Should Shareholders Have Second Thoughts About A Pay Rise For Changan Minsheng APLL Logistics Co., Ltd.'s (HKG:1292) CEO This Year?

Performance at Changan Minsheng APLL Logistics Co., Ltd. (HKG:1292) has not been particularly rosy recently and shareholders will likely be holding CEO Jinggang Shi and the board accountable for this. The next AGM coming up on 25 June 2021 will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

Check out our latest analysis for Changan Minsheng APLL Logistics

Comparing Changan Minsheng APLL Logistics Co., Ltd.'s CEO Compensation With the industry

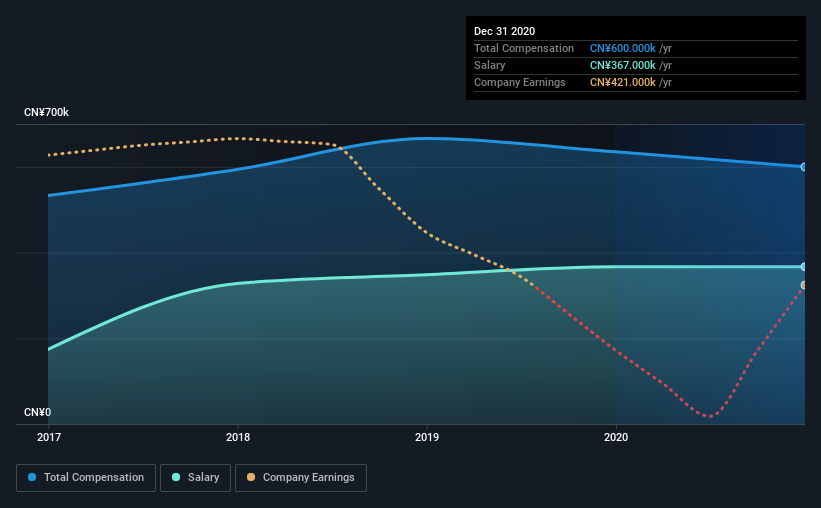

At the time of writing, our data shows that Changan Minsheng APLL Logistics Co., Ltd. has a market capitalization of HK$467m, and reported total annual CEO compensation of CN¥600k for the year to December 2020. We note that's a small decrease of 5.5% on last year. We note that the salary portion, which stands at CN¥367.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was CN¥989k. Accordingly, Changan Minsheng APLL Logistics pays its CEO under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥367k | CN¥367k | 61% |

| Other | CN¥233k | CN¥268k | 39% |

| Total Compensation | CN¥600k | CN¥635k | 100% |

On an industry level, roughly 78% of total compensation represents salary and 22% is other remuneration. Changan Minsheng APLL Logistics sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Changan Minsheng APLL Logistics Co., Ltd.'s Growth Numbers

Changan Minsheng APLL Logistics Co., Ltd. has reduced its earnings per share by 85% a year over the last three years. Its revenue is up 7.9% over the last year.

The decline in EPS is a bit concerning. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Changan Minsheng APLL Logistics Co., Ltd. Been A Good Investment?

With a total shareholder return of -36% over three years, Changan Minsheng APLL Logistics Co., Ltd. shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 3 warning signs for Changan Minsheng APLL Logistics (1 is a bit concerning!) that you should be aware of before investing here.

Switching gears from Changan Minsheng APLL Logistics, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1292

Changan Minsheng APLL Logistics

Provides supply chain management services for automobiles and automobile raw materials, components, and parts in China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives