SEHK:371

Is Refinancing Offshore Debt With RMB 2 Billion in Notes Changing the Investment Case for Beijing Enterprises Water Group (SEHK:371)?

Reviewed by Sasha Jovanovic

- The board of directors of Beijing Enterprises Water Group announced in November 2025 that the company completed the issuance of RMB 2 billion (US$280 million) in medium-term notes, with maturities in 2028 and 2030 at coupon rates of 1.96% and 2.11% per annum, respectively.

- This funding is specifically earmarked to repay loans from financial institutions outside mainland China, highlighting a shift toward optimizing the company’s debt structure and enhancing liquidity management.

- We’ll explore how refinancing offshore debt through these new notes could influence Beijing Enterprises Water Group’s investment narrative moving forward.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Beijing Enterprises Water Group's Investment Narrative?

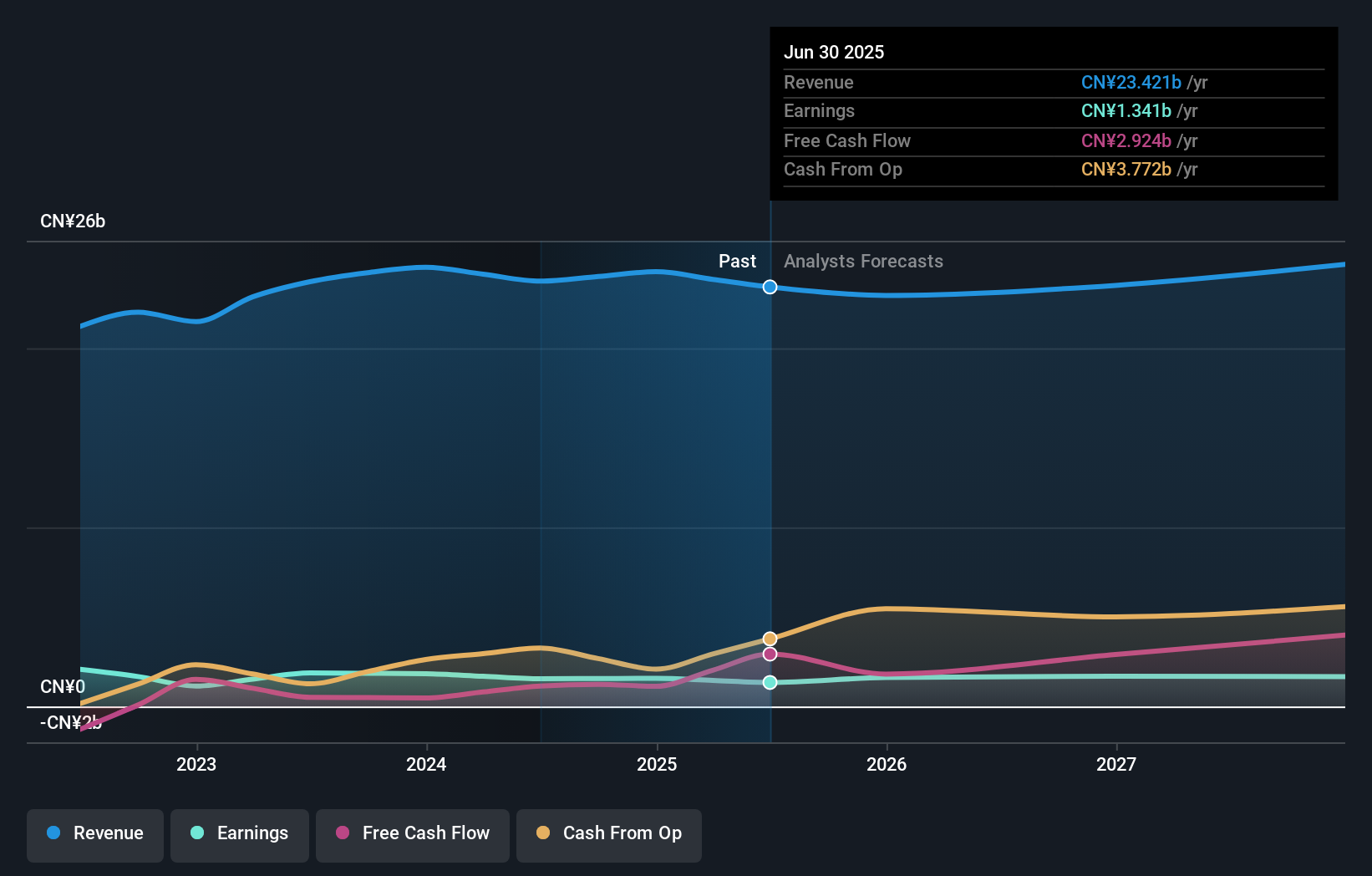

Investors looking at Beijing Enterprises Water Group typically need to have confidence in the essential nature of water utilities in China and the company's ongoing ability to navigate regulatory, funding, and operational challenges. The recent RMB 2 billion medium-term notes issuance, aimed at repaying offshore loans, marks a significant step in addressing near-term refinancing risk and may ease immediate pressure on cash flows. This move could improve liquidity and reduce foreign exchange risk, shifting one of the major short-term catalysts from debt repayment uncertainty to a clearer focus on operational performance and earnings stability. Prior to this, the biggest risks revolved around persistent earnings declines, high interest costs not well covered by earnings, and relatively expensive valuation multiples compared to peers. The refinancing effort slightly alters these risks, though sustained earnings growth and improved margin performance remain important for the investment thesis.

But with cash flow still under pressure, currency and coverage risks are not fully eliminated. Beijing Enterprises Water Group's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Beijing Enterprises Water Group - why the stock might be worth over 2x more than the current price!

Build Your Own Beijing Enterprises Water Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beijing Enterprises Water Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Beijing Enterprises Water Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beijing Enterprises Water Group's overall financial health at a glance.

No Opportunity In Beijing Enterprises Water Group?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Enterprises Water Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:371

Beijing Enterprises Water Group

An investment holding company, provides water treatment services.

Second-rate dividend payer and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.