- Hong Kong

- /

- Infrastructure

- /

- SEHK:871

Introducing China Dredging Environment Protection Holdings (HKG:871), The Stock That Collapsed 95%

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Anyone who held China Dredging Environment Protection Holdings Limited (HKG:871) for five years would be nursing their metaphorical wounds since the share price dropped 95% in that time. We also note that the stock has performed poorly over the last year, with the share price down 50%. The falls have accelerated recently, with the share price down 16% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for China Dredging Environment Protection Holdings

China Dredging Environment Protection Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade China Dredging Environment Protection Holdings reduced its trailing twelve month revenue by 9.7% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 46% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

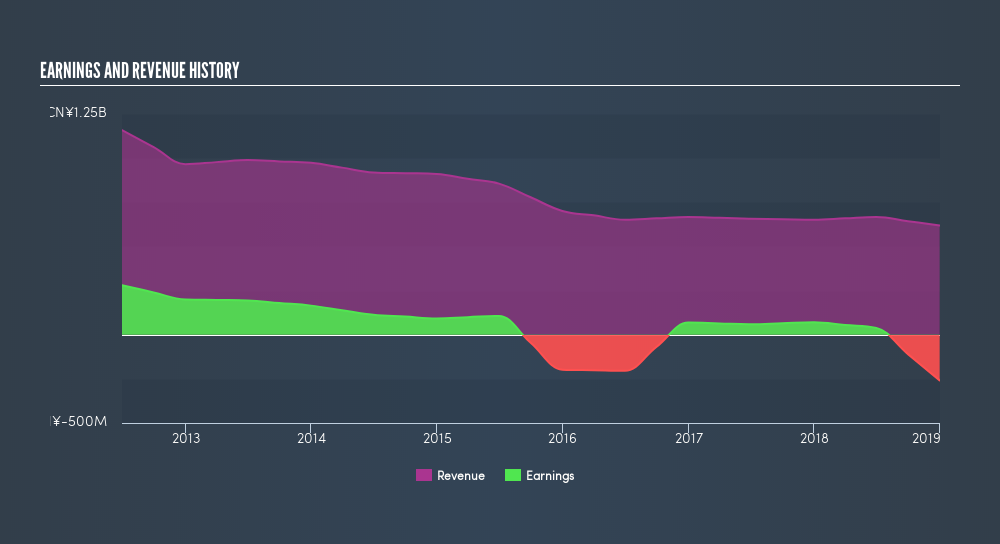

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We regret to report that China Dredging Environment Protection Holdings shareholders are down 50% for the year. Unfortunately, that's worse than the broader market decline of 0.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 46% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:871

China Dredging Environment Protection Holdings

An investment holding company, engages in dredging business in Mainland China and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives