- Taiwan

- /

- Auto Components

- /

- TWSE:4551

3 Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

In recent weeks, global markets have been grappling with tariff uncertainties and mixed economic signals, leading to fluctuations in major indices such as the S&P 500 and Dow Jones Industrial Average. Despite these challenges, opportunities may exist for investors seeking stocks that are potentially priced below their estimated value. In the current environment of cautious optimism and market volatility, identifying undervalued stocks involves looking for companies with strong fundamentals that have not yet been fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.60 | CN¥33.16 | 49.9% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.97 | CN¥55.65 | 49.7% |

| National World (LSE:NWOR) | £0.225 | £0.45 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$89.90 | NT$179.40 | 49.9% |

| Celsius Holdings (NasdaqCM:CELH) | US$22.41 | US$44.68 | 49.8% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.17 | US$26.20 | 49.7% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.24 | SEK165.67 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.03 | 49.7% |

| Kinaxis (TSX:KXS) | CA$165.40 | CA$330.68 | 50% |

| 29Metals (ASX:29M) | A$0.205 | A$0.41 | 49.9% |

Let's uncover some gems from our specialized screener.

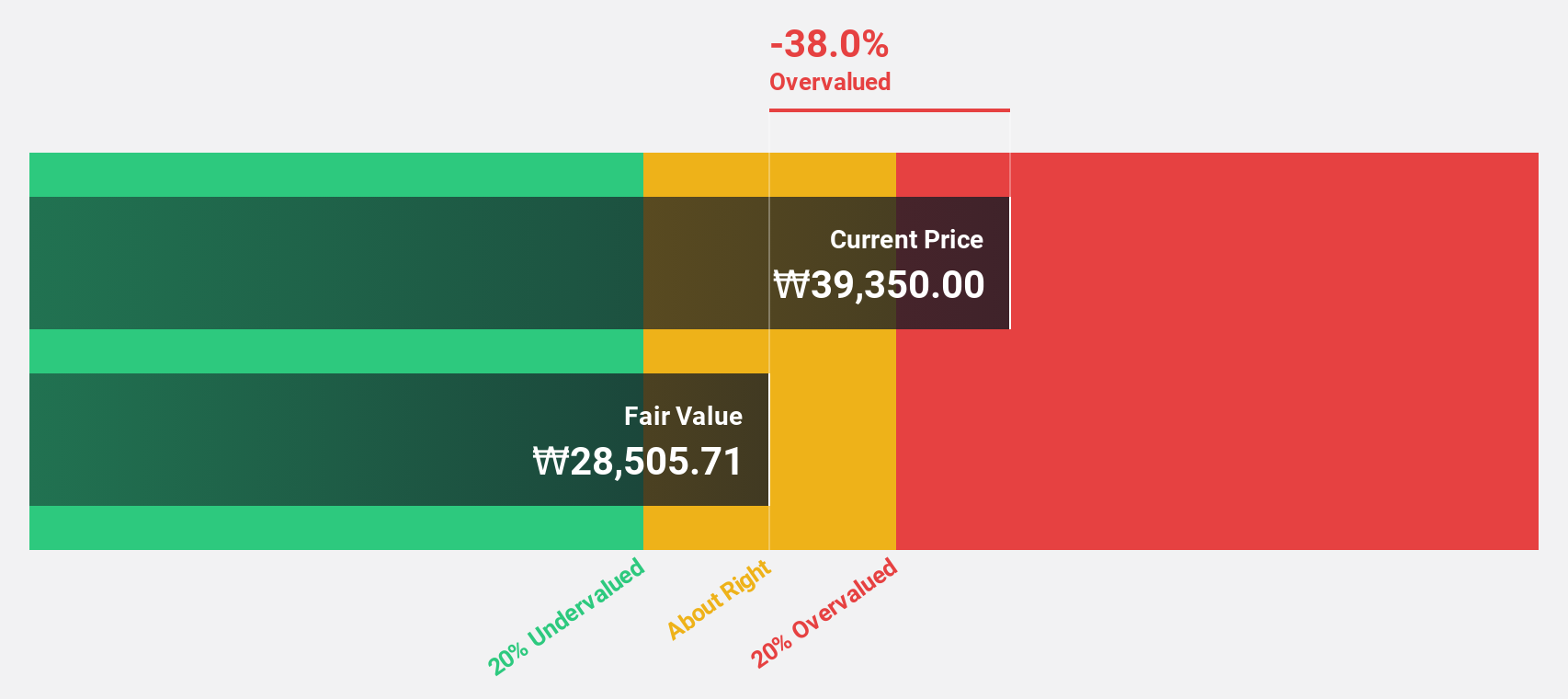

TSE (KOSDAQ:A131290)

Overview: TSE Co., Ltd offers semiconductor test solutions in South Korea and internationally, with a market cap of ₩481.57 billion.

Operations: TSE Co., Ltd's revenue primarily comes from its semiconductor test solutions business, serving both domestic and international markets.

Estimated Discount To Fair Value: 48.4%

TSE is trading at ₩45,000, significantly below its estimated fair value of ₩87,236.59. The company has become profitable this year and is expected to see earnings growth of 33.5% annually, outpacing the KR market's 27%. Although revenue growth is forecast at a moderate 12% per year, it still surpasses the market average of 9.1%. Despite a low projected return on equity of 12.1%, TSE appears undervalued based on discounted cash flow analysis.

- Upon reviewing our latest growth report, TSE's projected financial performance appears quite optimistic.

- Navigate through the intricacies of TSE with our comprehensive financial health report here.

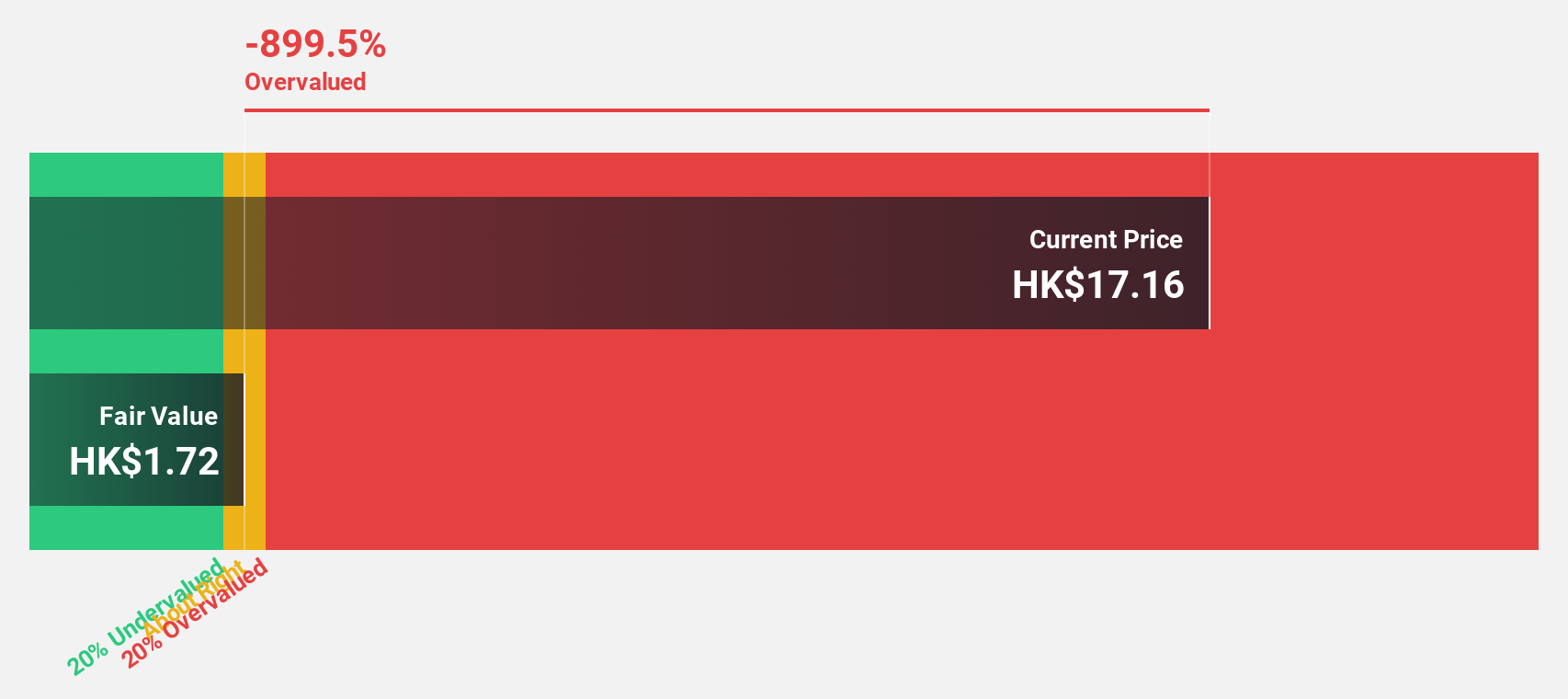

Hangzhou SF Intra-city Industrial (SEHK:9699)

Overview: Hangzhou SF Intra-city Industrial Co., Ltd. is an investment holding company that offers intra-city on-demand delivery services in the People's Republic of China, with a market cap of HK$8.07 billion.

Operations: The company generates revenue of CN¥13.52 billion from its intra-city on-demand delivery service business in the People's Republic of China.

Estimated Discount To Fair Value: 44%

Hangzhou SF Intra-city Industrial is trading at HK$8.79, well below its fair value estimate of HK$15.69, suggesting undervaluation based on cash flows. The company has recently turned profitable and anticipates earnings growth of 56.3% annually, significantly outpacing the Hong Kong market's average. Despite revenue growth projected at 19.3% per year being slower than some peers, it still exceeds the market average of 7.8%.

- Our growth report here indicates Hangzhou SF Intra-city Industrial may be poised for an improving outlook.

- Take a closer look at Hangzhou SF Intra-city Industrial's balance sheet health here in our report.

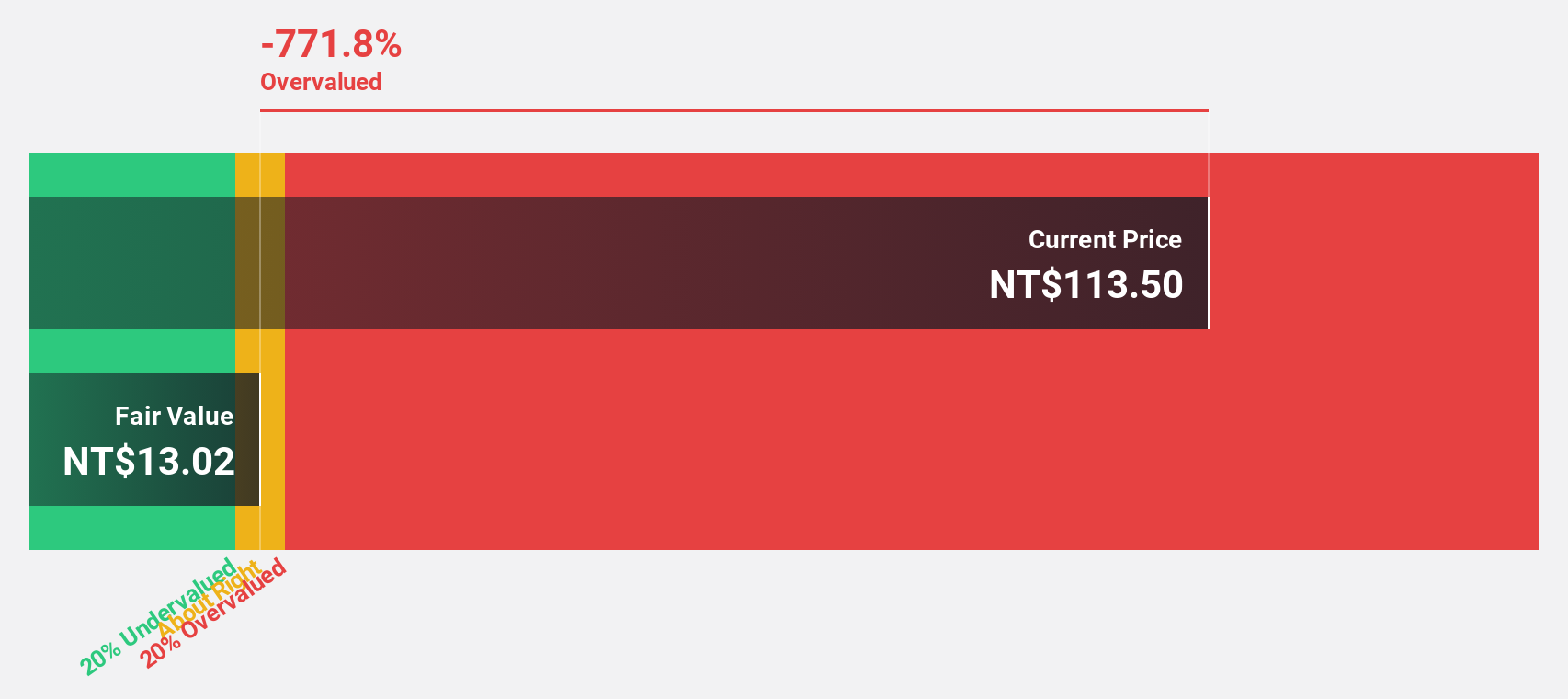

Global PMX (TWSE:4551)

Overview: Global PMX Co., Ltd. is involved in the manufacturing, processing, and sale of precision metal components for automotive products, hard disk drives, medical equipment, and various industrial products across major markets such as the United States, China, Germany, France, Italy, and Japan with a market cap of NT$12.33 billion.

Operations: The company's revenue from metal processors and fabrication amounts to NT$7.32 billion.

Estimated Discount To Fair Value: 42%

Global PMX is trading at NT$109, significantly below its estimated fair value of NT$188, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow 30.7% annually, outpacing the Taiwanese market average. Recent earnings reports show increased sales and net income compared to last year. However, the forecasted Return on Equity remains low at 12.7%, and its dividend track record is unstable despite strong revenue growth projections of 13.1% annually.

- The analysis detailed in our Global PMX growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Global PMX stock in this financial health report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 903 Undervalued Stocks Based On Cash Flows by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4551

Global PMX

Manufactures, processes, and sells precision metal components for automotive products, hard disk drives, medical equipment, and various industrial products primarily in the United States, China, Germany, France, Italy, and Japan.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives