- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:3683

It's A Story Of Risk Vs Reward With Great Harvest Maeta Holdings Limited (HKG:3683)

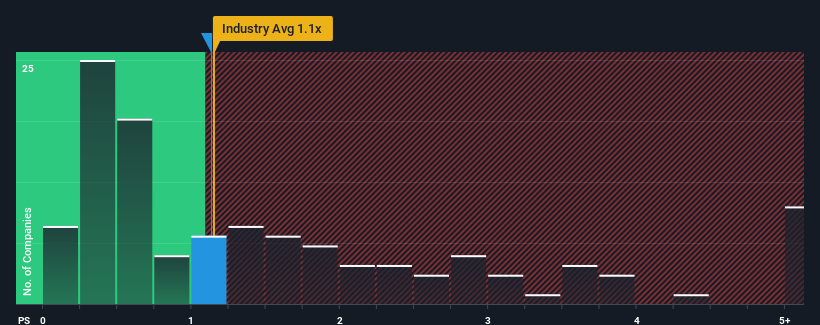

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Shipping industry in Hong Kong, you could be forgiven for feeling indifferent about Great Harvest Maeta Holdings Limited's (HKG:3683) P/S ratio of 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Great Harvest Maeta Holdings

How Has Great Harvest Maeta Holdings Performed Recently?

For instance, Great Harvest Maeta Holdings' receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Great Harvest Maeta Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Great Harvest Maeta Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Great Harvest Maeta Holdings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. Still, the latest three year period has seen an excellent 49% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to shrink 40% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we find it odd that Great Harvest Maeta Holdings is trading at a fairly similar P/S to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Great Harvest Maeta Holdings' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Great Harvest Maeta Holdings revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Great Harvest Maeta Holdings that you should be aware of.

If you're unsure about the strength of Great Harvest Maeta Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3683

Great Harvest Maeta Holdings

An investment holding company, provides dry bulk vessel chartering services worldwide.

Low with imperfect balance sheet.

Market Insights

Community Narratives