- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1732

Xiangxing International Holding Limited's (HKG:1732) 36% Jump Shows Its Popularity With Investors

Despite an already strong run, Xiangxing International Holding Limited (HKG:1732) shares have been powering on, with a gain of 36% in the last thirty days. The annual gain comes to 139% following the latest surge, making investors sit up and take notice.

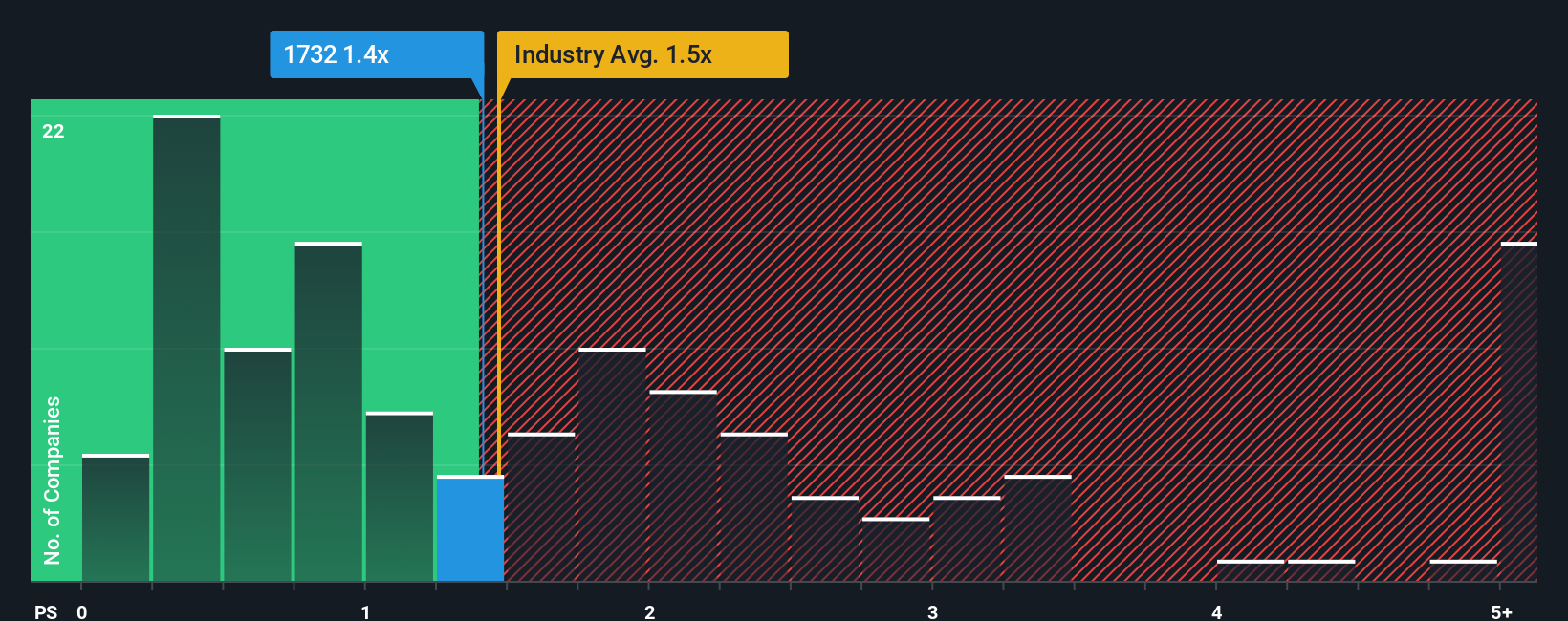

Although its price has surged higher, it's still not a stretch to say that Xiangxing International Holding's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Shipping industry in Hong Kong, where the median P/S ratio is around 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Xiangxing International Holding

What Does Xiangxing International Holding's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Xiangxing International Holding over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Xiangxing International Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Xiangxing International Holding's Revenue Growth Trending?

Xiangxing International Holding's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.2%. As a result, revenue from three years ago have also fallen 24% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

For that matter, there's little to separate that medium-term revenue trajectory on an annualised basis against the broader industry's one-year forecast for a contraction of 11% either.

In light of this, it's understandable that Xiangxing International Holding's P/S sits in line with the majority of other companies. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down in unison. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On Xiangxing International Holding's P/S

Xiangxing International Holding appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Xiangxing International Holding confirms that the company's contraction in revenue over the past three-year years is a major contributor to its industry-matching P/S, given the industry is set to decline in a similar fashion. Right now shareholders are comfortable with the P/S as they seem confident future revenue won't throw up any further unpleasant surprises. However, we're slightly cautious about the company's ability to stay its recent medium-term course and resist further pain to its business from the broader industry turmoil. For now though, it's hard to see the share price moving strongly in either direction unless there's a material change to operating conditions.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Xiangxing International Holding (of which 1 is significant!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1732

Xiangxing International Holding

An investment holding company, provides intra-port services, logistics services, and supply chain operations in the People’s Republic of China.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives