- Hong Kong

- /

- Electric Utilities

- /

- SEHK:2

CLP Holdings (SEHK:2): Evaluating Valuation During a Quiet Period for This Utility Stock

Reviewed by Simply Wall St

CLP Holdings (SEHK:2) has been on the radar for many investors lately, even though the company hasn’t announced any major news or game-changing event. Sometimes, a lack of headline-grabbing stories can make the market’s moves even more intriguing. It raises the question most investors quietly ask: is something simmering beneath the surface, or is this just the stock finding its level in a quiet period?

Looking at the numbers, CLP Holdings’ shares have edged up slightly so far this year, despite dipping over the past month. The company’s longer-term track record remains solid, with a 14% total return across three years, even if recent performance has been flat. Revenue and profit growth are moving in the right direction, though the pace has been measured rather than dramatic. As utilities stocks go, the momentum here appears stable but not surging.

After a year of modest moves and no clear catalyst in sight, is CLP Holdings offering patient investors a value opportunity, or is the current share price a fair reflection of its growth prospects?

Most Popular Narrative: 9.7% Undervalued

According to the most widely followed narrative, CLP Holdings shares currently trade below the level analysts view as a fair representation of the company's long-term growth and income. This implies potential upside if those assumptions play out.

Growing capital investment in grid modernization and zero-carbon infrastructure in Hong Kong, driven by upcoming cross-border transmission needs, electrification of transport, and the government's 2035 and 2050 climate targets, is set to underpin steady regulated asset growth and predictable earnings. This supports long-term increases in revenue and cash flow.

Curious how analysts justify a higher target price for this dependable utility? The answer involves ambitious assumptions about its ability to ramp up profits and maintain industry-beating margins due to massive infrastructure upgrades. Want to know which hard-hitting forecasts are driving these bold projections? Uncover the exact numbers and underlying logic powering this fair value calculation in the full narrative.

Result: Fair Value of $71.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sharp margin pressure overseas or unexpected regulatory shifts could easily derail these upbeat expectations and act as catalysts for a more cautious outlook.

Find out about the key risks to this CLP Holdings narrative.Another View: Our DCF Model

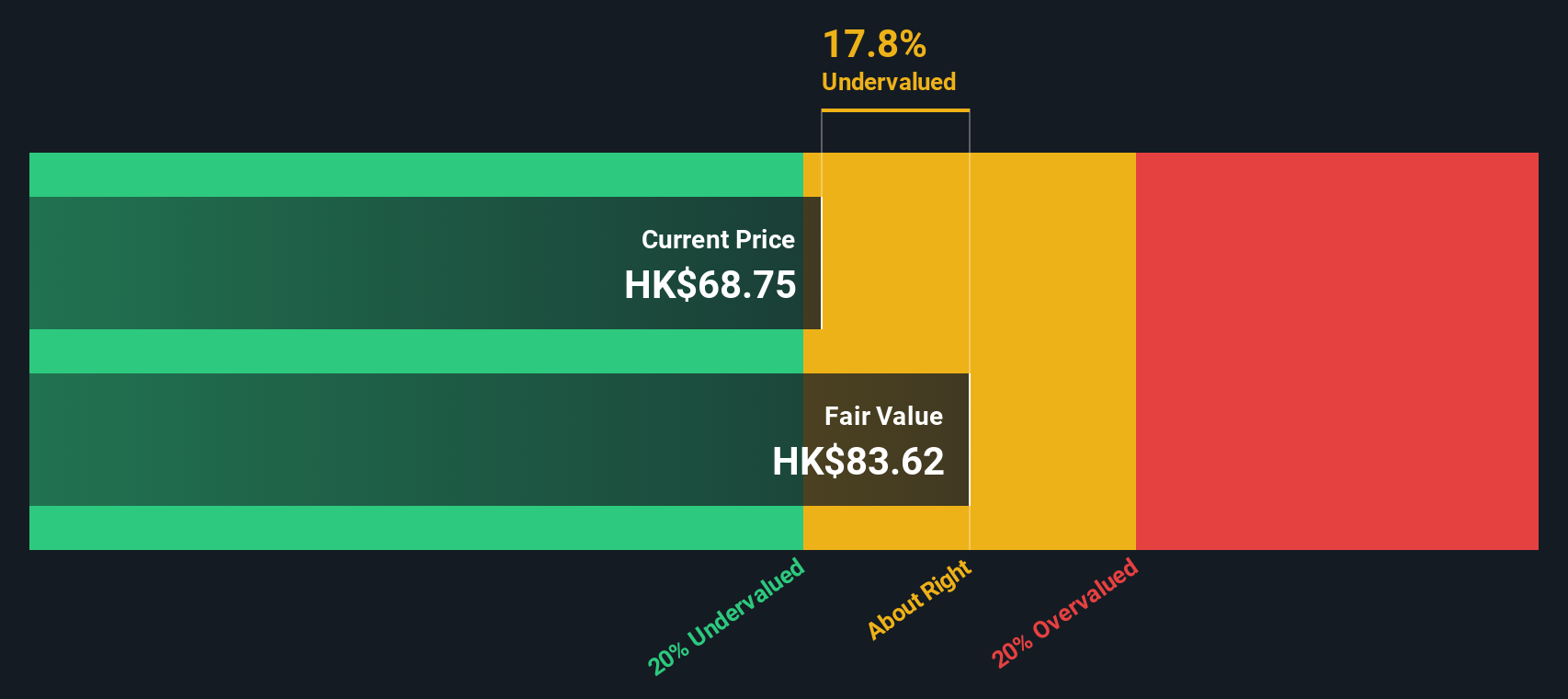

While analyst targets point to an undervalued share price, our SWS DCF model also suggests the stock remains below its estimated fair value. This reinforces the current opportunity. But do different assumptions lead to the same conclusion?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CLP Holdings Narrative

If you want to dig deeper or would rather form your own conclusions from the data, you can craft a personalized view in just a few minutes by using Do it your way.

A great starting point for your CLP Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Expand your investment horizons and stay ahead of the market by checking out these hand-picked stock ideas. If you’re after growth, income, or the next exciting sector, don’t let these opportunities slip by.

- Uncover companies winning the race for real-world adoption and financial strength with penny stocks with strong financials.

- Power up your watchlist by tapping into relentless innovation through healthcare AI stocks.

- Lock in reliable payouts and seek long-term wealth with stocks offering dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:2

CLP Holdings

An investment holding company, engages in the generation, retail, transmission, and distribution of electricity in Hong Kong, Mainland China, India, Thailand, Taiwan, and Australia.

Solid track record average dividend payer.

Market Insights

Community Narratives