- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:560

Chu Kong Shipping Enterprises (Group) (HKG:560) Share Prices Have Dropped 60% In The Last Five Years

For many, the main point of investing is to generate higher returns than the overall market. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Chu Kong Shipping Enterprises (Group) Company Limited (HKG:560) shareholders for doubting their decision to hold, with the stock down 60% over a half decade. And we doubt long term believers are the only worried holders, since the stock price has declined 29% over the last twelve months. Unhappily, the share price slid 2.1% in the last week.

View our latest analysis for Chu Kong Shipping Enterprises (Group)

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

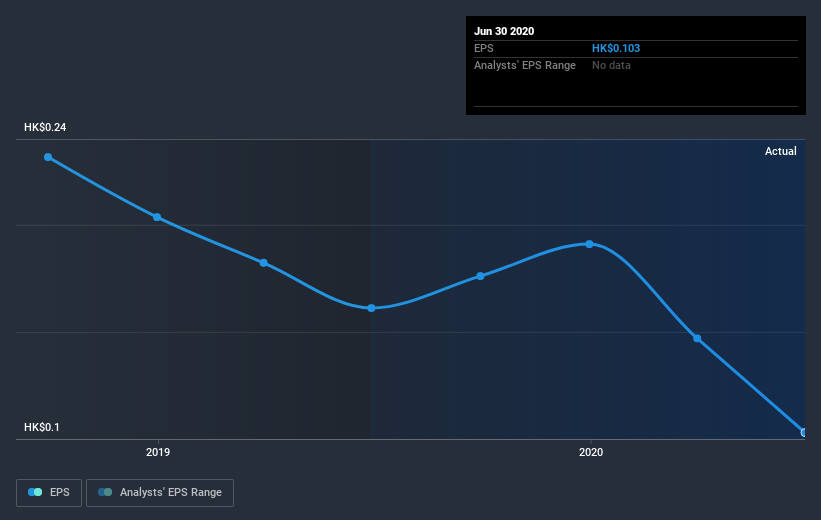

Looking back five years, both Chu Kong Shipping Enterprises (Group)'s share price and EPS declined; the latter at a rate of 18% per year. This change in EPS is reasonably close to the 17% average annual decrease in the share price. This implies that the market has had a fairly steady view of the stock. Rather, the share price has approximately tracked EPS growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Chu Kong Shipping Enterprises (Group)'s earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Chu Kong Shipping Enterprises (Group)'s total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Chu Kong Shipping Enterprises (Group) shareholders, and that cash payout explains why its total shareholder loss of 49%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Chu Kong Shipping Enterprises (Group) shareholders are down 27% for the year, but the market itself is up 8.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Chu Kong Shipping Enterprises (Group) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Chu Kong Shipping Enterprises (Group), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:560

Chu Kong Shipping Enterprises (Group)

An investment holding company, engages in the terminal logistics, waterway passenger transportation, and fuel supply businesses in Hong Kong and Mainland China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives