- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1811

CGN New Energy (SEHK:1811) Valuation Spotlight: Leadership Changes and Mixed Power Output Shape Investor Outlook

Reviewed by Simply Wall St

CGN New Energy Holdings (SEHK:1811) caught investors’ eyes after the resignation of President and executive Director Li Guangming. This move comes just days after the company reported a drop in power generation for both wind and hydro projects.

See our latest analysis for CGN New Energy Holdings.

CGN New Energy Holdings’ share price has picked up speed in 2025, closing at HK$2.83 after building on positive momentum from the past several months. Despite leadership changes and a dip in quarterly wind and hydro output, sentiment appears resilient, as evidenced by a 20.9% year-to-date share price return and a stellar 25.96% total return over the past year. Longer-term shareholders have been rewarded too, with the five-year total return reaching an impressive 238%. This suggests the underlying growth story remains intact even as operational challenges emerge.

If recent executive shakeups have you rethinking where to look next, now is a smart moment to broaden your perspective and discover fast growing stocks with high insider ownership

With the share price rallying despite leadership turnover and mixed operational results, investors are now faced with a crucial question: is CGN New Energy still trading below its true value, or has the market fully factored in future growth prospects?

Price-to-Earnings of 6.9x: Is it justified?

With CGN New Energy Holdings trading at a price-to-earnings (P/E) ratio of 6.9x, the stock appears attractively valued compared to both its industry and peers, especially with a last close price of HK$2.83.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings, making it a core benchmark for evaluating profitability and value within the renewable energy sector. A lower P/E can indicate an undervalued company, or it may reflect expectations of slower future growth.

In this case, CGN New Energy’s P/E of 6.9x is notably below the Hong Kong market average of 12.7x, the peer average of 7.9x, and the Asian Renewable Energy industry’s high level of 16.6x. Such a gap suggests the market may be underpricing the company’s future earning power. Regression analysis further points to a fair P/E closer to 9.4x, indicating the stock has room for multiple expansion if earnings growth is realized.

Explore the SWS fair ratio for CGN New Energy Holdings

Result: Price-to-Earnings of 6.9x (UNDERVALUED)

However, slower revenue growth or continued executive turnover could weigh on earnings momentum and investor confidence. This could potentially limit further share price gains.

Find out about the key risks to this CGN New Energy Holdings narrative.

Another View: What Does the SWS DCF Model Say?

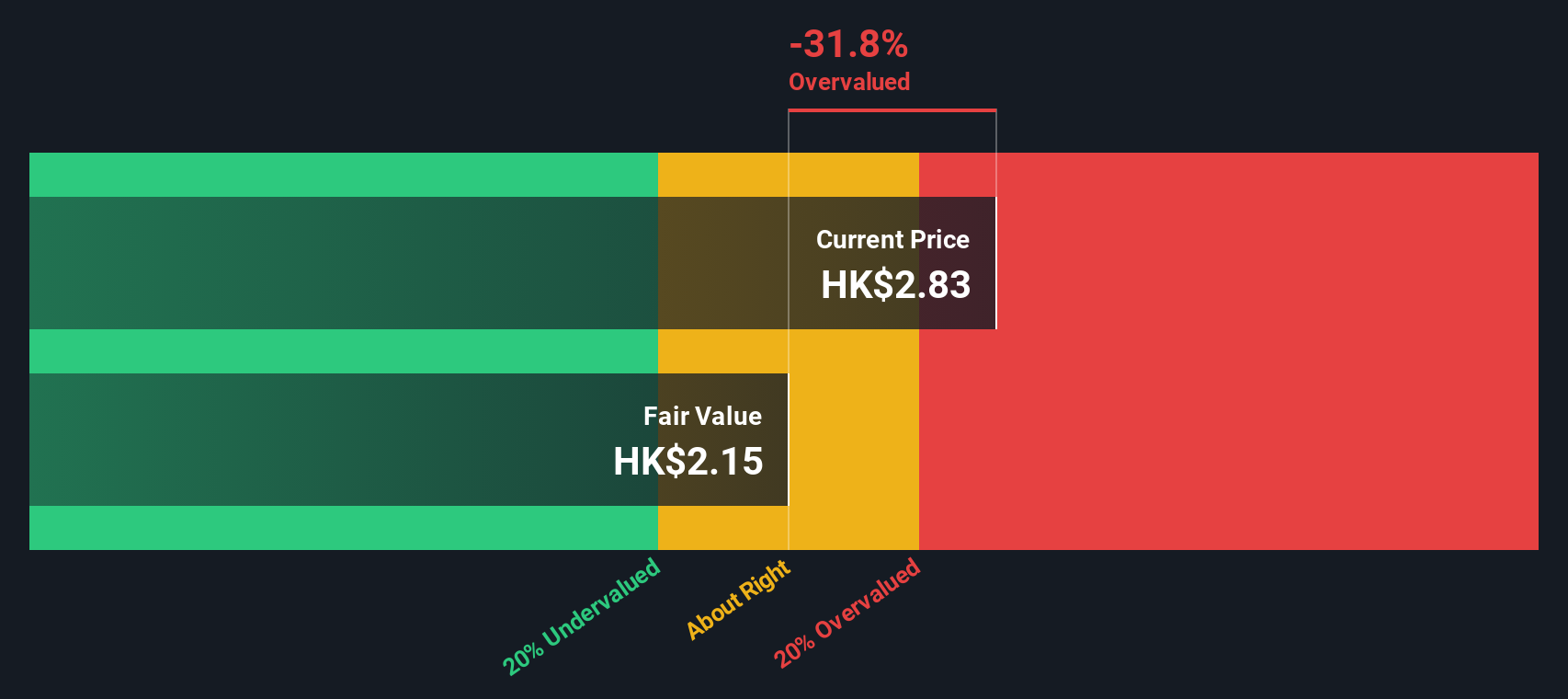

Taking a different angle, our DCF model estimates CGN New Energy Holdings’ fair value at HK$2.15, which is notably below its current price of HK$2.83. This result suggests the shares could be trading above their underlying cash flow value. This may challenge the optimism implied by low earnings multiples. How should investors weigh these conflicting results as they consider their next steps?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CGN New Energy Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CGN New Energy Holdings Narrative

If you see the recent numbers differently or want to dig deeper on your own terms, it's easy to build your own view in just minutes, so why not Do it your way

A great starting point for your CGN New Energy Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't wait on the sidelines while unique opportunities are gaining ground. Put yourself in front of fresh growth, innovation, and strong financials with these handpicked ideas:

- Accelerate your portfolio's potential and spot value with these 877 undervalued stocks based on cash flows based on solid cash flows.

- Fuel your future with passive income by targeting these 17 dividend stocks with yields > 3% boasting yields above 3%.

- Ride the AI disruption wave by tapping into these 27 AI penny stocks behind tomorrow’s digital breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1811

CGN New Energy Holdings

Generates and supplies electricity and steam in the People’s Republic of China and Republic of Korea.

Fair value second-rate dividend payer.

Market Insights

Community Narratives