Will PCCW’s (SEHK:8) IT Ecosystem Collaboration Reinforce Its Competitive Edge in Enterprise Digital Services?

Reviewed by Sasha Jovanovic

- Lenovo PCCW Solutions (LPS) recently launched a Next-Gen IT Ecosystem, collaborating with 18 major technology partners to deliver integrated digital transformation services for enterprises across Hong Kong and Asia Pacific.

- This initiative brings together strengths in application software, cybersecurity, office automation, and infrastructure, positioning PCCW and its partners to support Hong Kong's ambitions as a leading innovation and technology hub.

- We'll examine how the partnership-driven IT ecosystem launch could shape PCCW's business transformation and long-term enterprise growth prospects.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

PCCW Investment Narrative Recap

Owning PCCW stock today means believing in its ability to capture Hong Kong and Asia Pacific’s digital transformation wave, while managing lingering pressures in legacy media segments. The Next-Gen IT Ecosystem launch with Lenovo PCCW Solutions is a visible push into high-growth business services, but the immediate impact on core catalysts, such as enterprise revenue scale, may not be dramatic. The main risk remains persistent declines in traditional TV and event-driven revenue, as digital and streaming competition intensifies.

Among recent announcements, the affirmation of an interim dividend in August 2025 is particularly relevant. While underscoring PCCW's commitment to shareholder returns, sustaining such payouts amid ongoing losses and required digital investments can test cash flow resilience, especially if growth from new IT initiatives takes time to offset declines in legacy units.

On the other hand, investors should always keep in mind the potential vulnerability exposed by ongoing declines in PCCW's domestic TV and event business if...

Read the full narrative on PCCW (it's free!)

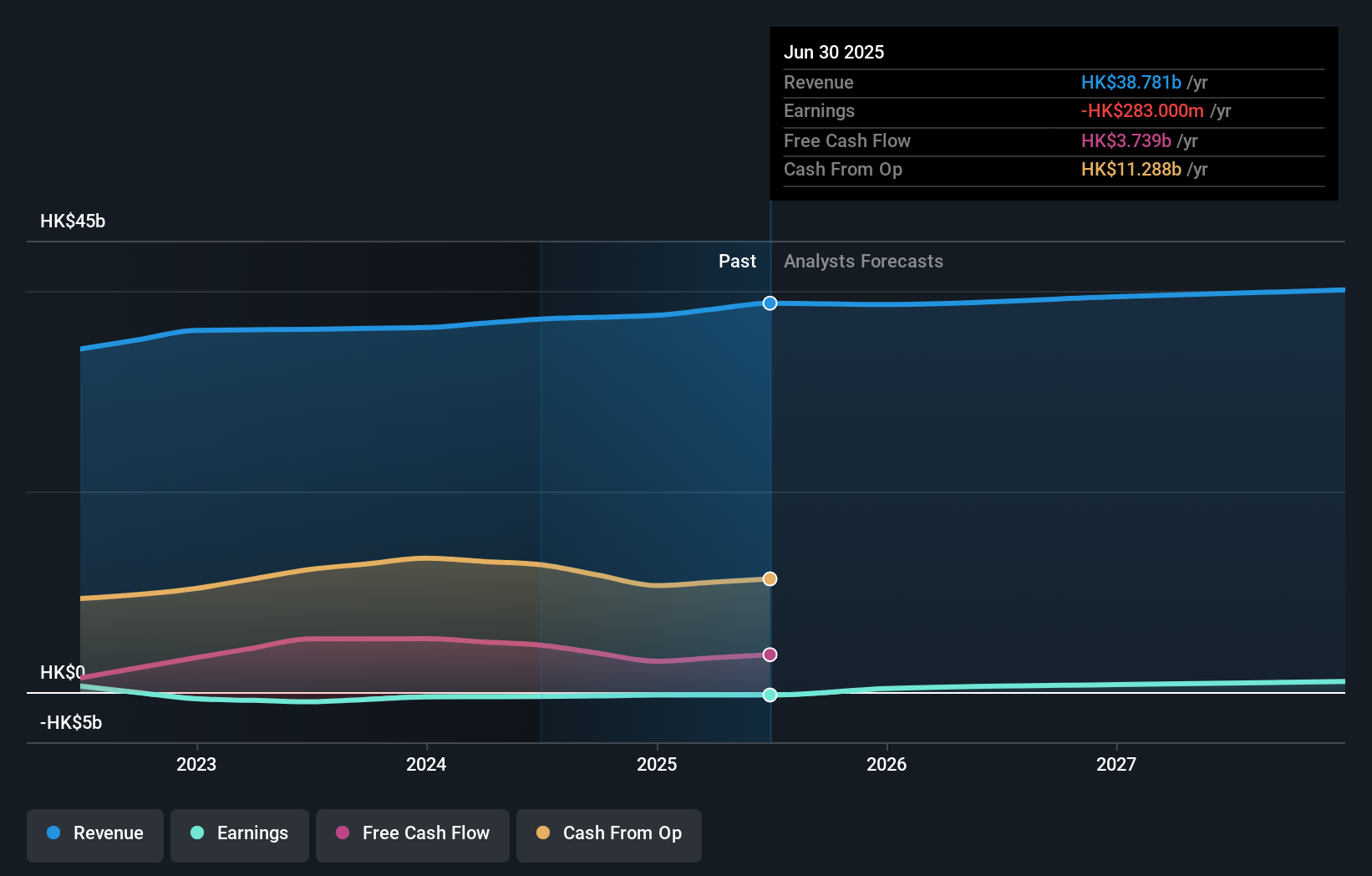

PCCW's narrative projects HK$39.9 billion revenue and HK$1.7 billion earnings by 2028. This requires a -1.0% yearly revenue decline and a HK$2.0 billion earnings increase from the current HK$-283.0 million.

Uncover how PCCW's forecasts yield a HK$5.40 fair value, a 11% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for PCCW between HK$5.40 and HK$5.67 across two analyses. While perspectives diverge, the risk of persistent revenue pressure in legacy segments highlights why opinions on PCCW’s future performance can vary meaningfully, see what your peers are forecasting and how it compares to your own view.

Explore 2 other fair value estimates on PCCW - why the stock might be worth 11% less than the current price!

Build Your Own PCCW Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PCCW research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free PCCW research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PCCW's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8

PCCW

Provides telecommunications and related services in Hong Kong, Mainland and other parts of China, Singapore, and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives