Does Guangdong Yueyun Transportation (HKG:3399) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Guangdong Yueyun Transportation Company Limited (HKG:3399) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Guangdong Yueyun Transportation

What Is Guangdong Yueyun Transportation's Net Debt?

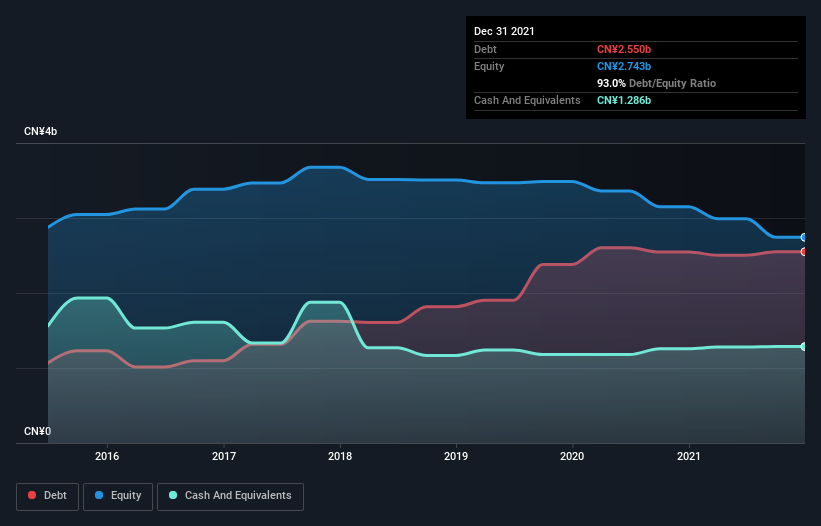

The chart below, which you can click on for greater detail, shows that Guangdong Yueyun Transportation had CN¥2.55b in debt in December 2021; about the same as the year before. However, it also had CN¥1.29b in cash, and so its net debt is CN¥1.26b.

How Healthy Is Guangdong Yueyun Transportation's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Guangdong Yueyun Transportation had liabilities of CN¥3.63b due within 12 months and liabilities of CN¥4.17b due beyond that. On the other hand, it had cash of CN¥1.29b and CN¥876.6m worth of receivables due within a year. So its liabilities total CN¥5.64b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the CN¥535.0m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Guangdong Yueyun Transportation would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Even though Guangdong Yueyun Transportation's debt is only 1.7, its interest cover is really very low at 0.021. The main reason for this is that it has such high depreciation and amortisation. These charges may be non-cash, so they could be excluded when it comes to paying down debt. But the accounting charges are there for a reason -- some assets are seen to be losing value. Either way there's no doubt the stock is using meaningful leverage. Notably, Guangdong Yueyun Transportation made a loss at the EBIT level, last year, but improved that to positive EBIT of CN¥4.4m in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Guangdong Yueyun Transportation will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Guangdong Yueyun Transportation recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

To be frank both Guangdong Yueyun Transportation's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. After considering the datapoints discussed, we think Guangdong Yueyun Transportation has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Guangdong Yueyun Transportation you should be aware of, and 2 of them are potentially serious.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3399

Guangdong Yueyun Transportation

An investment holding company, provides integrated transportation and logistics services in the People’s Republic of China.

Good value with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026