- Hong Kong

- /

- Infrastructure

- /

- SEHK:177

We Think Jiangsu Expressway (HKG:177) Is Taking Some Risk With Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Jiangsu Expressway Company Limited (HKG:177) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Jiangsu Expressway

How Much Debt Does Jiangsu Expressway Carry?

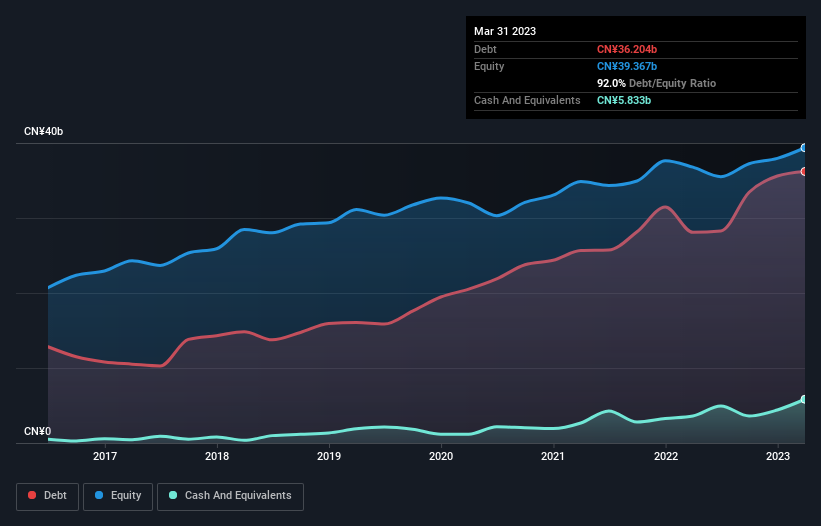

As you can see below, at the end of March 2023, Jiangsu Expressway had CN¥36.2b of debt, up from CN¥28.1b a year ago. Click the image for more detail. On the flip side, it has CN¥5.83b in cash leading to net debt of about CN¥30.4b.

How Healthy Is Jiangsu Expressway's Balance Sheet?

We can see from the most recent balance sheet that Jiangsu Expressway had liabilities of CN¥13.3b falling due within a year, and liabilities of CN¥27.4b due beyond that. Offsetting this, it had CN¥5.83b in cash and CN¥1.32b in receivables that were due within 12 months. So it has liabilities totalling CN¥33.5b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of CN¥42.5b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Jiangsu Expressway's net debt is 4.8 times its EBITDA, which is a significant but still reasonable amount of leverage. However, its interest coverage of 1k is very high, suggesting that the interest expense on the debt is currently quite low. Unfortunately, Jiangsu Expressway saw its EBIT slide 4.1% in the last twelve months. If that earnings trend continues then its debt load will grow heavy like the heart of a polar bear watching its sole cub. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Jiangsu Expressway can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Jiangsu Expressway's free cash flow amounted to 24% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Jiangsu Expressway's net debt to EBITDA and level of total liabilities definitely weigh on it, in our esteem. But its interest cover tells a very different story, and suggests some resilience. We should also note that Infrastructure industry companies like Jiangsu Expressway commonly do use debt without problems. When we consider all the factors discussed, it seems to us that Jiangsu Expressway is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Jiangsu Expressway (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:177

Jiangsu Expressway

Engages in investment, construction, operation, and management of toll roads and bridges in the People’s Republic of China.

Average dividend payer with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026