Does Air China’s (SEHK:753) High October Load Factor Reflect Enduring Demand or Tactical Scheduling?

Reviewed by Sasha Jovanovic

- Air China recently announced its operating results for October 2025 and the year to date, highlighting key metrics such as passengers carried, cargo volumes, and passenger load factors.

- An interesting insight from the latest disclosure is the 85.3% passenger load factor for October, providing a window into operational efficiency during the month.

- We'll explore how consistent passenger demand, as seen in Air China's October load factor, informs the company's broader investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Air China's Investment Narrative?

Being a shareholder in Air China asks you to be confident in the airline's ability to efficiently convert travel demand into sustainable profits despite volatile industry conditions. The recent October operating results, showing an 85.3% passenger load factor and robust traffic, point to steady demand and operational efficiency, offering incremental support to short-term momentum. However, these positive figures come amidst significant board changes and the pending execution of a large private placement, both of which may reset key risks and opportunities facing Air China. While the operational update appears directionally positive, its immediate impact on valuation or underlying catalysts does not seem material compared with bigger variables like management turnover, the execution of strategic fundraising and a new chair taking the helm. Investors should also weigh the quality of earnings, which were previously marked by significant one-off gains, and the presence of high debt, as these may continue to shape market sentiment in the near term.

Yet, changing board leadership could introduce new uncertainties investors should be aware of.

Exploring Other Perspectives

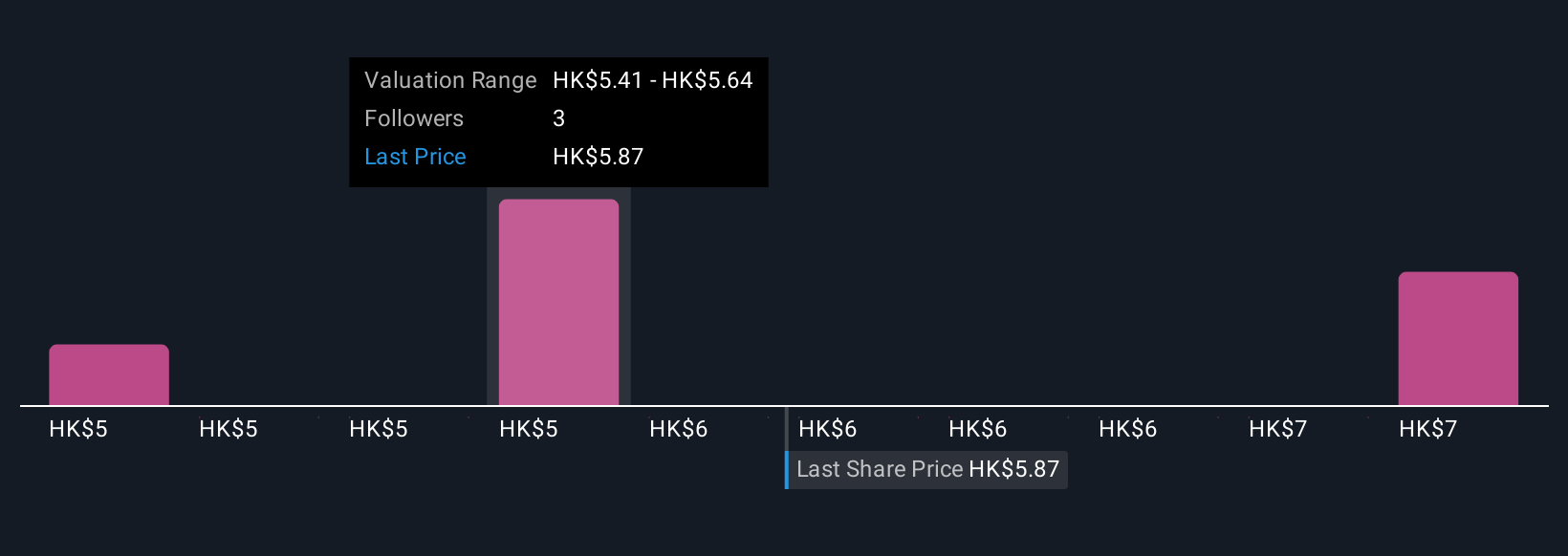

Explore 3 other fair value estimates on Air China - why the stock might be worth 29% less than the current price!

Build Your Own Air China Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air China research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Air China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air China's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:753

Air China

Provides air passenger, air cargo, and airline-related services in Mainland China, Hong Kong, Macau, Taiwan, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026