- Hong Kong

- /

- Gas Utilities

- /

- SEHK:3

Should Hong Kong and China Gas’ Earnings Miss and Profit Downgrade Require Action From SEHK:3 Investors?

Reviewed by Sasha Jovanovic

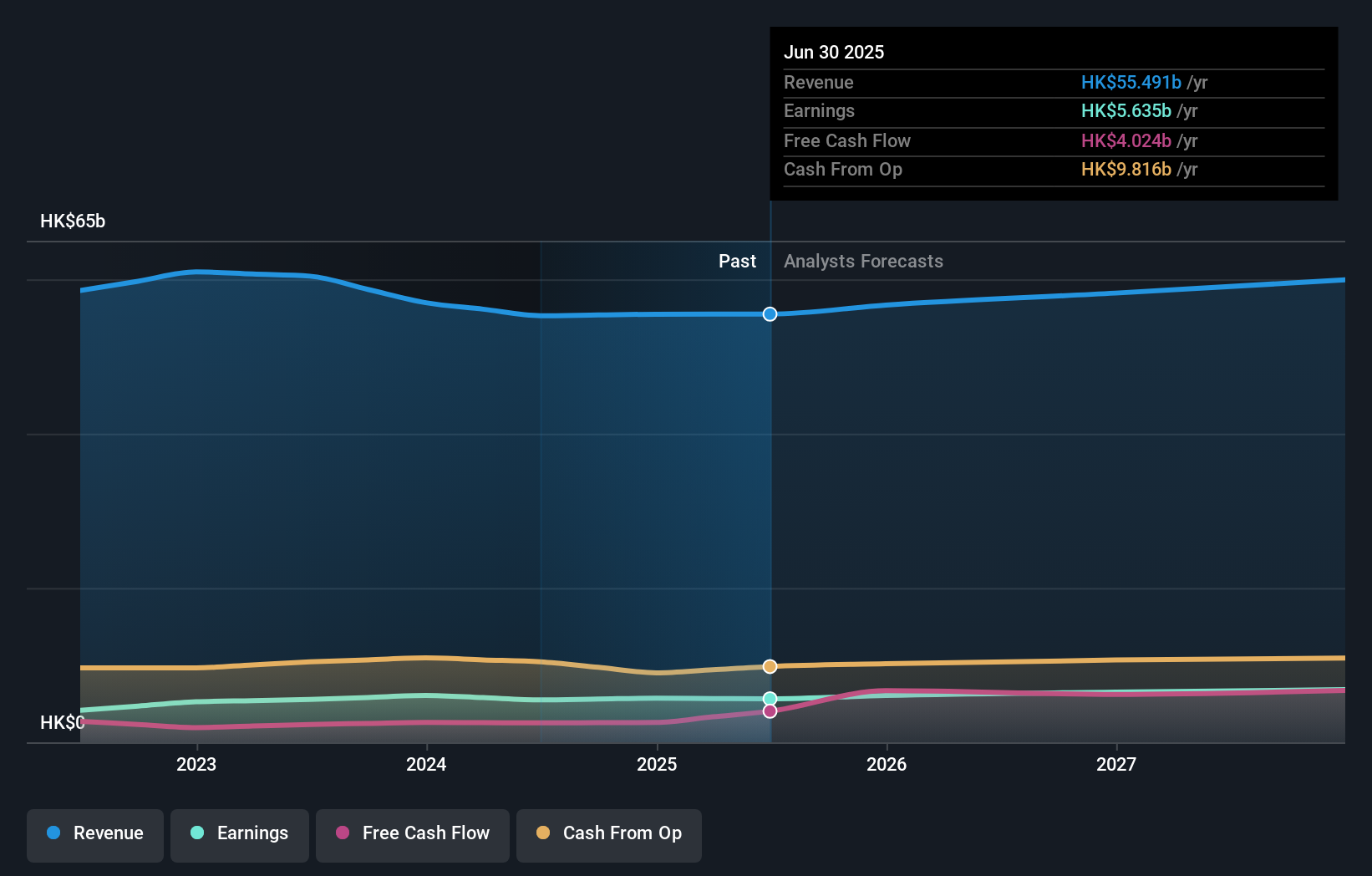

- In the first half of its fiscal year to September 2025, Hong Kong and China Gas reported a 2% year-on-year revenue decline and a 24% fall in net profit, undershooting broker expectations due mainly to weaker new residential gas connections.

- CICC responded by trimming its net profit forecasts for fiscal years 2026 and 2027 by around 9%, yet kept an Outperform rating, highlighting improving cash flow and the potential for stable dividends as important offsets to softer operating trends.

- We’ll now examine how the earnings miss and reduced profit forecasts shape Hong Kong and China Gas’s investment narrative and risk profile.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Hong Kong and China Gas' Investment Narrative?

To stay invested in Hong Kong and China Gas, you have to believe in a long-term, regulated utility story where gas distribution and related services can still generate steady cash flows, even if growth is modest and competition for capital is intense. The latest half-year miss and CICC’s profit forecast cuts reinforce that the near term is more about defending earnings quality than chasing expansion, with softer new residential connections now a more visible drag on one of the traditional growth levers. At the same time, the company’s track record of regular dividends and improving cash flow, highlighted by brokers, keeps income continuity as a key short-term catalyst, especially after a solid 1-year total return. The bigger risk now is that weaker demand and high leverage could pressure dividend sustainability if operating trends stay soft.

However, investors should be aware of the growing tension between dividend expectations and balance sheet flexibility. Despite retreating, Hong Kong and China Gas' shares might still be trading 23% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Hong Kong and China Gas - why the stock might be worth just HK$7.27!

Build Your Own Hong Kong and China Gas Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hong Kong and China Gas research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hong Kong and China Gas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hong Kong and China Gas' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong and China Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3

Hong Kong and China Gas

Produces, distributes, and markets gas, water supply and energy services in Hong Kong and Mainland China.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026