Subdued Growth No Barrier To Changan Minsheng APLL Logistics Co., Ltd. (HKG:1292) With Shares Advancing 34%

Despite an already strong run, Changan Minsheng APLL Logistics Co., Ltd. (HKG:1292) shares have been powering on, with a gain of 34% in the last thirty days. The annual gain comes to 119% following the latest surge, making investors sit up and take notice.

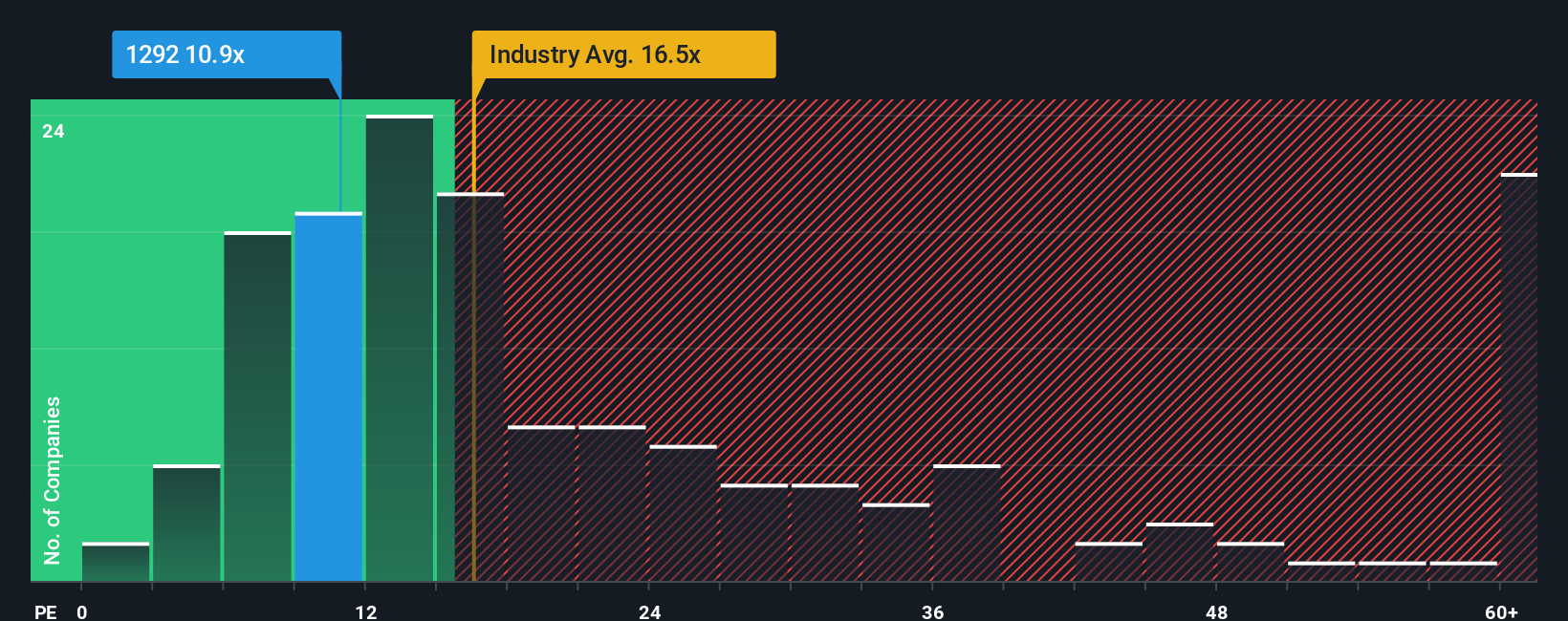

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Changan Minsheng APLL Logistics' P/E ratio of 10.9x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 12x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

The earnings growth achieved at Changan Minsheng APLL Logistics over the last year would be more than acceptable for most companies. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for Changan Minsheng APLL Logistics

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Changan Minsheng APLL Logistics' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 18% last year. The latest three year period has also seen an excellent 31% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 20% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Changan Minsheng APLL Logistics' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

Changan Minsheng APLL Logistics appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Changan Minsheng APLL Logistics currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Changan Minsheng APLL Logistics, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Changan Minsheng APLL Logistics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1292

Changan Minsheng APLL Logistics

Provides supply chain management services for automobiles and automobile raw materials, components, and parts in China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives