- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1748

Introducing Xin Yuan Enterprises Group (HKG:1748), A Stock That Climbed 17% In The Last Year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can significantly boost your returns by picking above-average stocks. For example, the Xin Yuan Enterprises Group Limited (HKG:1748) share price is up 17% in the last year, clearly besting the market return of around 10% (not including dividends). That's a solid performance by our standards! Xin Yuan Enterprises Group hasn't been listed for long, so it's still not clear if it is a long term winner.

See our latest analysis for Xin Yuan Enterprises Group

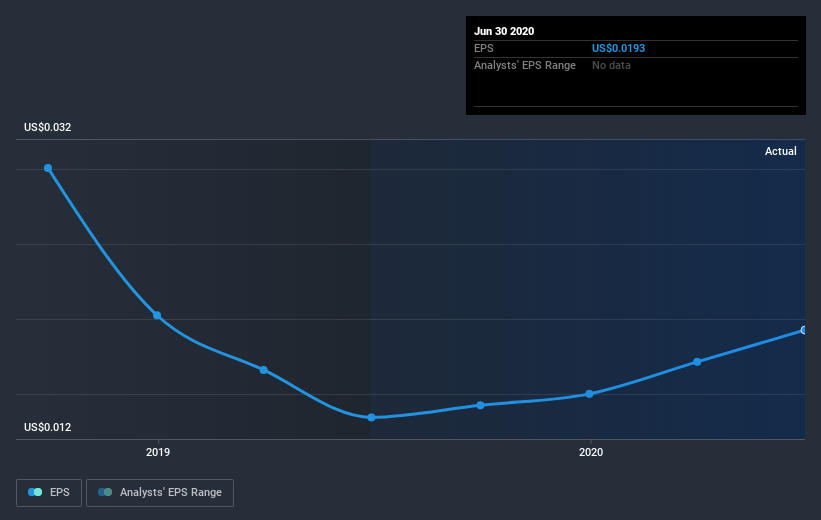

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Xin Yuan Enterprises Group was able to grow EPS by 43% in the last twelve months. This EPS growth is significantly higher than the 17% increase in the share price. Therefore, it seems the market isn't as excited about Xin Yuan Enterprises Group as it was before. This could be an opportunity. The caution is also evident in the lowish P/E ratio of 10.92.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Xin Yuan Enterprises Group boasts a total shareholder return of 17% for the last year. And the share price momentum remains respectable, with a gain of 16% in the last three months. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Xin Yuan Enterprises Group (of which 1 makes us a bit uncomfortable!) you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Xin Yuan Enterprises Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1748

Xin Yuan Enterprises Group

An investment holding company, provides asphalt tanker and bulk carrier chartering services in the People’s Republic of China, Hong Kong, and Singapore.

Flawless balance sheet and fair value.

Market Insights

Community Narratives