- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1083

Investors Appear Satisfied With Towngas Smart Energy Company Limited's (HKG:1083) Prospects

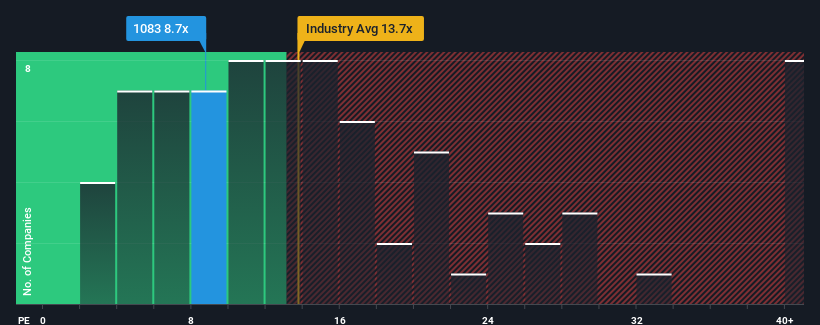

It's not a stretch to say that Towngas Smart Energy Company Limited's (HKG:1083) price-to-earnings (or "P/E") ratio of 8.7x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 10x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Towngas Smart Energy certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Towngas Smart Energy

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Towngas Smart Energy would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a decent 12% gain to the company's bottom line. Still, lamentably EPS has fallen 38% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 12% each year as estimated by the ten analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 13% per year, which is not materially different.

With this information, we can see why Towngas Smart Energy is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Towngas Smart Energy maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Towngas Smart Energy (including 1 which is concerning).

Of course, you might also be able to find a better stock than Towngas Smart Energy. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Towngas Smart Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1083

Towngas Smart Energy

An investment holding company, sells piped gas, renewable energy, and other types of energy in the People’s Republic of China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.