- Hong Kong

- /

- Water Utilities

- /

- SEHK:1129

These 4 Measures Indicate That China Water Industry Group (HKG:1129) Is Using Debt Extensively

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that China Water Industry Group Limited (HKG:1129) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for China Water Industry Group

How Much Debt Does China Water Industry Group Carry?

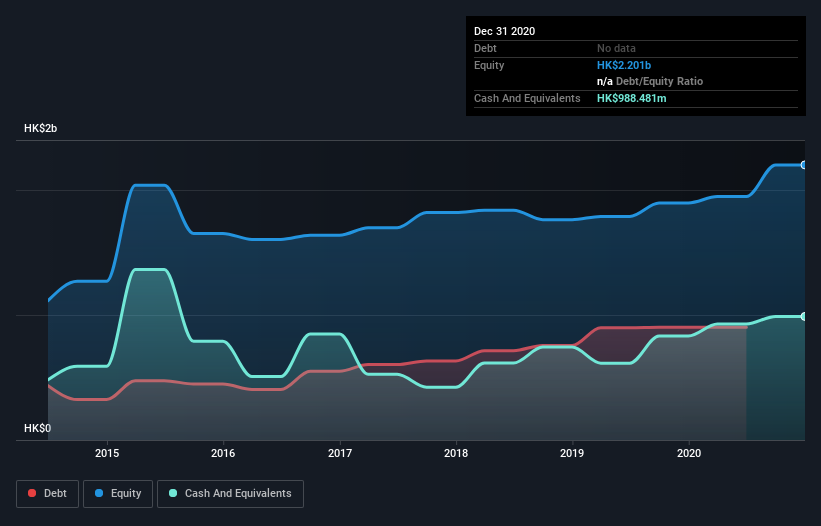

As you can see below, China Water Industry Group had HK$884.0m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. But on the other hand it also has HK$988.5m in cash, leading to a HK$104.5m net cash position.

How Healthy Is China Water Industry Group's Balance Sheet?

According to the last reported balance sheet, China Water Industry Group had liabilities of HK$2.67b due within 12 months, and liabilities of HK$761.1m due beyond 12 months. Offsetting this, it had HK$988.5m in cash and HK$1.09b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$1.35b.

The deficiency here weighs heavily on the HK$439.0m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, China Water Industry Group would likely require a major re-capitalisation if it had to pay its creditors today. China Water Industry Group boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

It is well worth noting that China Water Industry Group's EBIT shot up like bamboo after rain, gaining 46% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But it is China Water Industry Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. China Water Industry Group may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, China Water Industry Group reported free cash flow worth 18% of its EBIT, which is really quite low. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Summing up

While China Water Industry Group does have more liabilities than liquid assets, it also has net cash of HK$104.5m. And it impressed us with its EBIT growth of 46% over the last year. So although we see some areas for improvement, we're not too worried about China Water Industry Group's balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example - China Water Industry Group has 3 warning signs we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1129

China Water Industry Group

An investment holding company, provides water supply and sewage treatment services in the People’s Republic of China.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives