- Hong Kong

- /

- Gas Utilities

- /

- SEHK:3

Some Shareholders Feeling Restless Over The Hong Kong and China Gas Company Limited's (HKG:3) P/E Ratio

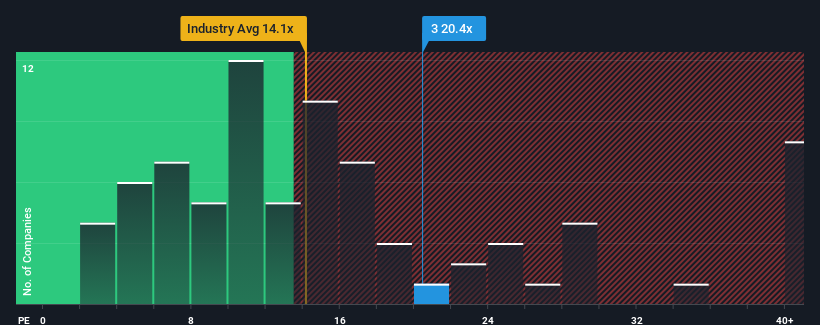

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider The Hong Kong and China Gas Company Limited (HKG:3) as a stock to avoid entirely with its 20.4x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Hong Kong and China Gas' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Hong Kong and China Gas

Does Growth Match The High P/E?

Hong Kong and China Gas' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 27% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 10% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 12% per annum, which is not materially different.

With this information, we find it interesting that Hong Kong and China Gas is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Hong Kong and China Gas currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Hong Kong and China Gas that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong and China Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3

Hong Kong and China Gas

Produces, distributes, and markets gas, water supply and energy services in Hong Kong and Mainland China.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives