Amidst global economic uncertainties, Asian markets have shown resilience with China's recent stimulus hopes and Japan's modest stock market gains providing some positive momentum. In this context, dividend stocks in Asia present an attractive option for investors seeking steady income streams, as they can offer stability and potential returns even in volatile market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.68% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.02% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.82% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.34% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.82% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.24% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.84% | ★★★★★★ |

Click here to see the full list of 1118 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

ENN Energy Holdings (SEHK:2688)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ENN Energy Holdings Limited is an investment holding company involved in the investment, construction, operation, and management of gas pipeline infrastructure in the People’s Republic of China with a market cap of HK$65.62 billion.

Operations: ENN Energy Holdings Limited generates revenue through several key segments, including Retail Gas Sales Business (CN¥67.73 billion), Wholesale of Gas (CN¥40.99 billion), Integrated Energy Business (CN¥15.95 billion), Value Added Business (CN¥7.74 billion), and Construction and Installation services (CN¥5.58 billion).

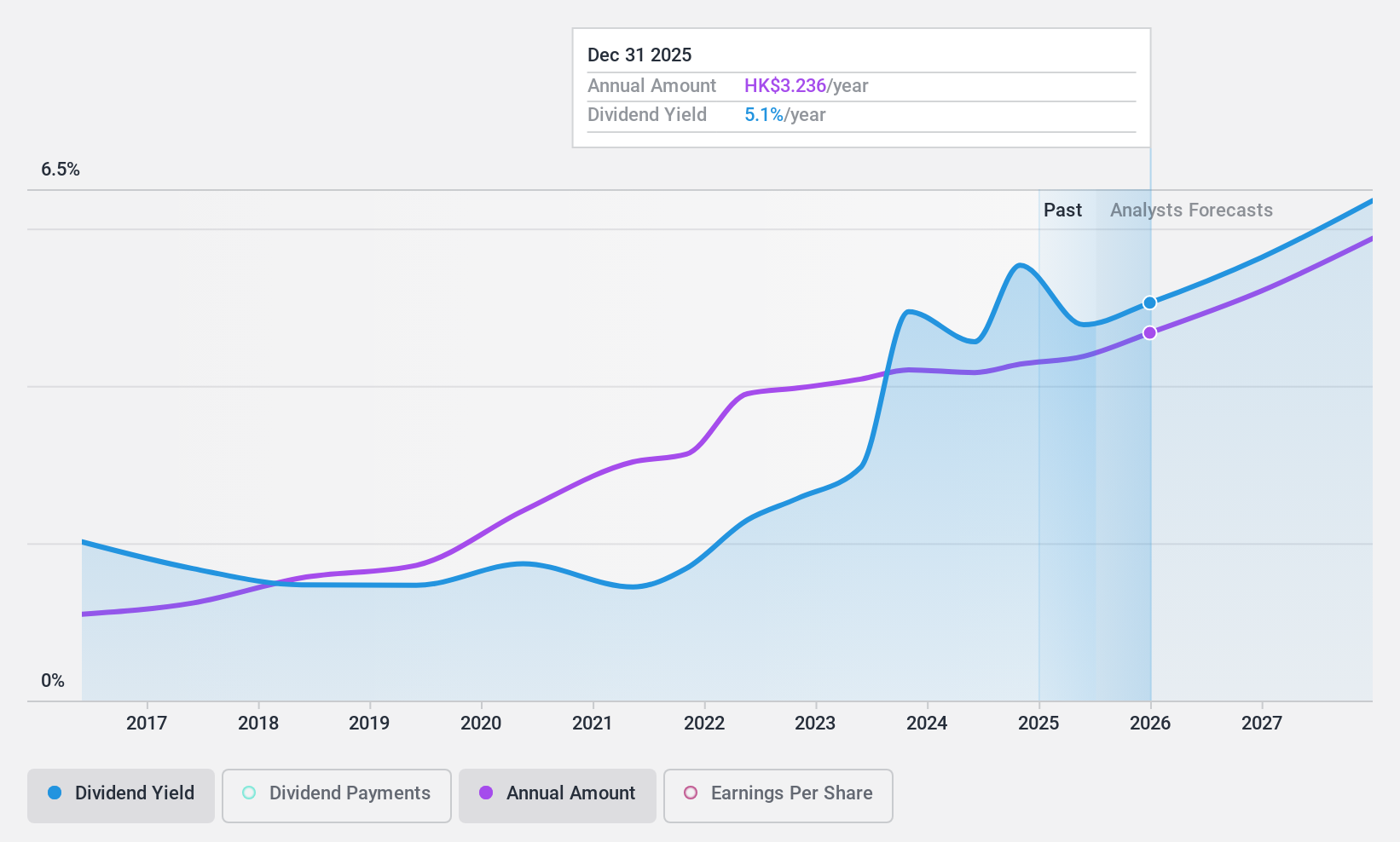

Dividend Yield: 4.9%

ENN Energy Holdings' dividend payments have been stable and growing over the past decade, but with a yield of 4.9%, it falls short compared to top-tier dividend payers in Hong Kong. Although the payout ratio is reasonably low at 49.9%, indicating coverage by earnings, the high cash payout ratio of 113.6% suggests dividends are not well covered by free cash flows. Recent executive changes may influence strategic direction and potentially affect future dividend sustainability and growth prospects.

- Delve into the full analysis dividend report here for a deeper understanding of ENN Energy Holdings.

- The valuation report we've compiled suggests that ENN Energy Holdings' current price could be quite moderate.

Anjoy Foods Group (SHSE:603345)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anjoy Foods Group Co., Ltd. focuses on the research, development, production, and sale of quick-frozen hot pot, noodle rice, and dish products with a market capitalization of approximately CN¥25.09 billion.

Operations: Anjoy Foods Group Co., Ltd. generates revenue from its Food Processing segment, totaling CN¥14.85 billion.

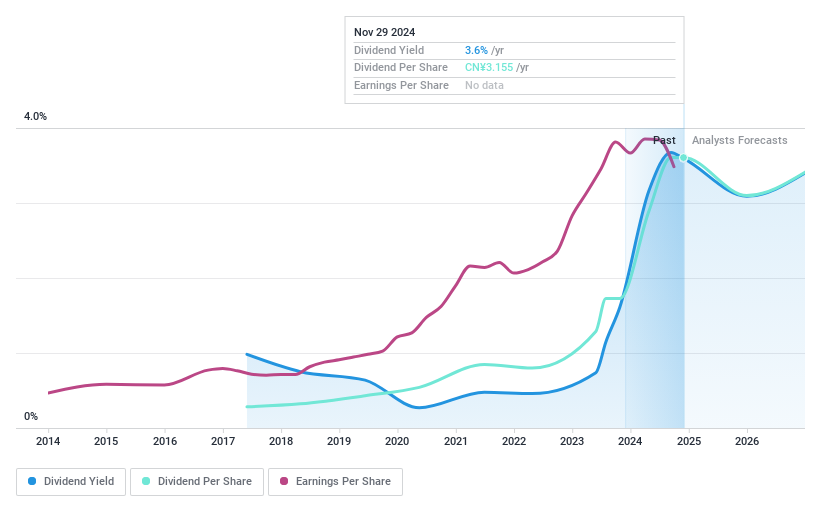

Dividend Yield: 3.7%

Anjoy Foods Group's dividend yield of 3.68% ranks it among the top 25% in the CN market, with dividends covered by earnings (65.9%) and cash flows (83.2%). While stable, dividends have only been paid for eight years, indicating limited historical reliability. The stock trades at a significant discount to its estimated fair value and offers growth potential with forecasted earnings growth of 12.61% annually, suggesting a balanced opportunity for dividend-focused investors seeking value in Asia.

- Click here and access our complete dividend analysis report to understand the dynamics of Anjoy Foods Group.

- Our expertly prepared valuation report Anjoy Foods Group implies its share price may be lower than expected.

Dexerials (TSE:4980)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dexerials Corporation is a Japanese company that manufactures and sells electronic components, bonding materials, and optics materials, with a market cap of ¥351.15 billion.

Operations: Dexerials Corporation's revenue is primarily derived from its Optical Materials and Components segment, which generated ¥53.56 billion, and its Electronic Materials and Components segment, contributing ¥58.77 billion.

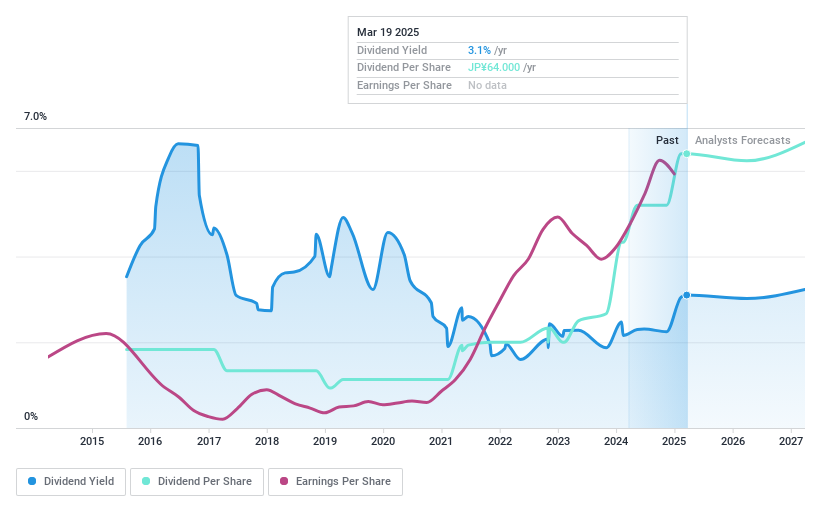

Dividend Yield: 3.1%

Dexerials exhibits a low payout ratio of 31.3%, ensuring dividends are well covered by earnings and cash flows, with a cash payout ratio of 35.1%. Despite an unstable dividend track record over the past decade, recent buybacks totaling ¥4,999.95 million aim to enhance shareholder returns. The stock trades at a significant discount to its fair value estimate and has seen substantial earnings growth recently, although its dividend yield of 3.1% is below top-tier levels in Japan.

- Dive into the specifics of Dexerials here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Dexerials shares in the market.

Summing It All Up

- Click here to access our complete index of 1118 Top Asian Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603345

Anjoy Foods Group

Engages in the research and development, production, and sale of quick-frozen hot pot, noodle rice, and dish products.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives