- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1083

Towngas Smart Energy Company Limited's (HKG:1083) Popularity With Investors Is Clear

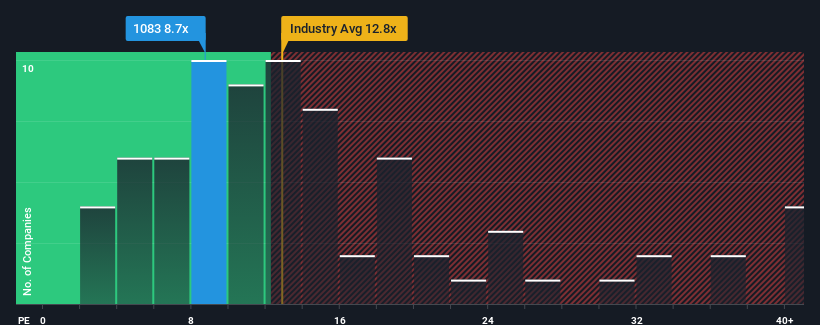

With a median price-to-earnings (or "P/E") ratio of close to 9x in Hong Kong, you could be forgiven for feeling indifferent about Towngas Smart Energy Company Limited's (HKG:1083) P/E ratio of 8.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Towngas Smart Energy as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Towngas Smart Energy

How Is Towngas Smart Energy's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Towngas Smart Energy's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 12%. However, this wasn't enough as the latest three year period has seen an unpleasant 38% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 13% per year during the coming three years according to the ten analysts following the company. With the market predicted to deliver 12% growth per annum, the company is positioned for a comparable earnings result.

With this information, we can see why Towngas Smart Energy is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Towngas Smart Energy's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Towngas Smart Energy maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 3 warning signs for Towngas Smart Energy (1 is concerning!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Towngas Smart Energy. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Towngas Smart Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1083

Towngas Smart Energy

An investment holding company, sells piped gas, renewable energy, and other types of energy in the People’s Republic of China.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives