Last Update 12 Sep 25

Fair value Increased 1.89%Consensus forecasts for PCCW have improved, driven by notable increases in expected revenue growth and net profit margin, resulting in a marginal upward revision of the price target to HK$5.40.

What's in the News

- PCCW to hold a Board Meeting to approve interim results for the first half of 2025 and consider an interim dividend.

Valuation Changes

Summary of Valuation Changes for PCCW

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from HK$5.30 to HK$5.40.

- The Consensus Revenue Growth forecasts for PCCW has significantly risen from 1.0% per annum to 1.3% per annum.

- The Net Profit Margin for PCCW has significantly risen from 4.13% to 4.87%.

Key Takeaways

- Expanding digital media and enterprise services, alongside efficiency improvements, strengthens PCCW's revenue growth and margin outlook across media and connectivity segments.

- Enhanced capital structure and strategic investments enable greater focus on high-growth opportunities while supporting potential increases in shareholder returns.

- Heavy reliance on declining legacy segments, fierce OTT competition, high infrastructure spending, and geographic concentration threaten growth, profitability, and long-term revenue stability.

Catalysts

About PCCW- Provides telecommunications and related services in Hong Kong, Mainland and other parts of China, Singapore, and internationally.

- Strong growth in OTT (over-the-top) streaming subscribers and advertising revenue, particularly the 27% increase in subscription and advertising revenues and pathway to positive cash flow, positions PCCW's media businesses to benefit from increased consumption of digital content in emerging Asian markets-supporting future revenue and EBITDA expansion.

- Accelerated enterprise demand for digital transformation, high-speed fiber, and 5G mobile services, driven by remote/hybrid work and business modernization across Asia, has already fueled 4% growth in HKT's revenues and is likely to drive further top-line revenue and margin improvement as digital infrastructure adoption deepens.

- Successful execution on optimizing operating expenses through AI-driven efficiency gains, network streamlining, and branding-reflected in a 5% reduction in OpEx and improved margins-creates a foundation for higher future net margins and sustainable earnings growth.

- The deepening partnership ecosystem, both in content (e.g., expanded carrier collaboration and original content co-productions) and enterprise solutions, supports further scaling opportunities in both the media and connectivity segments, expanding addressable markets and likely boosting forward revenue and top-line growth.

- Improving capital structure through deleveraging, disciplined capex, and strong liquidity positions the company to allocate more capital toward high-growth, high-margin opportunities in digital infrastructure and OTT, while supporting the potential for increased shareholder returns through dividends or special distributions; this should enhance future net earnings.

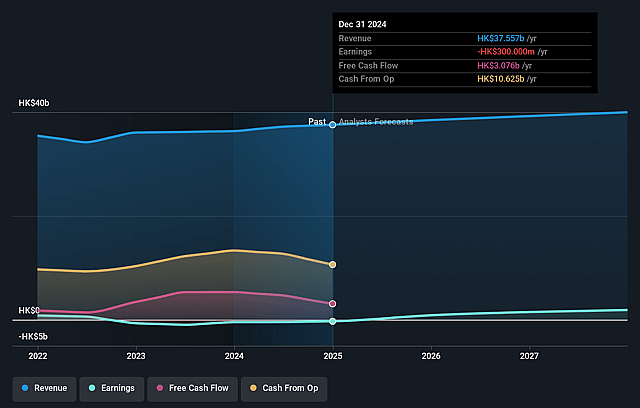

PCCW Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PCCW's revenue will decrease by 1.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.7% today to 4.1% in 3 years time.

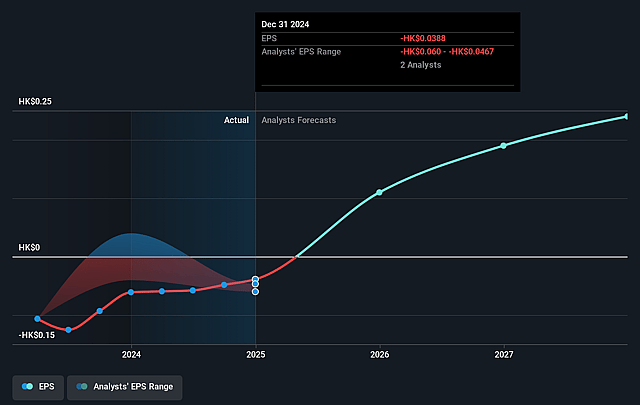

- Analysts expect earnings to reach HK$1.7 billion (and earnings per share of HK$0.13) by about September 2028, up from HK$-283.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting HK$1.9 billion in earnings, and the most bearish expecting HK$233.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.7x on those 2028 earnings, up from -142.9x today. This future PE is greater than the current PE for the HK Telecom industry at 14.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.28%, as per the Simply Wall St company report.

PCCW Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- PCCW's exposed reliance on traditional free TV and event-driven segments is evident from the revenue decline in its domestic TV and event business during the first half of 2025; this sector remains vulnerable to secular declines in linear TV consumption and volatile concert/event scheduling, which could exert ongoing pressure on future revenue stability and earnings.

- The Media/Viu OTT business faces intensifying competition from global streaming giants (e.g., Netflix, Disney+), whose scale, content budgets, and brand power may erode market share and hinder PCCW's subscriber and ARPU growth-potentially capping long-term revenue expansion and compressing margins.

- Sustained high capital expenditure in next-generation digital infrastructure (fiber, AI, 5G), while necessary to maintain competitiveness, may continue to weigh on free cash flow and constrain the company's ability to invest in higher-margin or diversified growth areas, potentially affecting net margins and long-term earnings power if returns lag investment.

- PCCW's operations remain geographically concentrated in Hong Kong and certain Asian markets; this leaves the company exposed to local economic slowdowns, demographic trends, or regulatory changes-any prolonged downturn or adverse shift in these factors could directly undermine core revenue streams and reduce overall profitability.

- Declining fixed-line telephony revenues, which were not highlighted as a growth area in the results but remain a legacy part of PCCW's business, reflect a broader industry trend toward mobile and digital solutions; continued erosion in this segment could drag on aggregate revenue growth rates and dilute group margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$5.3 for PCCW based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be HK$39.9 billion, earnings will come to HK$1.7 billion, and it would be trading on a PE ratio of 30.7x, assuming you use a discount rate of 7.3%.

- Given the current share price of HK$5.23, the analyst price target of HK$5.3 is 1.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.