- Hong Kong

- /

- Gas Utilities

- /

- SEHK:2688

ENN Energy Holdings Limited Recorded A 5.7% Miss On Revenue: Analysts Are Revisiting Their Models

ENN Energy Holdings Limited (HKG:2688) came out with its full-year results last week, and we wanted to see how the business is performing and what industry forecasters think of the company following this report. Results look mixed - while revenue fell marginally short of analyst estimates at CN¥72b, statutory earnings beat expectations 2.5%, with ENN Energy Holdings reporting profits of CN¥5.57 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for ENN Energy Holdings

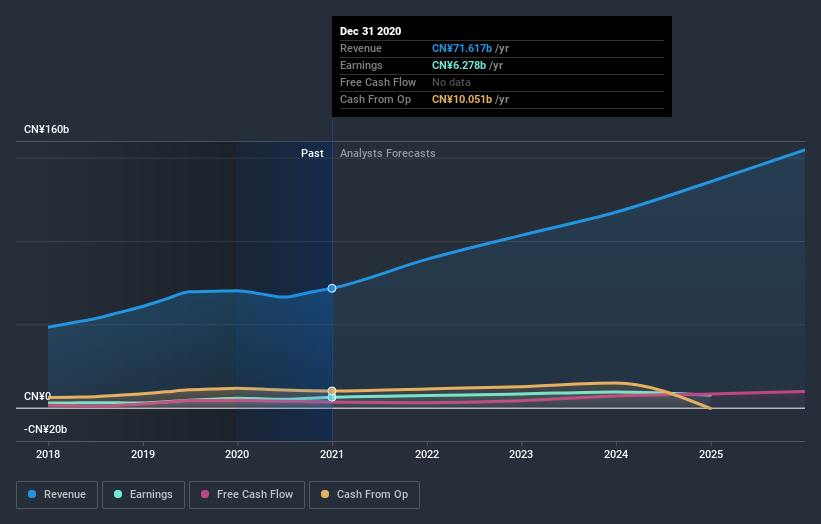

Taking into account the latest results, the consensus forecast from ENN Energy Holdings' 26 analysts is for revenues of CN¥88.9b in 2021, which would reflect a substantial 24% improvement in sales compared to the last 12 months. Per-share earnings are expected to climb 16% to CN¥6.50. Before this earnings report, the analysts had been forecasting revenues of CN¥90.9b and earnings per share (EPS) of CN¥6.29 in 2021. If anything, the analysts look to have become slightly more optimistic overall; while they decreased their revenue forecasts, EPS predictions increased and ultimately earnings are more important.

The average price target rose 5.4% to CN¥112, with the analysts signalling that the improved earnings outlook is the key driver of value for shareholders - enough to offset the reduction in revenue estimates. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic ENN Energy Holdings analyst has a price target of CN¥164 per share, while the most pessimistic values it at CN¥71.42. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting ENN Energy Holdings' growth to accelerate, with the forecast 24% annualised growth to the end of 2021 ranking favourably alongside historical growth of 18% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 11% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that ENN Energy Holdings is expected to grow much faster than its industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around ENN Energy Holdings' earnings potential next year. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. With that said, earnings are more important to the long-term value of the business. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for ENN Energy Holdings going out to 2025, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 2 warning signs for ENN Energy Holdings that you should be aware of.

If you’re looking to trade ENN Energy Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade ENN Energy Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ENN Energy Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2688

ENN Energy Holdings

An investment holding company, engages in the investment, construction, operation, and management of gas pipeline infrastructure in the People’s Republic of China.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives