- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:1883

CITIC Telecom International Holdings' (HKG:1883) Shareholders Will Receive A Bigger Dividend Than Last Year

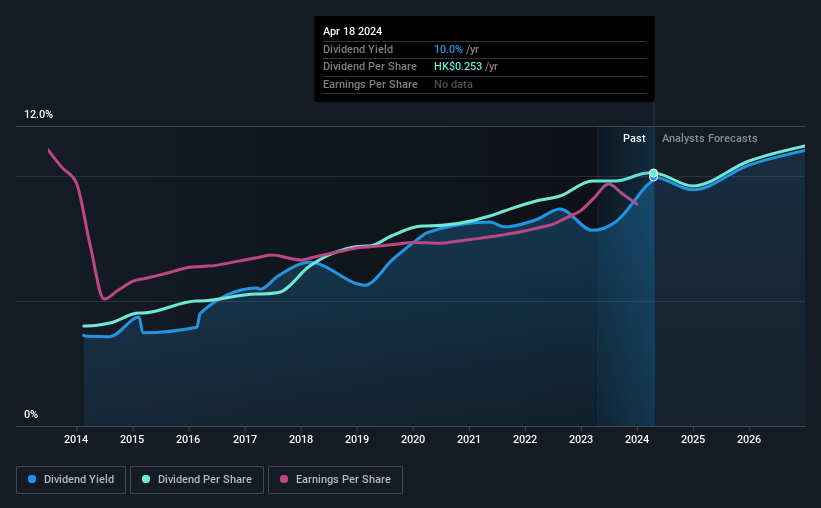

CITIC Telecom International Holdings Limited (HKG:1883) will increase its dividend on the 13th of June to HK$0.193, which is 4.3% higher than last year's payment from the same period of HK$0.185. This will take the dividend yield to an attractive 10.0%, providing a nice boost to shareholder returns.

See our latest analysis for CITIC Telecom International Holdings

CITIC Telecom International Holdings' Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before this announcement, CITIC Telecom International Holdings was paying out 76% of earnings, but a comparatively small 59% of free cash flows. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Over the next year, EPS is forecast to expand by 5.1%. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 79% - on the higher side, but we wouldn't necessarily say this is unsustainable.

CITIC Telecom International Holdings Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2014, the annual payment back then was HK$0.10, compared to the most recent full-year payment of HK$0.253. This works out to be a compound annual growth rate (CAGR) of approximately 9.7% a year over that time. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

Dividend Growth May Be Hard To Achieve

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Earnings have grown at around 4.5% a year for the past five years, which isn't massive but still better than seeing them shrink. CITIC Telecom International Holdings' earnings per share has barely grown, which is not ideal - perhaps this is why the company pays out the majority of its earnings to shareholders. When a company prefers to pay out cash to its shareholders instead of reinvesting it, this can often say a lot about that company's dividend prospects.

In Summary

Overall, we always like to see the dividend being raised, but we don't think CITIC Telecom International Holdings will make a great income stock. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. We don't think CITIC Telecom International Holdings is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Are management backing themselves to deliver performance? Check their shareholdings in CITIC Telecom International Holdings in our latest insider ownership analysis. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1883

CITIC Telecom International Holdings

An investment holding company, engages in the provision of international telecommunications services in Hong Kong, China, Macau, Singapore, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success