- Hong Kong

- /

- Gas Utilities

- /

- SEHK:3

What Investors Should Know About The Hong Kong and China Gas Company Limited's (HKG:3) Financial Strength

There are a number of reasons that attract investors towards large-cap companies such as The Hong Kong and China Gas Company Limited (HKG:3), with a market cap of HK$279b. Market participants who are conscious of risk tend to search for large firms, attracted by the prospect of varied revenue sources and strong returns on capital. However, the health of the financials determines whether the company continues to succeed. I will provide an overview of Hong Kong and China Gas’s financial liquidity and leverage to give you an idea of Hong Kong and China Gas’s position to take advantage of potential acquisitions or comfortably endure future downturns. Note that this commentary is very high-level and solely focused on financial health, so I suggest you dig deeper yourself into 3 here.

Check out our latest analysis for Hong Kong and China Gas

Does 3 Produce Much Cash Relative To Its Debt?

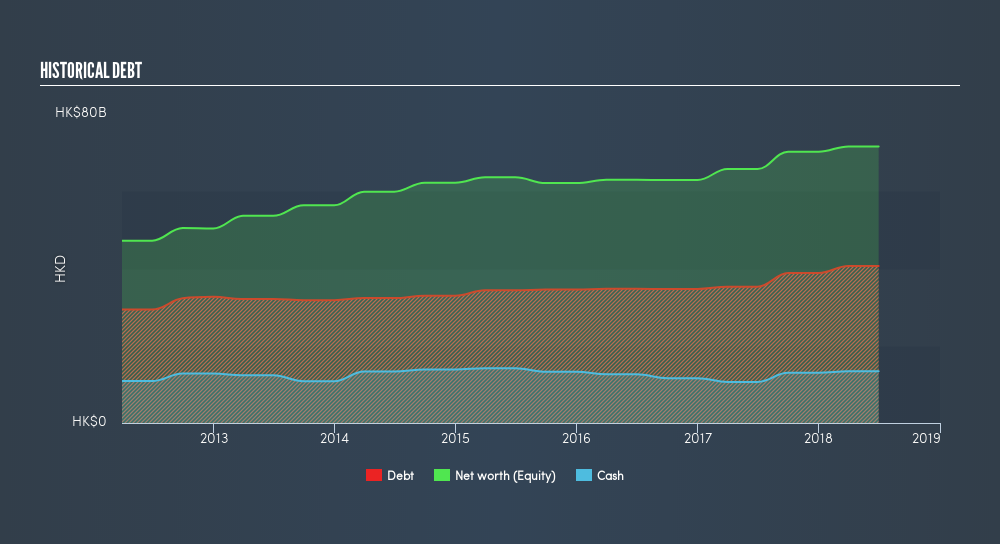

3 has built up its total debt levels in the last twelve months, from HK$35b to HK$41b – this includes long-term debt. With this growth in debt, 3's cash and short-term investments stands at HK$13b to keep the business going. Additionally, 3 has produced HK$9.1b in operating cash flow over the same time period, leading to an operating cash to total debt ratio of 22%, indicating that 3’s debt is appropriately covered by operating cash.

Can 3 meet its short-term obligations with the cash in hand?

At the current liabilities level of HK$33b, it appears that the company may not be able to easily meet these obligations given the level of current assets of HK$25b, with a current ratio of 0.76x. The current ratio is calculated by dividing current assets by current liabilities.

Does 3 face the risk of succumbing to its debt-load?

With debt reaching 57% of equity, 3 may be thought of as relatively highly levered. This is not unusual for large-caps since debt tends to be less expensive than equity because interest payments are tax deductible. Since large-caps are seen as safer than their smaller constituents, they tend to enjoy lower cost of capital. We can test if 3’s debt levels are sustainable by measuring interest payments against earnings of a company. A company generating earnings after interest and tax at least three times its net interest payments is considered financially sound. For 3, the ratio of 10.08x suggests that interest is amply covered. It is considered a responsible and reassuring practice to maintain high interest coverage, which makes 3 and other large-cap investments thought to be safe.

Next Steps:

At its current level of cash flow coverage, 3 has room for improvement to better cushion for events which may require debt repayment. In addition to this, its low liquidity raises concerns over whether current asset management practices are properly implemented for the large-cap. I admit this is a fairly basic analysis for 3's financial health. Other important fundamentals need to be considered alongside. I suggest you continue to research Hong Kong and China Gas to get a more holistic view of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for 3’s future growth? Take a look at our free research report of analyst consensus for 3’s outlook.

- Valuation: What is 3 worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether 3 is currently mispriced by the market.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:3

Hong Kong and China Gas

Produces, distributes, and markets gas, water supply and energy services in Hong Kong and Mainland China.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives