- Hong Kong

- /

- Gas Utilities

- /

- SEHK:2688

ENN Energy Holdings (SEHK:2688) Eyes Growth with Renewable Focus Despite Earnings Challenges

Reviewed by Simply Wall St

Get an in-depth perspective on ENN Energy Holdings's performance by reading our analysis here.

Unique Capabilities Enhancing ENN Energy Holdings's Market Position

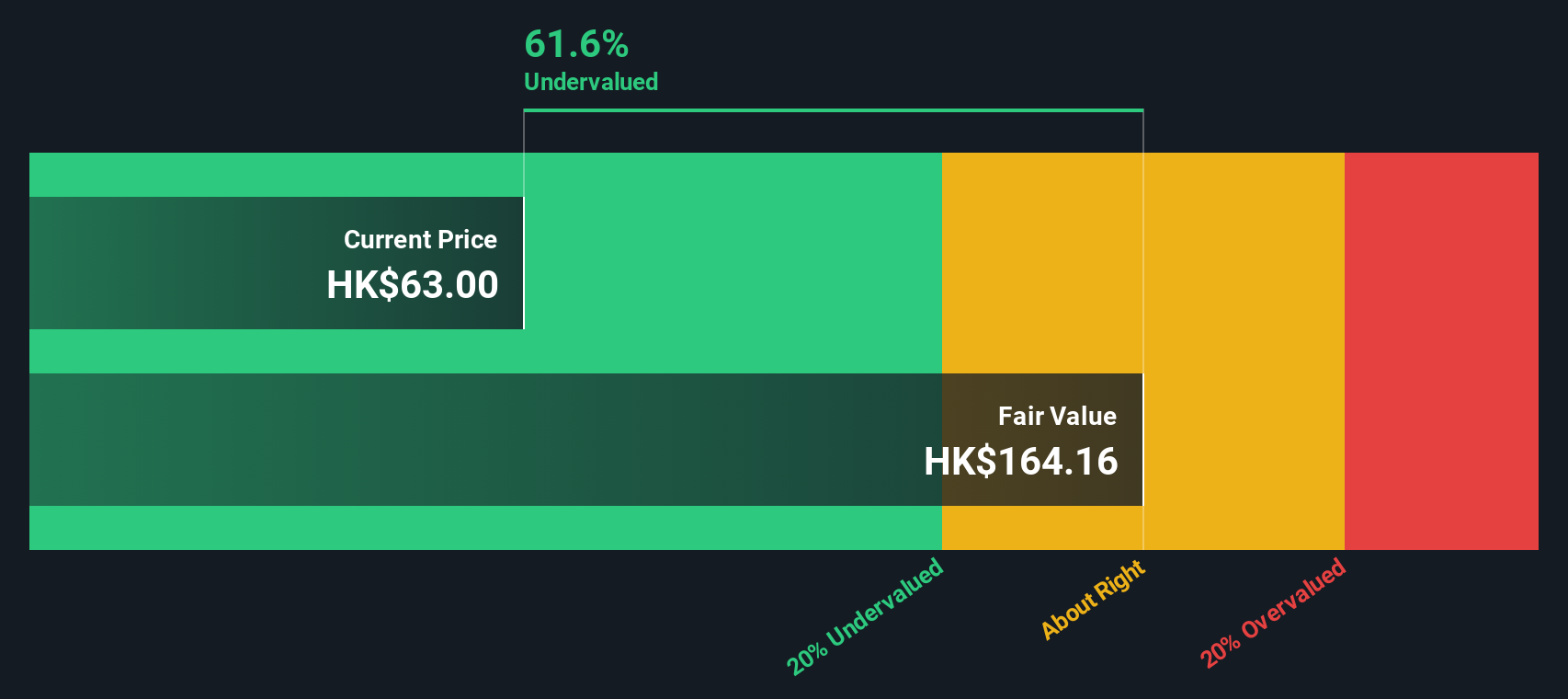

ENN Energy Holdings demonstrates strong financial health, with a Price-To-Earnings Ratio of 9.2x, which is favorable compared to the Asian Gas Utilities industry average of 13.7x. This valuation suggests a solid market position, further supported by analysts forecasting a target price over 20% higher than the current share price. The company's commitment to operational growth is evident from the 4.8% increase in retail gas sales and a 5.7% rise in sales to commercial and industrial customers, as highlighted by an executive in their recent earnings call. Additionally, the integrated energy business reported a significant 21.4% year-on-year sales volume increase, reaching 29.67 billion kilowatt hours, showcasing potential for future expansion.

Challenges Constraining ENN Energy Holdings's Potential

ENN Energy faces challenges with its earnings growth, which is forecasted at 9.7% annually, lagging behind the Hong Kong market average of 11.4%. The Return on Equity stands at 14.4%, below the benchmark of 20%, indicating room for improvement in profitability. Furthermore, the integrated energy segment experienced a slowdown due to seasonal factors, affecting subsegment performance. This deceleration, coupled with a reduction in average selling price by $0.10, underscores the need for strategic adjustments to maintain competitive advantage.

Areas for Expansion and Innovation for ENN Energy Holdings

Opportunities for ENN Energy are abundant, particularly in renewable energy and value-added services. The company's active engagement in renewable sectors, as mentioned by their Deputy Head of IR, presents avenues for diversification and growth. Additionally, the expansion of value-added business through diversified product offerings, such as intelligent cooking equipment, could enhance customer engagement and drive revenue. The potential for increased engagement with medium, small, and micro businesses further positions ENN Energy to capitalize on emerging market opportunities.

Competitive Pressures and Market Risks Facing ENN Energy Holdings

However, the company must navigate several threats, including seasonal economic influences and regulatory changes. The recovery in the property sector has impacted the growth of natural gas sales, as noted by an executive. Moreover, cost and pricing pressures due to policy shifts and upstream supplier dynamics could affect profitability. Regulatory changes at the local level also pose risks to operational stability, necessitating adaptive strategies to mitigate these challenges effectively.

Conclusion

ENN Energy Holdings is strategically positioned for growth, trading at 63.7% below its estimated fair value, indicating significant market potential. The company's favorable Price-To-Earnings Ratio of 9.2x, compared to the industry average, reflects a strong market position, with analysts predicting a share price increase of over 20%. Challenges such as slower earnings growth and a Return on Equity below the benchmark remain, but ENN Energy's focus on renewable energy and value-added services presents promising avenues for diversification and revenue enhancement. To capitalize on these opportunities, the company must address competitive pressures and regulatory risks, ensuring adaptive strategies to maintain and enhance profitability and market share.

Summing It All Up

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ENN Energy Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2688

ENN Energy Holdings

An investment holding company, engages in the investment, construction, operation, and management of gas pipeline infrastructure in the People’s Republic of China.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives