- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1748

Here's Why We Think Xin Yuan Enterprises Group (HKG:1748) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Xin Yuan Enterprises Group (HKG:1748). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Xin Yuan Enterprises Group with the means to add long-term value to shareholders.

View our latest analysis for Xin Yuan Enterprises Group

Xin Yuan Enterprises Group's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Xin Yuan Enterprises Group's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 39%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

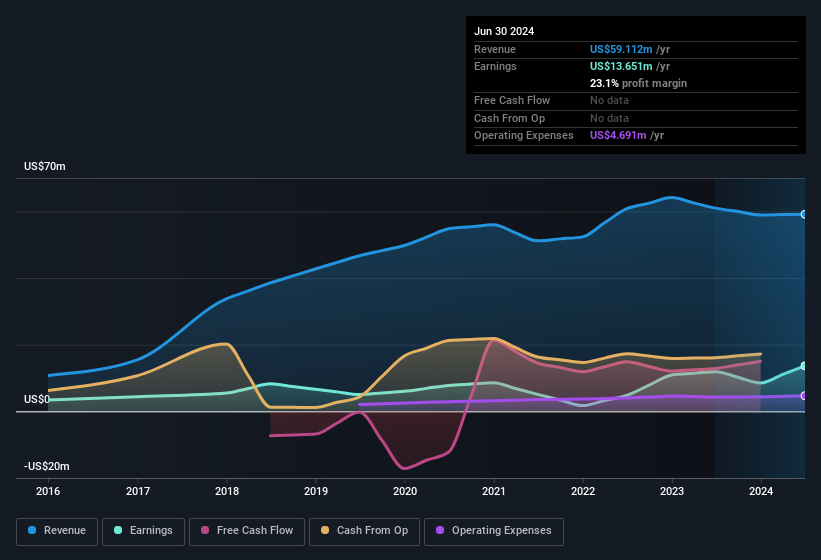

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While Xin Yuan Enterprises Group may have maintained EBIT margins over the last year, revenue has fallen. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Xin Yuan Enterprises Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Although we did see some insider selling (worth US$230m) this was overshadowed by a mountain of buying, totalling US$359m in just one year. This adds to the interest in Xin Yuan Enterprises Group because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was company insider Liangquan Fan who made the biggest single purchase, worth HK$202m, paying HK$4.85 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Xin Yuan Enterprises Group will reveal that insiders own a significant piece of the pie. In fact, they own 65% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling US$1.7b. That means they have plenty of their own capital riding on the performance of the business!

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Wenjun Xu is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Xin Yuan Enterprises Group with market caps between US$200m and US$800m is about US$422k.

The CEO of Xin Yuan Enterprises Group was paid just US$212k in total compensation for the year ending December 2023. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Xin Yuan Enterprises Group Deserve A Spot On Your Watchlist?

Xin Yuan Enterprises Group's earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Xin Yuan Enterprises Group deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Xin Yuan Enterprises Group (at least 1 which makes us a bit uncomfortable) , and understanding these should be part of your investment process.

Keen growth investors love to see insider activity. Thankfully, Xin Yuan Enterprises Group isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1748

Xin Yuan Enterprises Group

An investment holding company, provides asphalt tanker and bulk carrier chartering services in the People’s Republic of China, Hong Kong, and Singapore.

Flawless balance sheet and fair value.

Market Insights

Community Narratives