As global markets continue to reach new heights, with major indices like the Dow Jones Industrial Average and S&P 500 hitting record intraday highs, investors are navigating a landscape influenced by geopolitical developments and domestic policy changes. In this dynamic environment, dividend stocks such as Sinotrans offer attractive opportunities for those seeking stable income streams amid market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.70% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

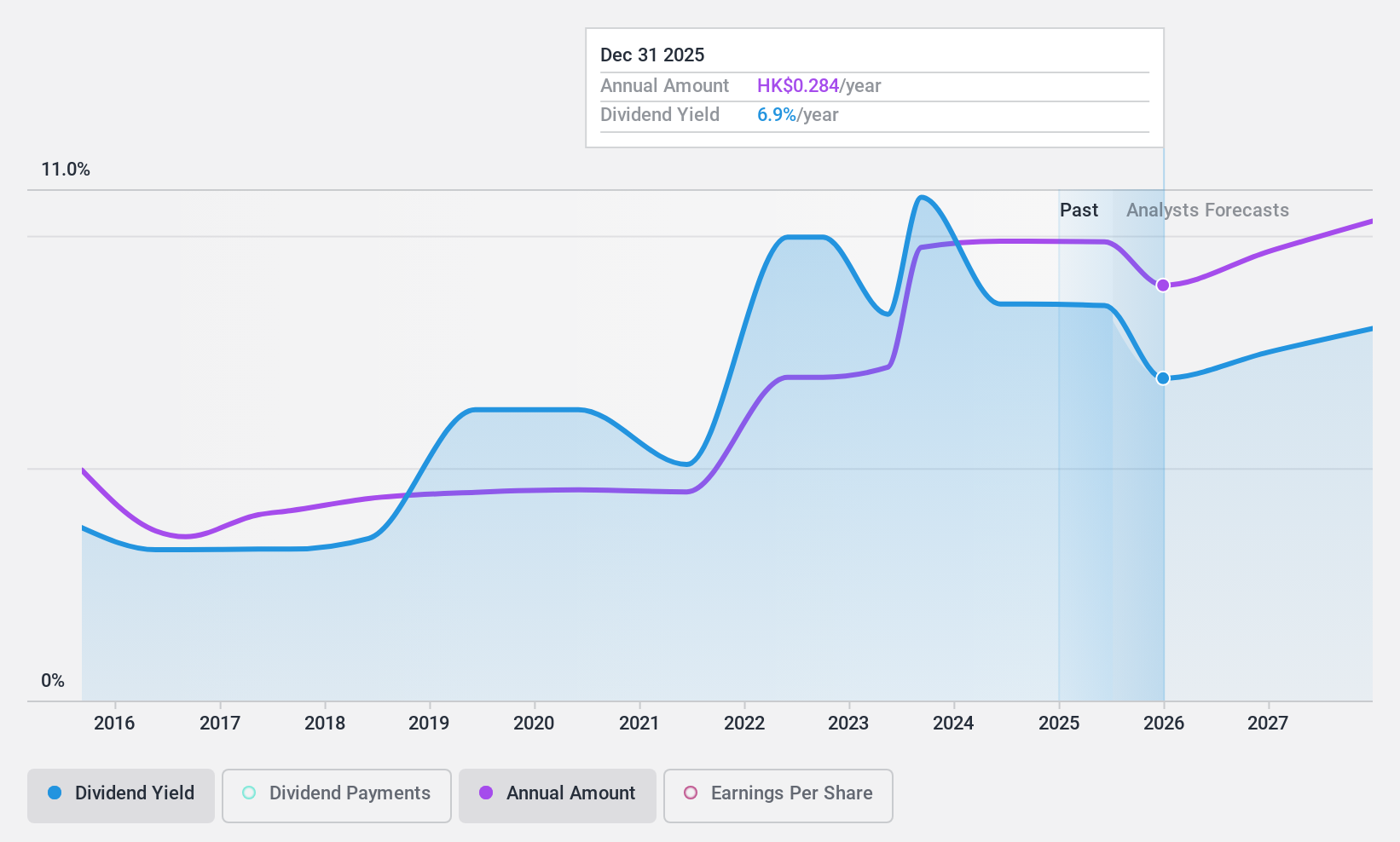

Sinotrans (SEHK:598)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinotrans Limited offers integrated logistics services mainly in the People’s Republic of China and has a market capitalization of approximately HK$36.31 billion.

Operations: Sinotrans Limited's revenue is derived from its integrated logistics services primarily in the People’s Republic of China.

Dividend Yield: 9.4%

Sinotrans offers a high dividend yield of 9.43%, ranking in the top 25% of Hong Kong payers, though it's not well covered by free cash flow with a cash payout ratio of 93.2%. Despite reasonable earnings coverage with a payout ratio of 53.6%, dividends have been volatile over the past decade. Recent earnings show increased sales but decreased net income, while upcoming share buybacks aim to enhance investor confidence and stabilize value using CNY 542 million in funds.

- Get an in-depth perspective on Sinotrans' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Sinotrans' current price could be quite moderate.

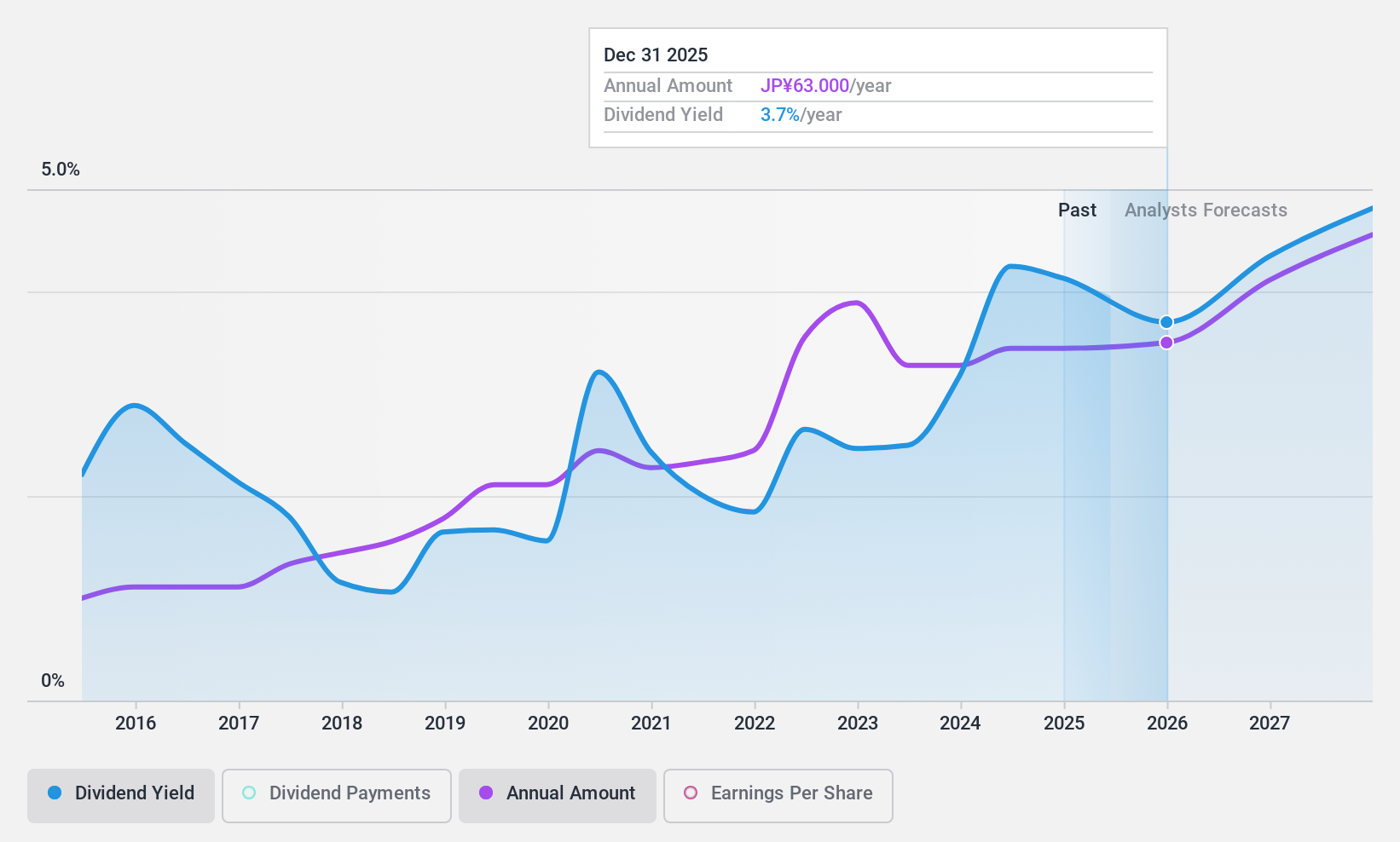

Fullcast Holdings (TSE:4848)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fullcast Holdings Co., Ltd., along with its subsidiaries, offers human resource solutions in Japan and has a market cap of ¥51.48 billion.

Operations: Fullcast Holdings Co., Ltd. generates revenue through its Short-Term Operational Support Business at ¥56.07 billion, Food and Beverage Business at ¥7.39 billion, Sales Support Business at ¥3.31 billion, and Security, Other Businesses at ¥2.39 billion.

Dividend Yield: 4.2%

Fullcast Holdings' dividend yield of 4.24% places it among the top 25% in Japan, though its track record over the past decade has been volatile. Despite this, dividends are well-covered by earnings and cash flows with payout ratios of 40.7% and 29.7%, respectively. The stock trades significantly below estimated fair value, suggesting potential upside relative to peers. Earnings growth is forecast at 9.9% annually, supporting future dividend sustainability despite past instability.

- Delve into the full analysis dividend report here for a deeper understanding of Fullcast Holdings.

- In light of our recent valuation report, it seems possible that Fullcast Holdings is trading behind its estimated value.

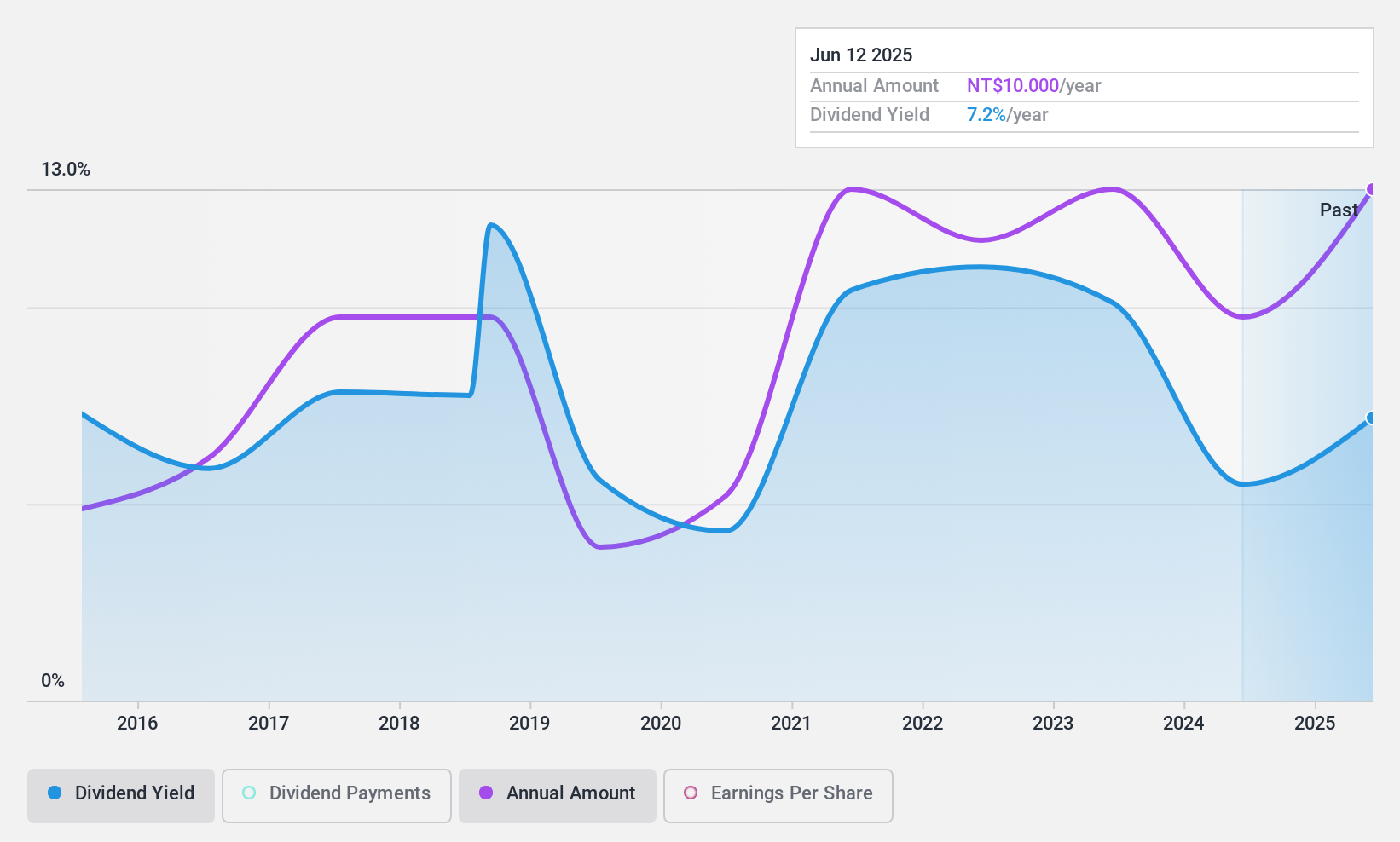

Nishoku Technology (TWSE:3679)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nishoku Technology Inc. designs and manufactures plastic injection molds, operating in Taiwan, the rest of Asia, the United States, Europe, and internationally, with a market cap of NT$8.38 billion.

Operations: Nishoku Technology Inc. generates revenue primarily from the provision of electronic components and related products, amounting to NT$4.03 billion.

Dividend Yield: 5.6%

Nishoku Technology's dividend yield of 5.64% ranks in the top 25% within Taiwan, yet its sustainability is questionable due to a high cash payout ratio of 138.1%. Earnings cover the current payout ratio of 82.6%, but dividends remain unreliable and volatile over the past decade. Recent earnings show increased revenue but decreased quarterly net income, indicating potential pressure on future payouts despite historical growth in dividend payments over ten years.

- Click here to discover the nuances of Nishoku Technology with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Nishoku Technology shares in the market.

Turning Ideas Into Actions

- Explore the 1962 names from our Top Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nishoku Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3679

Nishoku Technology

Designs and manufactures plastic injection molds in Taiwan, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet average dividend payer.