Does JD Logistics Offer Value After Recent Recovery Signs in 2025?

Reviewed by Bailey Pemberton

If you are wrestling with the question of what to do with JD Logistics stock right now, you are not alone. Shares closed at 12.89 in the latest session and while the company's price hasn’t exactly skyrocketed lately, there are clear signals that the market's perception is quietly shifting. Over the last seven days, the stock notched a 0.5% gain. Over thirty days, it's up by 1.5%, and so far this year, JD Logistics has inched forward by 1.7%. Yet, if we zoom out, the one-year performance stands at -14.0%. The story here is about a recovery waiting to happen, and the market may be recalibrating how it judges risk around logistics names in a rapidly transforming Chinese economy.

The context around these numbers matters. China’s logistics sector has seen renewed interest from both investors and analysts, especially as digitalization, supply chain reconfiguration, and ecommerce growth continue to reshape the landscape. While there hasn’t been a single blockbuster announcement tied directly to JD Logistics’ recent moves, the general pickup in logistics demand has been hard to ignore. That means even subtle market shifts could be laying the groundwork for bigger changes in the quarters ahead.

What jumps out for valuation-focused investors is JD Logistics’ value score: a full 6, indicating the company is undervalued on every one of the six major checks commonly used by analysts. This fact alone should put the stock on any bargain hunter’s radar. In the next section, I will walk you through what those valuation checks mean. Importantly, sometimes a traditional analysis is just the starting point. Stay tuned for a smarter approach to understanding JD Logistics’ worth at the end of the article.

Why JD Logistics is lagging behind its peers

Approach 1: JD Logistics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a method that estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's value. This helps investors determine what a business is truly worth compared to its current market price.

For JD Logistics, the DCF analysis starts with the company's latest twelve-month free cash flow of CN¥13.82 billion. Analysts forecast this figure to grow gradually, reaching approximately CN¥14.10 billion by 2029. Projections beyond five years rely on extrapolation, but even those suggest steady performance out to 2035. All cash flows referenced here are denominated in Chinese Yuan (CN¥), the reporting currency for JD Logistics.

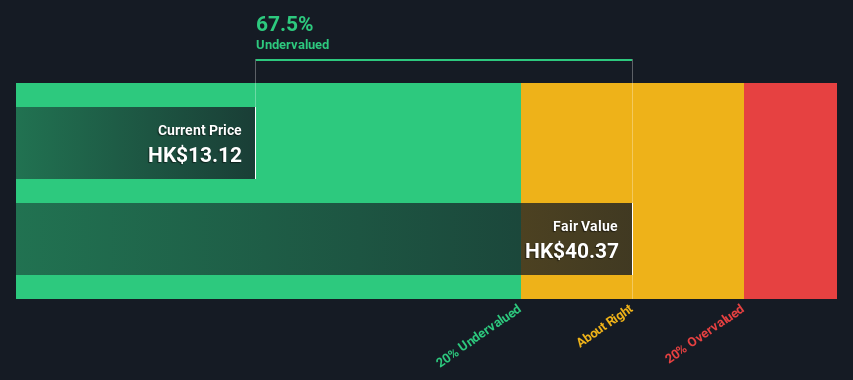

Using these cash flow forecasts, the DCF model arrives at an estimated intrinsic value for JD Logistics of HK$39.11 per share. With the stock currently trading at HK$12.89, this implies a significant 67.0% discount to fair value.

This analysis suggests the market may be underestimating JD Logistics’ long-term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests JD Logistics is undervalued by 67.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: JD Logistics Price vs Earnings

For profitable companies like JD Logistics, the Price-to-Earnings (PE) ratio is one of the most widely used ways to measure value. The PE ratio effectively tells investors how much they are paying for each dollar of earnings. This makes it a good fit for steady businesses with predictable profits.

It's important to note that what counts as a "normal" or "fair" PE ratio depends on industry trends, expected future growth, and how much risk investors are willing to take. Fast-growing companies or those in high-demand sectors typically command higher PE ratios, while firms with slower growth, smaller margins, or higher perceived risk tend to trade at lower multiples.

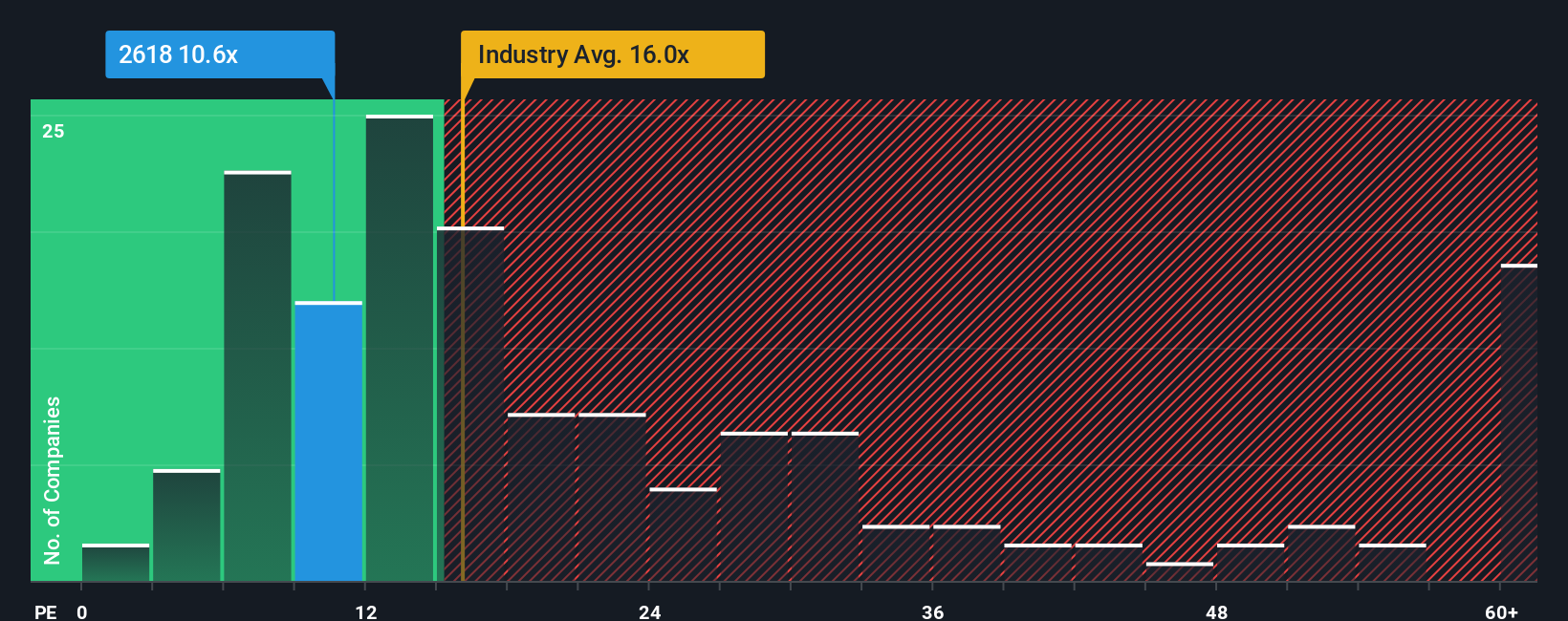

JD Logistics is currently trading at 11.2x earnings. For context, the average PE for the logistics industry sits at 16.0x, while similar peers command an even higher average of 35.2x. At first glance, JD Logistics appears noticeably cheaper than both its sector and competitors. However, a more nuanced approach is needed to factor in specifics beyond surface-level averages.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, set at 13.2x for JD Logistics, incorporates earnings growth, industry conditions, profit margins, market capitalization, and company-specific risks to produce a more tailored benchmark. Unlike simple comparisons, this method provides a more accurate measure of the value investors are getting for the unique profile of JD Logistics.

Comparing the current PE ratio of 11.2x to the Fair Ratio of 13.2x suggests the stock is modestly undervalued, as it trades below what would be considered fair based on all key financial and operational inputs.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your JD Logistics Narrative

Earlier we mentioned a better way to understand valuation, so let's introduce you to Narratives. Put simply, a Narrative is the story behind the numbers, capturing your perspective (or the community's) about a company's outlook by tying together assumptions about future revenue, earnings, and profit margins to create your own financial forecast and a resulting fair value.

By linking a company's story directly to a forecast and fair value, Narratives offer a full-picture approach that goes beyond static ratios or historical trends. On Simply Wall St's Community page, used by millions of investors, Narratives make it easy for anyone to share and compare views, whether you’re new to investing or experienced, so you can understand not just what a stock is worth, but why.

Narratives empower you to make buy and sell decisions by seeing the current price next to the fair value from your own (or others') Narrative, and since they are updated dynamically with new news or earnings releases, your investment thesis always stays current.

For example, on JD Logistics, one investor might build a bullish Narrative forecasting aggressive international expansion and margin growth, producing a higher fair value than today’s price, while another could take a conservative view about overseas risks and margin pressure and derive a much lower fair value instead.

Do you think there's more to the story for JD Logistics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2618

JD Logistics

An investment holding company, provides integrated supply chain solutions and logistics services in the People’s Republic of China.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success