- Hong Kong

- /

- Infrastructure

- /

- SEHK:871

China Dredging Environment Protection Holdings Limited's (HKG:871) Shares Leap 64% Yet They're Still Not Telling The Full Story

The China Dredging Environment Protection Holdings Limited (HKG:871) share price has done very well over the last month, posting an excellent gain of 64%. The last month tops off a massive increase of 146% in the last year.

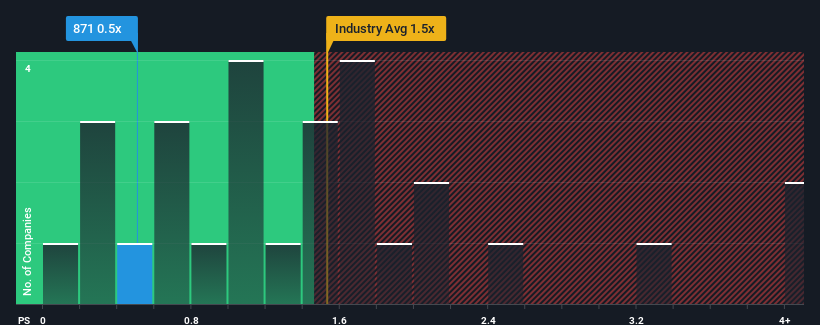

Even after such a large jump in price, it would still be understandable if you think China Dredging Environment Protection Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.5x, considering almost half the companies in Hong Kong's Infrastructure industry have P/S ratios above 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for China Dredging Environment Protection Holdings

What Does China Dredging Environment Protection Holdings' P/S Mean For Shareholders?

For example, consider that China Dredging Environment Protection Holdings' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for China Dredging Environment Protection Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as China Dredging Environment Protection Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 2.7% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 31% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 7.1%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that China Dredging Environment Protection Holdings' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Despite China Dredging Environment Protection Holdings' share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see China Dredging Environment Protection Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Having said that, be aware China Dredging Environment Protection Holdings is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of China Dredging Environment Protection Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:871

China Dredging Environment Protection Holdings

An investment holding company, engages in dredging business in Mainland China and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives