In a week marked by significant economic data and earnings reports, global markets saw mixed performances with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst these fluctuations, investors often look beyond large-cap stocks to explore opportunities in smaller or newer companies that can offer unique growth potential. Penny stocks, while an outdated term, still capture the essence of investing in these lesser-known entities. By focusing on those with strong financial foundations and clear growth paths, investors might uncover valuable opportunities among penny stocks that balance affordability with potential upside.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.81B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.73 | MYR124.72M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$507.83M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR351.85M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.55 | £360.49M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR766.84M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.01 | MYR2.09B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.025 | £391.86M | ★★★★☆☆ |

Click here to see the full list of 5,818 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

SSY Group (SEHK:2005)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SSY Group Limited is an investment holding company that engages in the research, development, manufacturing, trading, and sale of pharmaceutical products to hospitals and distributors both in the People’s Republic of China and internationally, with a market cap of HK$11.24 billion.

Operations: The company generates revenue from two main segments: Intravenous Infusion Solution and Others at HK$6.30 billion, and Medical Materials at HK$402.49 million.

Market Cap: HK$11.24B

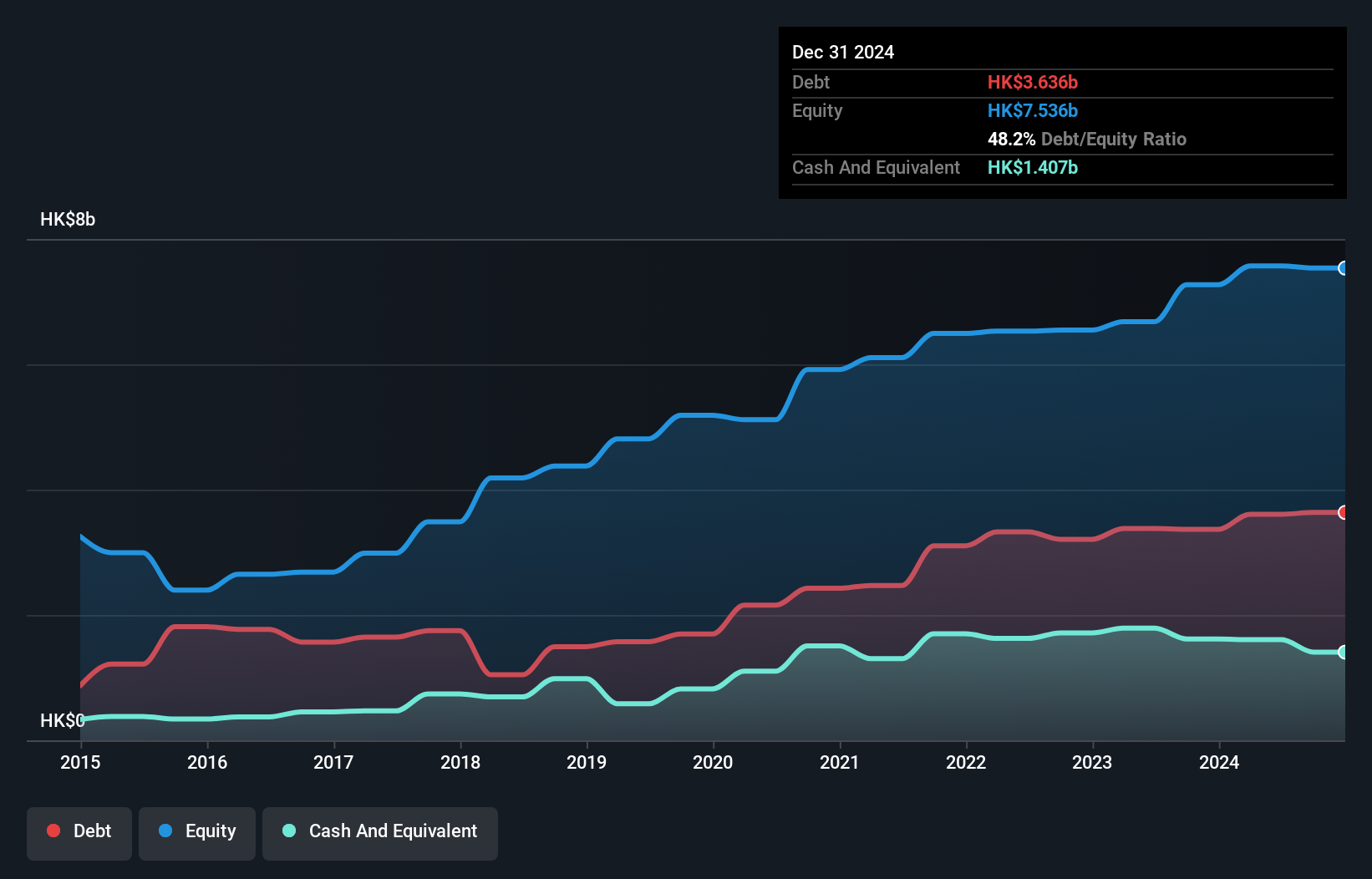

SSY Group Limited demonstrates a solid financial position with HK$5.3 billion in short-term assets exceeding both its short-term and long-term liabilities, indicating strong liquidity. The company's earnings have grown by 14.6% over the past year, surpassing industry growth and showing robust profitability with net profit margins improving to 21.1%. However, its debt-to-equity ratio has increased over five years, though it remains satisfactorily covered by operating cash flow. Recent drug approvals from China's National Medical Products Administration signal potential for future revenue growth in pharmaceutical sales, enhancing SSY's market position amidst competitive pressures in the industry.

- Click here to discover the nuances of SSY Group with our detailed analytical financial health report.

- Gain insights into SSY Group's outlook and expected performance with our report on the company's earnings estimates.

Logory Logistics Technology (SEHK:2482)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Logory Logistics Technology Co., Ltd. offers digital freight transportation services and solutions to logistics companies, cargo owners, shippers, and truck drivers in China with a market cap of HK$1.07 billion.

Operations: The company generates CN¥6.26 billion in revenue from its digital freight businesses and related services.

Market Cap: HK$1.07B

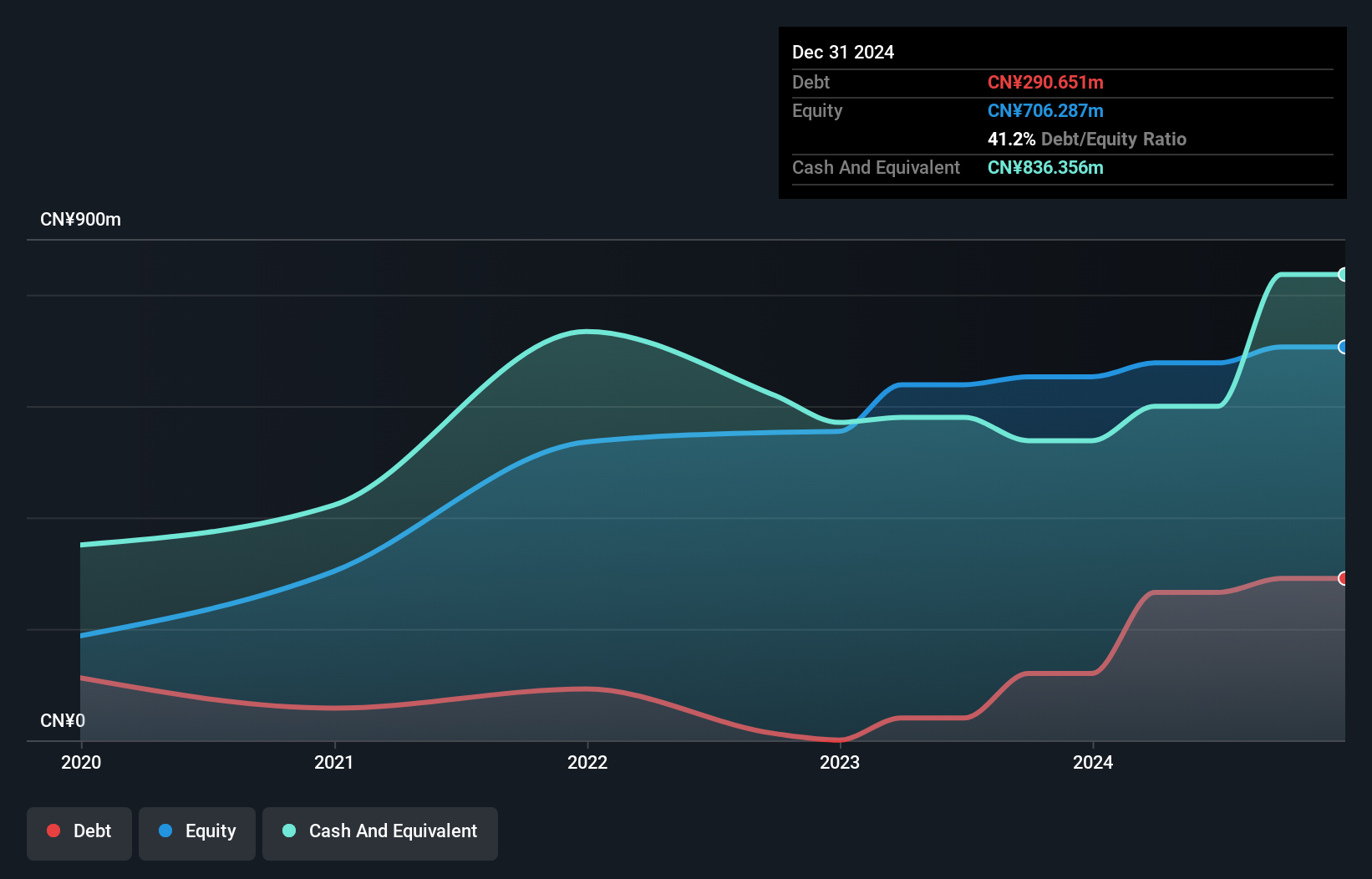

Logory Logistics Technology Co., Ltd. has recently transitioned to profitability, reporting a net income of CN¥24.04 million for the first half of 2024, compared to a loss in the previous year. Despite negative operating cash flow indicating debt is not well covered, the company maintains more cash than total debt and covers interest payments effectively with an EBIT coverage of 9.6 times. The board and management team are considered experienced with average tenures over three years. Recent changes include Ms. Wang Yao's transition from CFO to non-executive director as part of strategic adjustments following her retirement decision.

- Unlock comprehensive insights into our analysis of Logory Logistics Technology stock in this financial health report.

- Review our historical performance report to gain insights into Logory Logistics Technology's track record.

Yunhong Guixin Group Holdings (SEHK:8349)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yunhong Guixin Group Holdings Limited is an investment holding company involved in the research, development, production, and sale of fiberglass reinforced plastic products in China, with a market capitalization of HK$436 million.

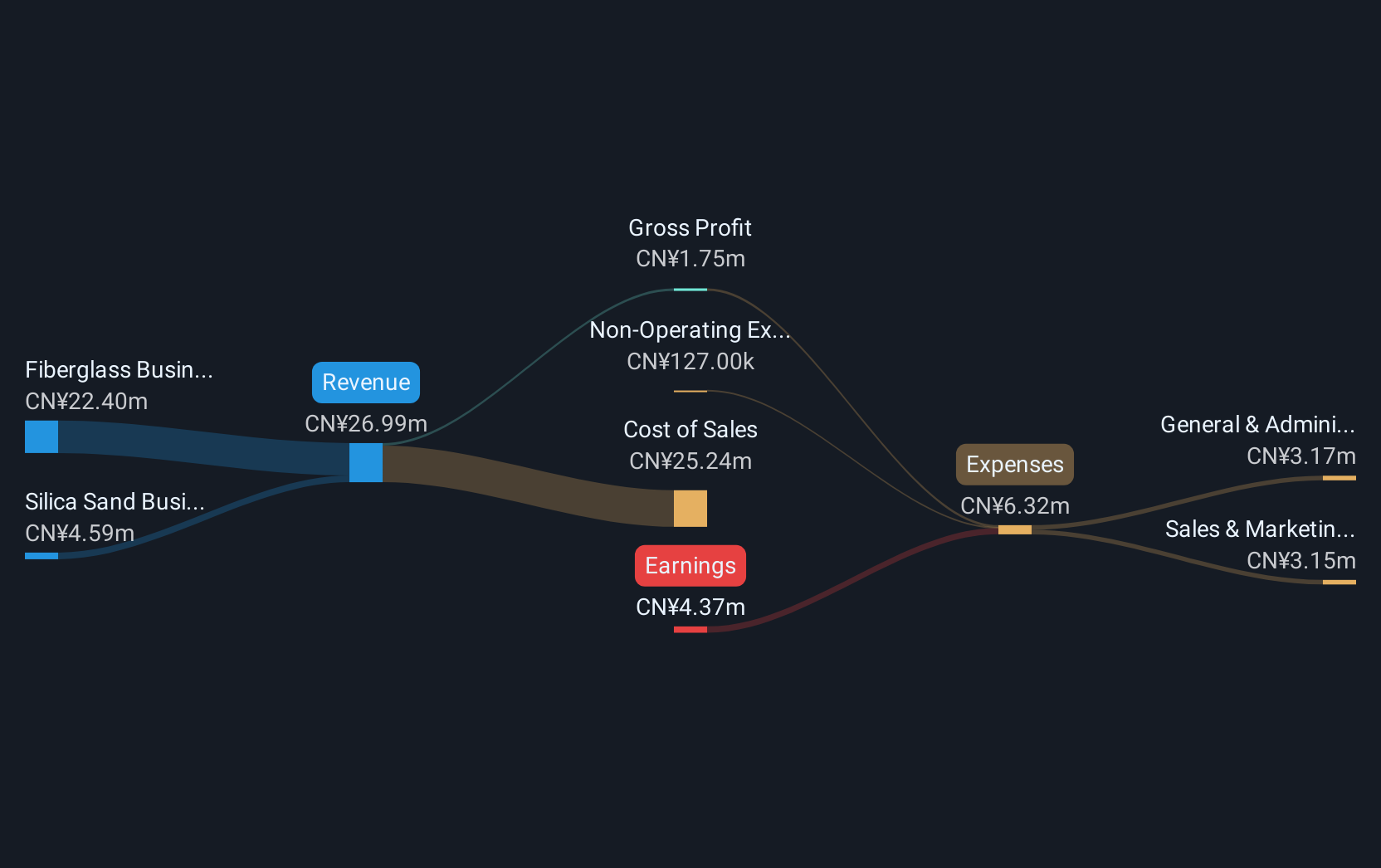

Operations: The company's revenue is primarily derived from its Fiberglass Business, which generated CN¥36.44 million.

Market Cap: HK$436M

Yunhong Guixin Group Holdings is navigating challenges with its fiberglass business, reporting a decline in sales to CN¥16.08 million for the first half of 2024, down from CN¥25.61 million the previous year. The company remains unprofitable with an increased net loss of CN¥1.78 million, but benefits from being debt-free and having short-term assets exceeding liabilities. Recent leadership changes include appointing Ms. Jin Dan as an executive director, bringing extensive marketing experience to potentially bolster strategic direction amidst high share price volatility and ongoing financial losses over recent years.

- Take a closer look at Yunhong Guixin Group Holdings' potential here in our financial health report.

- Assess Yunhong Guixin Group Holdings' previous results with our detailed historical performance reports.

Make It Happen

- Jump into our full catalog of 5,818 Penny Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2482

Logory Logistics Technology

Provides road freight transportation services and solutions to logistics companies, cargo owners, truckers, freight brokers, and other related service providers in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives