- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:137

Would Shareholders Who Purchased Jinhui Holdings' (HKG:137) Stock Three Years Be Happy With The Share price Today?

It is a pleasure to report that the Jinhui Holdings Company Limited (HKG:137) is up 47% in the last quarter. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 24% in the last three years, significantly under-performing the market.

View our latest analysis for Jinhui Holdings

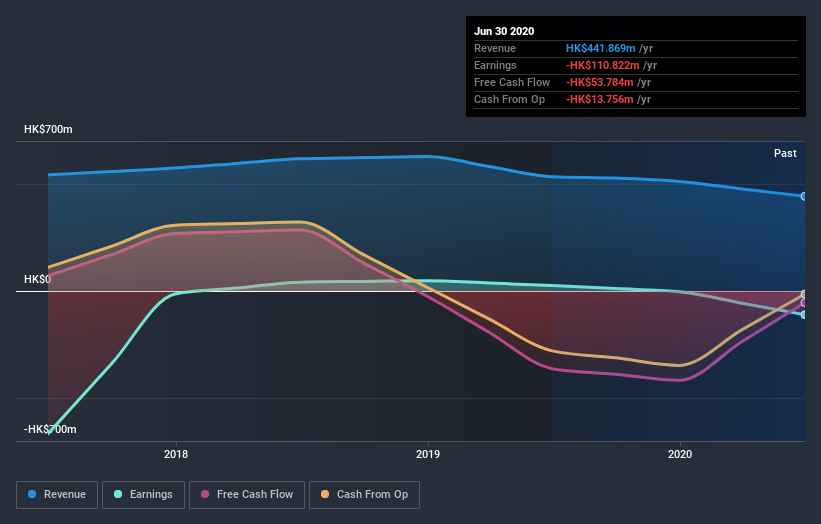

Given that Jinhui Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Jinhui Holdings' revenue dropped 6.6% per year. That is not a good result. The stock has disappointed holders over the last three years, falling 8%, annualized. That makes sense given the lack of either profits or revenue growth. Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Jinhui Holdings shareholders gained a total return of 11% during the year. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 4% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Jinhui Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Jinhui Holdings , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Jinhui Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:137

Jinhui Holdings

An investment holding company, engages in ship chartering and owning activities worldwide.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives