Risks To Shareholder Returns Are Elevated At These Prices For Kerry Logistics Network Limited (HKG:636)

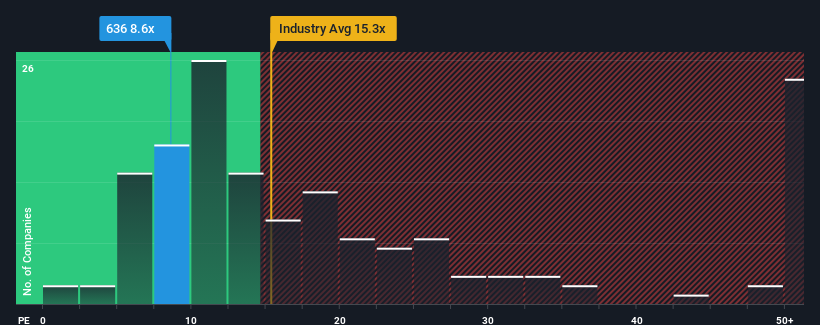

It's not a stretch to say that Kerry Logistics Network Limited's (HKG:636) price-to-earnings (or "P/E") ratio of 8.6x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, Kerry Logistics Network's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Kerry Logistics Network

Is There Some Growth For Kerry Logistics Network?

There's an inherent assumption that a company should be matching the market for P/E ratios like Kerry Logistics Network's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 62%. Still, the latest three year period has seen an excellent 70% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 6.2% per annum as estimated by the ten analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 15% per year, which is noticeably more attractive.

In light of this, it's curious that Kerry Logistics Network's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Kerry Logistics Network currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 1 warning sign for Kerry Logistics Network that we have uncovered.

Of course, you might also be able to find a better stock than Kerry Logistics Network. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if KLN Logistics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:636

KLN Logistics Group

An investment holding company, provides logistics services in Hong Kong, Mainland China, the rest of Asia, the Americas, Europe, the Middle East, Africa, and Oceania.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives