- Hong Kong

- /

- Gas Utilities

- /

- SEHK:3

The Hong Kong and China Gas Company Limited (HKG:3): What Are The Future Prospects?

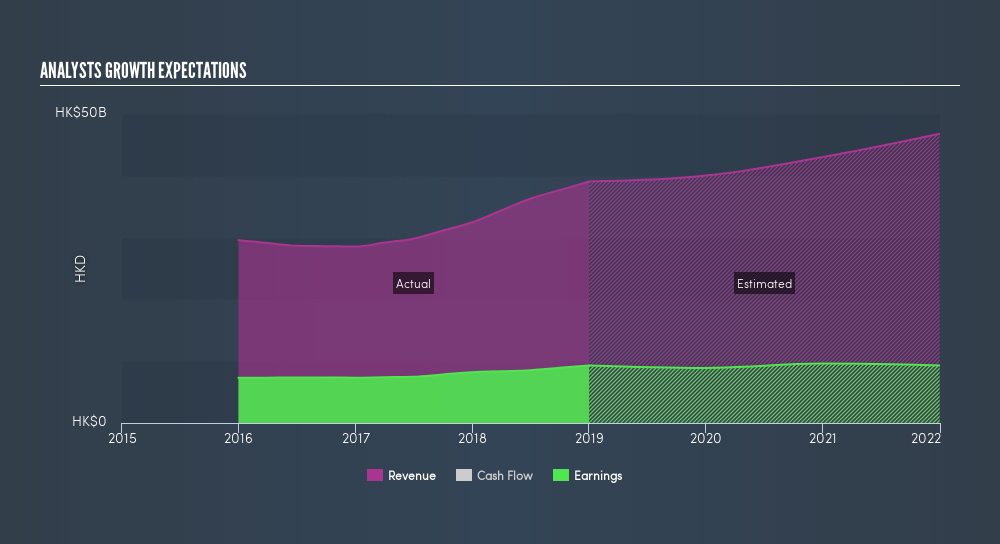

In December 2018, The Hong Kong and China Gas Company Limited (HKG:3) released its most recent earnings announcement, which revealed that the company benefited from a strong tailwind, leading to a double-digit earnings growth of 13%. Below is my commentary, albeit very simple and high-level, on how market analysts predict Hong Kong and China Gas's earnings growth outlook over the next couple of years and whether the future looks even brighter than the past. I will be using net income excluding extraordinary items in order to exclude one-off volatility which I am not interested in.

View our latest analysis for Hong Kong and China Gas

Market analysts' consensus outlook for next year seems pessimistic, with earnings falling by -4.3%. But in the following year, there's contrast in performance, with earnings growth rates reaching double digit 3.4% compared to today’s level before decreasing. to HK$9.3b in 2022.

While it is informative understanding the rate of growth each year relative to today’s figure, it may be more valuable estimating the rate at which the business is moving every year, on average. The benefit of this technique is that it ignores near term flucuations and accounts for the overarching direction of Hong Kong and China Gas's earnings trajectory over time, be more volatile. To calculate this rate, I put a line of best fit through analyst consensus of forecasted earnings. The slope of this line is the rate of earnings growth, which in this case is 1.2%. This means that, we can presume Hong Kong and China Gas will grow its earnings by 1.2% every year for the next couple of years.

Next Steps:

For Hong Kong and China Gas, I've compiled three key factors you should further examine:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Valuation: What is 3 worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether 3 is currently mispriced by the market.

- Other High-Growth Alternatives: Are there other high-growth stocks you could be holding instead of 3? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:3

Hong Kong and China Gas

Produces, distributes, and markets gas, water supply and energy services in Hong Kong and Mainland China.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives