- Hong Kong

- /

- Gas Utilities

- /

- SEHK:3

Earnings Miss: The Hong Kong and China Gas Company Limited Missed EPS By 16% And Analysts Are Revising Their Forecasts

The Hong Kong and China Gas Company Limited (HKG:3) missed earnings with its latest yearly results, disappointing overly-optimistic forecasters. It wasn't a great result overall - while revenue fell marginally short of analyst estimates at HK$41b, statutory earnings missed forecasts by 16%, coming in at just HK$0.41 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Hong Kong and China Gas

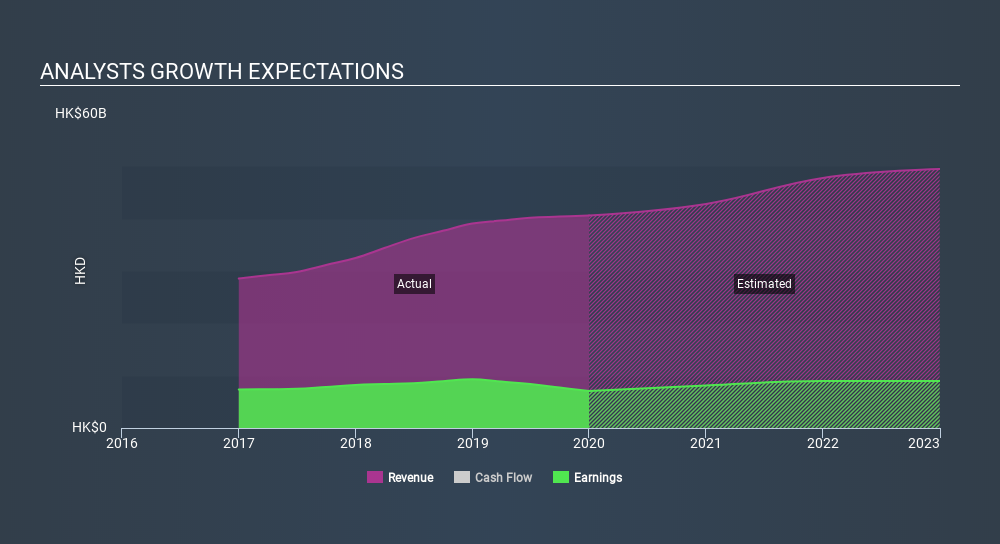

Taking into account the latest results, the consensus forecast from Hong Kong and China Gas's twelve analysts is for revenues of HK$42.8b in 2020, which would reflect a modest 5.4% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to step up 16% to HK$0.48. In the lead-up to this report, the analysts had been modelling revenues of HK$44.3b and earnings per share (EPS) of HK$0.51 in 2020. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a small dip in earnings per share estimates.

The analysts made no major changes to their price target of HK$13.96, suggesting the downgrades are not expected to have a long-term impact on Hong Kong and China Gas's valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Hong Kong and China Gas at HK$20.16 per share, while the most bearish prices it at HK$10.40. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that Hong Kong and China Gas's revenue growth will slow down substantially, with revenues next year expected to grow 5.4%, compared to a historical growth rate of 7.3% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 10% next year. Factoring in the forecast slowdown in growth, it seems obvious that Hong Kong and China Gas is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. The consensus price target held steady at HK$13.96, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Hong Kong and China Gas. Long-term earnings power is much more important than next year's profits. We have forecasts for Hong Kong and China Gas going out to 2022, and you can see them free on our platform here.

It is also worth noting that we have found 1 warning sign for Hong Kong and China Gas that you need to take into consideration.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:3

Hong Kong and China Gas

Produces, distributes, and markets gas, water supply and energy services in Hong Kong and Mainland China.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives