- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1308

Is SITC International Holdings (HKG:1308) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, SITC International Holdings Company Limited (HKG:1308) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for SITC International Holdings

What Is SITC International Holdings's Net Debt?

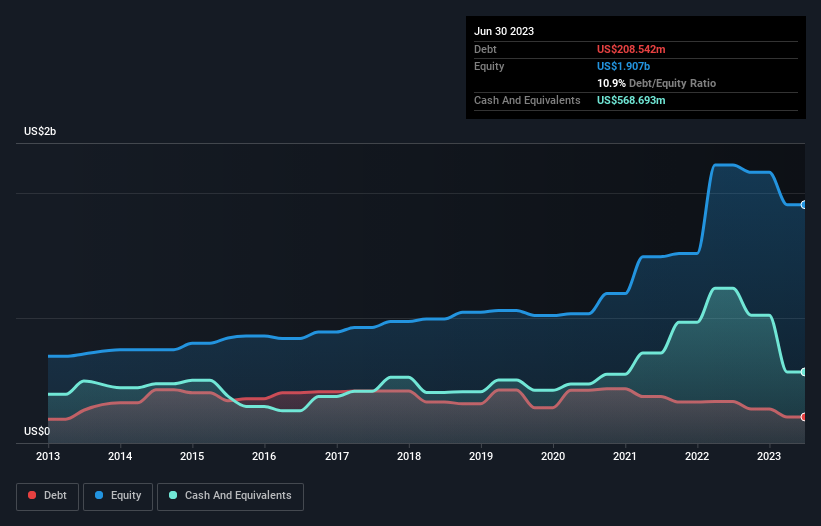

You can click the graphic below for the historical numbers, but it shows that SITC International Holdings had US$208.5m of debt in June 2023, down from US$332.2m, one year before. However, its balance sheet shows it holds US$568.7m in cash, so it actually has US$360.2m net cash.

A Look At SITC International Holdings' Liabilities

The latest balance sheet data shows that SITC International Holdings had liabilities of US$476.6m due within a year, and liabilities of US$309.7m falling due after that. Offsetting this, it had US$568.7m in cash and US$99.8m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$117.7m.

Since publicly traded SITC International Holdings shares are worth a total of US$4.86b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, SITC International Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

In fact SITC International Holdings's saving grace is its low debt levels, because its EBIT has tanked 47% in the last twelve months. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if SITC International Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While SITC International Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, SITC International Holdings recorded free cash flow worth a fulsome 87% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that SITC International Holdings has US$360.2m in net cash. And it impressed us with free cash flow of US$769m, being 87% of its EBIT. So we are not troubled with SITC International Holdings's debt use. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example SITC International Holdings has 3 warning signs (and 2 which are a bit concerning) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1308

SITC International Holdings

A shipping logistics company, engages in the provision of integrated transportation and logistics solutions in Mainland China, Hong Kong, Taiwan, Japan, Southeast Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives