- Hong Kong

- /

- Transportation

- /

- SEHK:9956

Cautious Investors Not Rewarding ANE (Cayman) Inc.'s (HKG:9956) Performance Completely

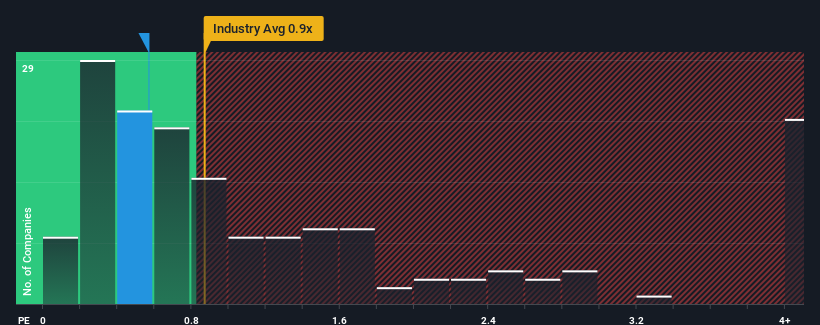

It's not a stretch to say that ANE (Cayman) Inc.'s (HKG:9956) price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" for companies in the Transportation industry in Hong Kong, where the median P/S ratio is around 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for ANE (Cayman)

How ANE (Cayman) Has Been Performing

Recent times haven't been great for ANE (Cayman) as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ANE (Cayman).Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, ANE (Cayman) would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.2% last year. This was backed up an excellent period prior to see revenue up by 40% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 11% each year as estimated by the four analysts watching the company. With the industry only predicted to deliver 7.9% each year, the company is positioned for a stronger revenue result.

With this information, we find it interesting that ANE (Cayman) is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that ANE (Cayman) currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for ANE (Cayman) with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of ANE (Cayman)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9956

ANE (Cayman)

An investment holding company operates an express freight network in the less-than-truckload (LTL) market in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives