- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1193

Investor Optimism Abounds China Resources Gas Group Limited (HKG:1193) But Growth Is Lacking

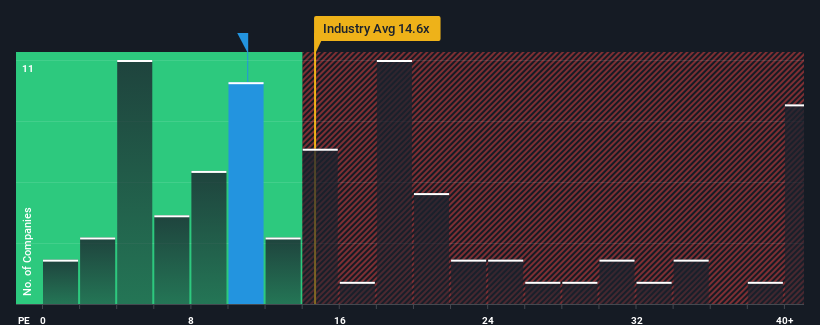

It's not a stretch to say that China Resources Gas Group Limited's (HKG:1193) price-to-earnings (or "P/E") ratio of 11x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for China Resources Gas Group as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

View our latest analysis for China Resources Gas Group

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like China Resources Gas Group's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. Regardless, EPS has managed to lift by a handy 9.6% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 12% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 15% per year, which is noticeably more attractive.

In light of this, it's curious that China Resources Gas Group's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that China Resources Gas Group currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for China Resources Gas Group you should know about.

If these risks are making you reconsider your opinion on China Resources Gas Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1193

China Resources Gas Group

An investment holding company, engages in the sale of natural and liquefied gas, and connection of gas pipelines.

Adequate balance sheet average dividend payer.