- Hong Kong

- /

- Wireless Telecom

- /

- SEHK:3773

With EPS Growth And More, Yinsheng Digifavor (HKG:3773) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Yinsheng Digifavor (HKG:3773). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Quickly Is Yinsheng Digifavor Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Yinsheng Digifavor grew its EPS by 6.5% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Yinsheng Digifavor shareholders is that EBIT margins have grown from 22% to 27% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

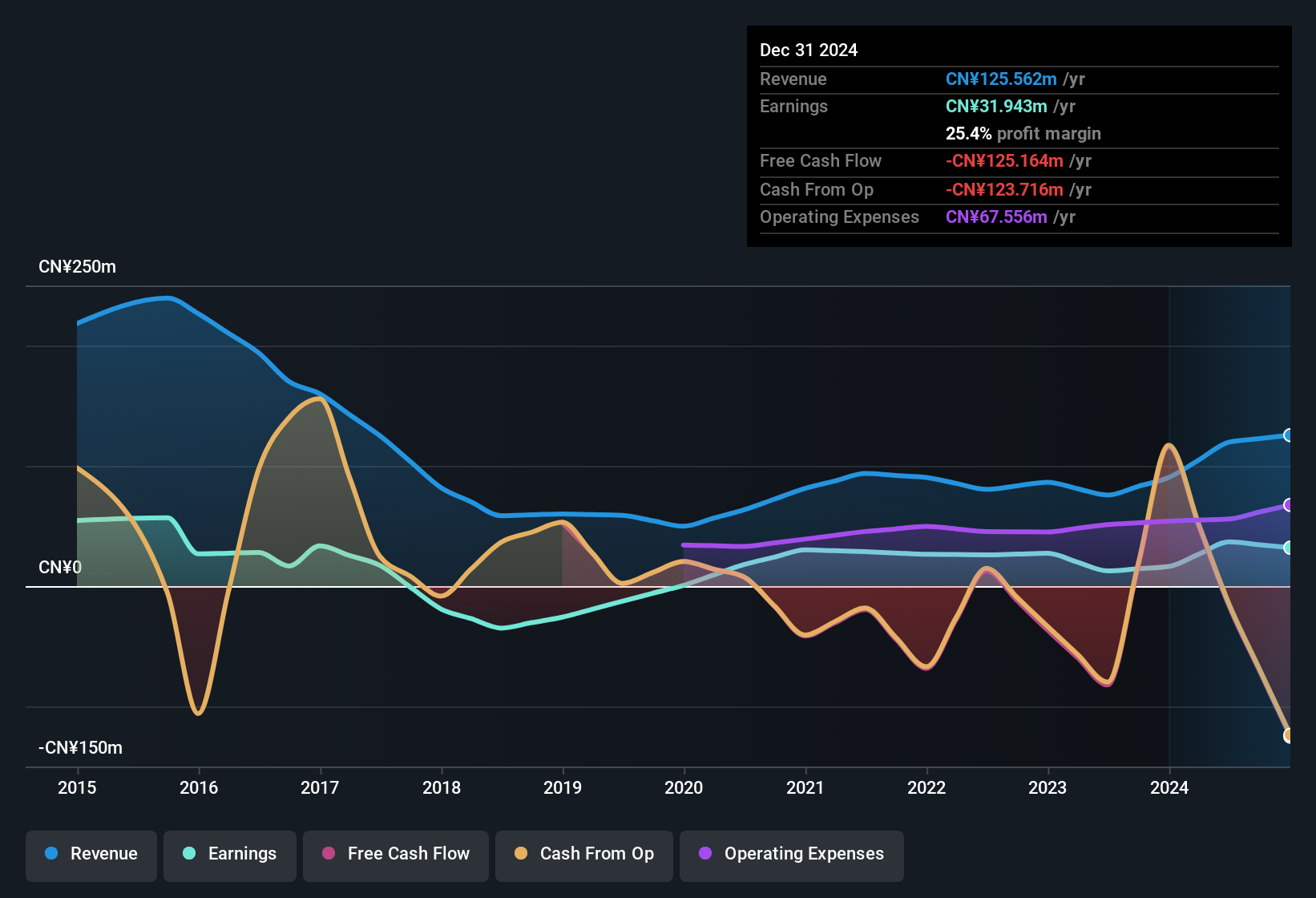

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

See our latest analysis for Yinsheng Digifavor

Since Yinsheng Digifavor is no giant, with a market capitalisation of HK$685m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Yinsheng Digifavor Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Yinsheng Digifavor shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that CEO & Executive Director Heng Guan bought CN¥71k worth of shares at an average price of around CN¥1.78. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

On top of the insider buying, we can also see that Yinsheng Digifavor insiders own a large chunk of the company. In fact, they own 67% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at CN¥462m at the current share price. That's nothing to sneeze at!

Is Yinsheng Digifavor Worth Keeping An Eye On?

One important encouraging feature of Yinsheng Digifavor is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. We should say that we've discovered 2 warning signs for Yinsheng Digifavor (1 is significant!) that you should be aware of before investing here.

Keen growth investors love to see insider activity. Thankfully, Yinsheng Digifavor isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3773

Yinsheng Digifavor

Provides mobile and data usage top-up services to mobile subscribers in the People’s Republic of China.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.