How Is World-Link Logistics (Asia) Holding's (HKG:6083) CEO Paid Relative To Peers?

Kwong Fat Yeung has been the CEO of World-Link Logistics (Asia) Holding Limited (HKG:6083) since 2015, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for World-Link Logistics (Asia) Holding.

Check out our latest analysis for World-Link Logistics (Asia) Holding

Comparing World-Link Logistics (Asia) Holding Limited's CEO Compensation With the industry

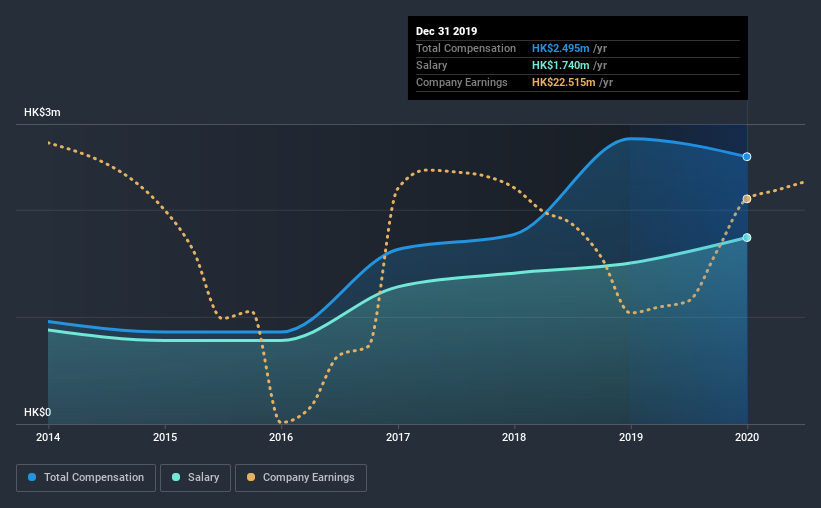

Our data indicates that World-Link Logistics (Asia) Holding Limited has a market capitalization of HK$219m, and total annual CEO compensation was reported as HK$2.5m for the year to December 2019. That's a slight decrease of 6.3% on the prior year. In particular, the salary of HK$1.74m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.2m. Accordingly, our analysis reveals that World-Link Logistics (Asia) Holding Limited pays Kwong Fat Yeung north of the industry median. Moreover, Kwong Fat Yeung also holds HK$43m worth of World-Link Logistics (Asia) Holding stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | HK$1.7m | HK$1.5m | 70% |

| Other | HK$755k | HK$1.2m | 30% |

| Total Compensation | HK$2.5m | HK$2.7m | 100% |

On an industry level, around 70% of total compensation represents salary and 30% is other remuneration. Although there is a difference in how total compensation is set, World-Link Logistics (Asia) Holding more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at World-Link Logistics (Asia) Holding Limited's Growth Numbers

Over the last three years, World-Link Logistics (Asia) Holding Limited has shrunk its earnings per share by 2.3% per year. It achieved revenue growth of 38% over the last year.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has World-Link Logistics (Asia) Holding Limited Been A Good Investment?

Given the total shareholder loss of 68% over three years, many shareholders in World-Link Logistics (Asia) Holding Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we touched on above, World-Link Logistics (Asia) Holding Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. It concerns us that EPS growth for the company is negative, while share price gains did not materialize over the last three years. On a more positive note, the company has produced a more positive revenue growth more recently. Few would argue that it's wise for the company to pay any more, before returns improve.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for World-Link Logistics (Asia) Holding that you should be aware of before investing.

Switching gears from World-Link Logistics (Asia) Holding, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade World-Link Logistics (Asia) Holding, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if World-Link Logistics (Asia) Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:6083

World-Link Logistics (Asia) Holding

An investment holding company, provides logistics services in Hong Kong and Macau.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives