- Hong Kong

- /

- Water Utilities

- /

- SEHK:270

Guangdong Investment Limited (HKG:270) May Have Run Too Fast Too Soon With Recent 28% Price Plummet

Unfortunately for some shareholders, the Guangdong Investment Limited (HKG:270) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

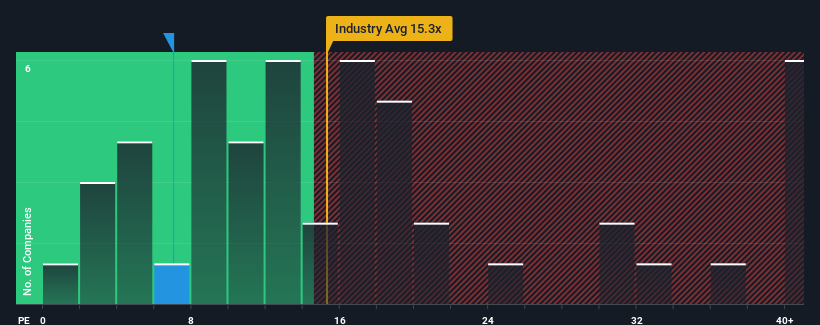

Even after such a large drop in price, it's still not a stretch to say that Guangdong Investment's price-to-earnings (or "P/E") ratio of 7x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, Guangdong Investment's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Guangdong Investment

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Guangdong Investment's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 31% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 8.0% per year over the next three years. With the market predicted to deliver 15% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's curious that Guangdong Investment's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Guangdong Investment's P/E?

Following Guangdong Investment's share price tumble, its P/E is now hanging on to the median market P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Guangdong Investment currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Guangdong Investment (of which 1 makes us a bit uncomfortable!) you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:270

Guangdong Investment

An investment holding company, engages in water resources, property investment and development, department store operation, hotel ownership, energy project operation and management, and road and bridge operation businesses.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives