- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1381

Imagine Owning Canvest Environmental Protection Group (HKG:1381) And Wondering If The 12% Share Price Slide Is Justified

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Canvest Environmental Protection Group Company Limited (HKG:1381) shareholders over the last year, as the share price declined 12%. That falls noticeably short of the market return of around -3.5%. On the other hand, the stock is actually up 5.2% over three years.

View our latest analysis for Canvest Environmental Protection Group

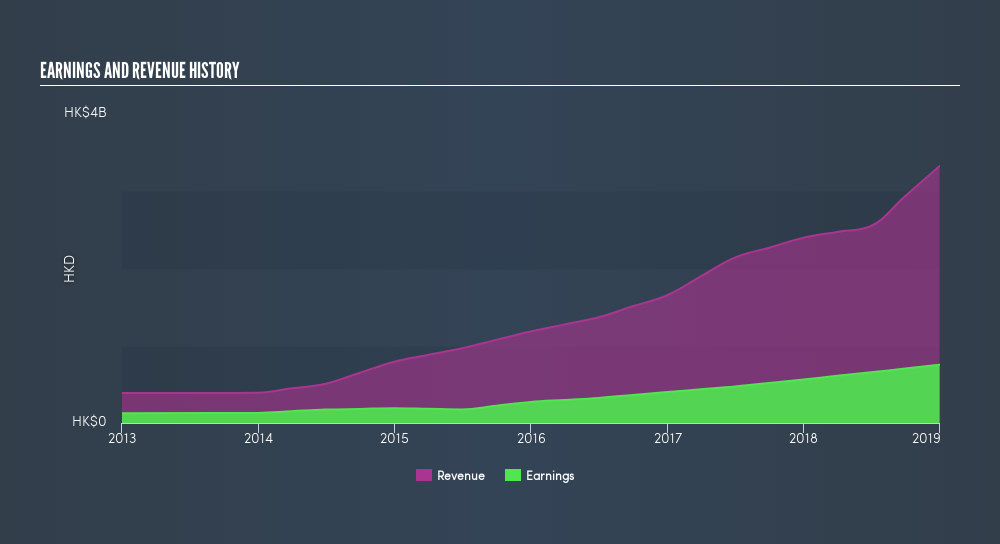

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the Canvest Environmental Protection Group share price fell, it actually saw its earnings per share (EPS) improve by 28%. It could be that the share price was previously over-hyped. The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

Given the yield is quite low, at 1.3%, we doubt the dividend can shed much light on the share price. Canvest Environmental Protection Group managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

Canvest Environmental Protection Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Canvest Environmental Protection Group's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Canvest Environmental Protection Group's TSR, which was a 11% drop over the last year, was not as bad as the share price return.

A Different Perspective

Canvest Environmental Protection Group shareholders are down 11% for the year (even including dividends), falling short of the market return. The market shed around 3.5%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 2.6% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Before forming an opinion on Canvest Environmental Protection Group you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1381

Canvest Environmental Protection Group

An investment holding company, engages in the operation and management of waste-to-energy (WTE) plants in the People’s Republic of China.

Fair value with acceptable track record.

Market Insights

Community Narratives