- Hong Kong

- /

- Infrastructure

- /

- SEHK:517

COSCO SHIPPING International (Hong Kong) (HKG:517) Is Paying Out A Larger Dividend Than Last Year

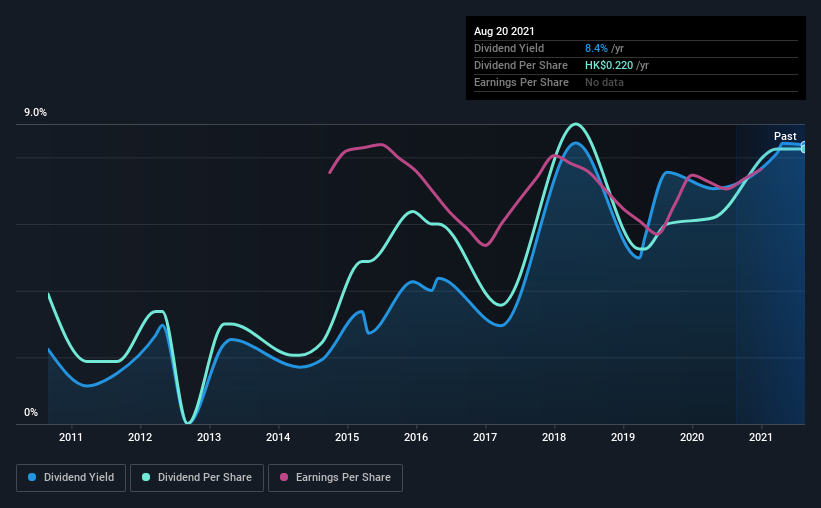

The board of COSCO SHIPPING International (Hong Kong) Co., Ltd. (HKG:517) has announced that it will be increasing its dividend by 54% on the 28th of September to HK$0.10. This will take the dividend yield from 8.4% to 9.7%, providing a nice boost to shareholder returns.

View our latest analysis for COSCO SHIPPING International (Hong Kong)

COSCO SHIPPING International (Hong Kong) Is Paying Out More Than It Is Earning

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, the company wasn't making enough to cover what it was paying to shareholders. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

Over the next year, EPS could expand by 0.2% if the company continues along the path it has been on recently. However, if the dividend continues growing along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 122% over the next year.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2011, the first annual payment was HK$0.10, compared to the most recent full-year payment of HK$0.22. This implies that the company grew its distributions at a yearly rate of about 7.8% over that duration. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. COSCO SHIPPING International (Hong Kong) might have put its house in order since then, but we remain cautious.

COSCO SHIPPING International (Hong Kong) May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Although it's important to note that COSCO SHIPPING International (Hong Kong)'s earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. So the company has struggled to grow its EPS yet it's still paying out 100% of its earnings. As they say in finance, 'past performance is not indicative of future performance', but we are not confident a company with limited earnings growth and a high payout ratio will be a star dividend-payer over the next decade.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think COSCO SHIPPING International (Hong Kong)'s payments are rock solid. The track record isn't great, and the payments are a bit high to be considered sustainable. We don't think COSCO SHIPPING International (Hong Kong) is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for COSCO SHIPPING International (Hong Kong) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:517

COSCO SHIPPING International (Hong Kong)

An investment holding company, provides shipping services in Hong Kong, the People’s Republic of China, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives