- Hong Kong

- /

- Transportation

- /

- SEHK:66

MTR (SEHK:66) Valuation in Focus After Landmark Green Loan and Leadership Transition

Reviewed by Simply Wall St

MTR (SEHK:66) has just completed a significant HKD 30 billion syndicated green loan, marking its largest return to the Asia loan market in almost ten years. Investors are keeping a close eye on this strategic financing move.

See our latest analysis for MTR.

MTR’s record-setting green loan and a seamless leadership transition have put the company back in the market spotlight, and momentum seems to be cautiously returning. While the stock’s 1-year total return is down 1.3%, a steady share price recovery since the start of the year signals that investors are warming to management’s big moves and strategic direction. However, multi-year returns remain in negative territory.

If you’re weighing what other opportunities might be emerging with sector shakeups and renewed management focus, broaden your search and discover fast growing stocks with high insider ownership

Yet with shares still trading at a modest discount to analyst price targets, and multi-year returns in the red, the key question for investors is whether MTR is now undervalued or if the market has already priced in a potential turnaround.

Most Popular Narrative: 2.2% Undervalued

MTR’s most widely followed narrative puts its fair value just above the last closing price, reflecting a marginal discount and setting the stage for debate over growth versus value. The difference is small, suggesting that every operating assumption matters for this valuation.

The planned HK$140 billion in new railway investments and HK$65 billion over 5 years for maintenance signal a major long-term CapEx cycle. If passenger growth disappoints due to remote or hybrid work or population trends, revenue growth may fail to keep pace with rising debt and funding costs, compressing net margins and dampening earnings.

Want to know the hidden drivers behind this narrow valuation gap? The most influential assumption centers on how bold expansion bets and shrinking margins shape future earnings. Wondering what projections anchor this fair value? The full narrative reveals the numbers and expectations rocking the consensus price target.

Result: Fair Value of $27.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, substantial revenue from new rail lines and international growth, along with technology upgrades, could bolster MTR’s margins beyond current expectations.

Find out about the key risks to this MTR narrative.

Another View: What Does the SWS DCF Model Suggest?

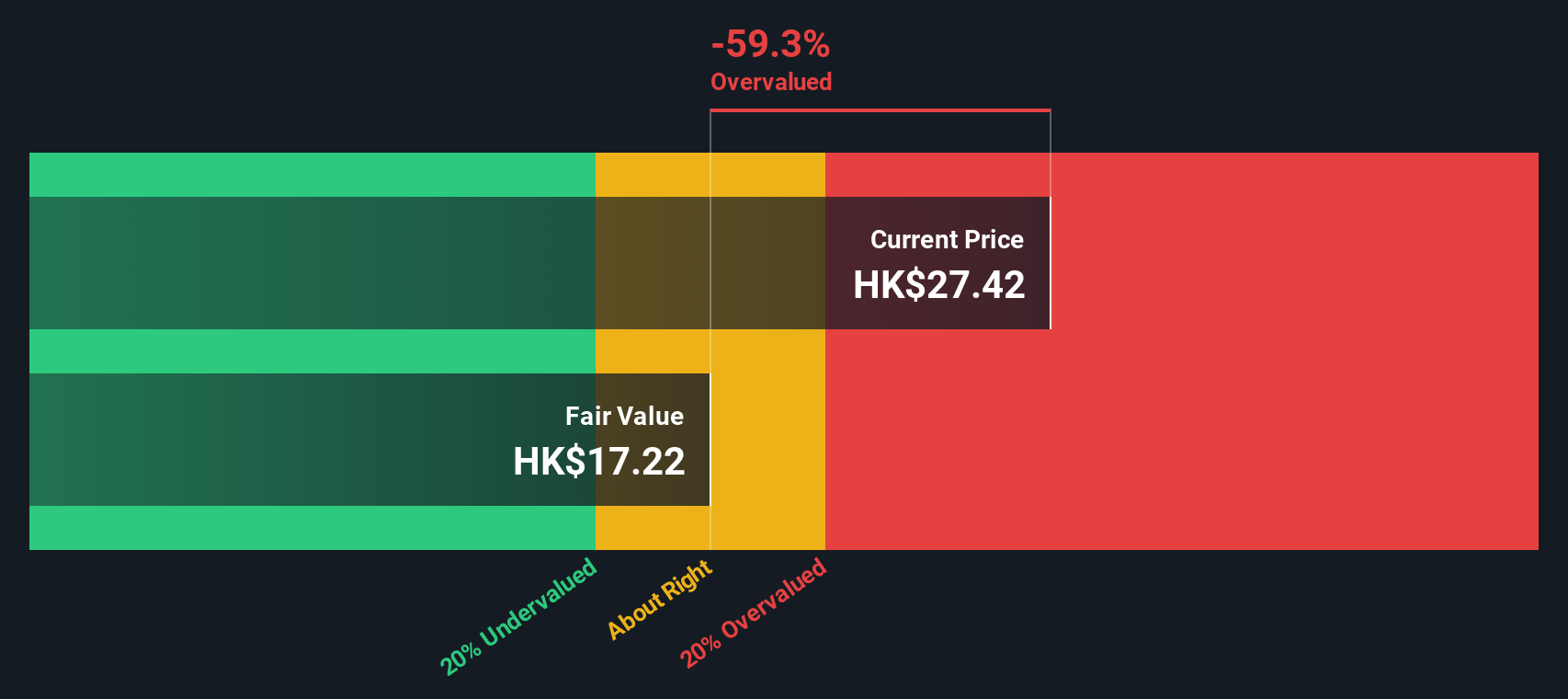

While analysts call MTR’s shares slightly undervalued based on future earnings and target price, our SWS DCF model tells a different story. Using discounted cash flow, MTR appears expensive, trading above our estimated fair value. Is the market betting too much on future growth or missing key risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MTR for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MTR Narrative

If you see things differently or want to challenge these assumptions for yourself, you can build your own data-driven narrative in just minutes. Do it your way

A great starting point for your MTR research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step up your strategy and tap into handpicked stock opportunities that could give you a smart advantage in today’s market. Don’t miss your chance to get ahead.

- Unlock hidden gains by scanning these 872 undervalued stocks based on cash flows, which is packed with shares that look undervalued based on future cash flows and expert analysis.

- Secure meaningful income by browsing these 17 dividend stocks with yields > 3%, which features companies with strong dividend yields above 3% for stable return potential.

- Ride the next technology surge with these 26 quantum computing stocks, which highlights businesses breaking barriers in quantum computing and shaping tomorrow’s innovation landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:66

MTR

Engages in railway design, construction, operation, maintenance, and investment in Hong Kong, Australia, Mainland China, Macao, Sweden, and the United Kingdom.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives