- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1811

Does CGN New Energy Holdings (HKG:1811) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies CGN New Energy Holdings Co., Ltd. (HKG:1811) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for CGN New Energy Holdings

How Much Debt Does CGN New Energy Holdings Carry?

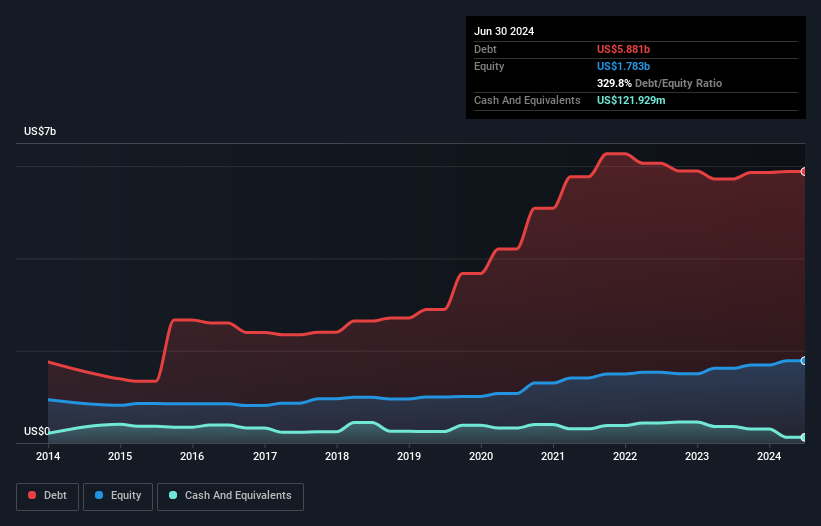

The chart below, which you can click on for greater detail, shows that CGN New Energy Holdings had US$5.88b in debt in June 2024; about the same as the year before. On the flip side, it has US$121.9m in cash leading to net debt of about US$5.76b.

How Strong Is CGN New Energy Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that CGN New Energy Holdings had liabilities of US$2.02b due within 12 months and liabilities of US$4.60b due beyond that. On the other hand, it had cash of US$121.9m and US$1.44b worth of receivables due within a year. So its liabilities total US$5.06b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the US$1.32b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, CGN New Energy Holdings would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

CGN New Energy Holdings has a rather high debt to EBITDA ratio of 6.7 which suggests a meaningful debt load. But the good news is that it boasts fairly comforting interest cover of 2.7 times, suggesting it can responsibly service its obligations. Investors should also be troubled by the fact that CGN New Energy Holdings saw its EBIT drop by 15% over the last twelve months. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if CGN New Energy Holdings can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Considering the last three years, CGN New Energy Holdings actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

On the face of it, CGN New Energy Holdings's net debt to EBITDA left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. And furthermore, its EBIT growth rate also fails to instill confidence. Considering all the factors previously mentioned, we think that CGN New Energy Holdings really is carrying too much debt. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that CGN New Energy Holdings is showing 2 warning signs in our investment analysis , and 1 of those is significant...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1811

CGN New Energy Holdings

Generates and supplies electricity and steam in the People’s Republic of China and Republic of Korea.

Fair value second-rate dividend payer.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026