- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:1883

CITIC Telecom International Holdings (HKG:1883) Is Increasing Its Dividend To HK$0.17

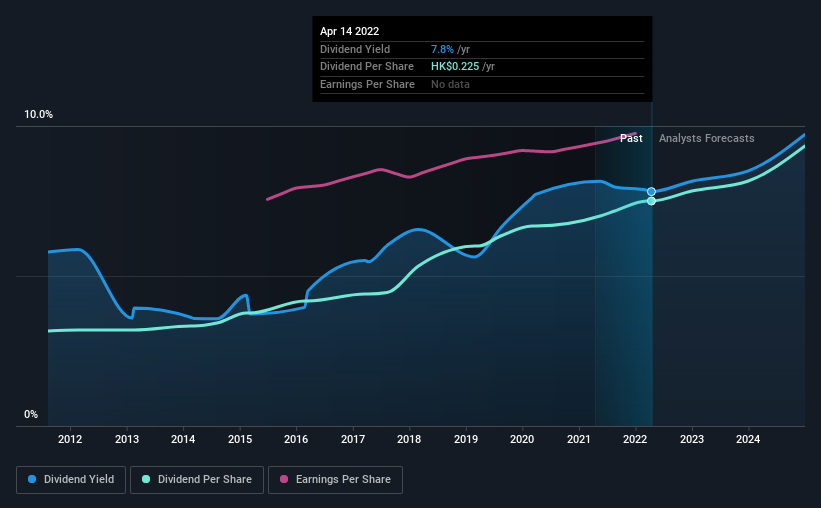

CITIC Telecom International Holdings Limited (HKG:1883) has announced that it will be increasing its dividend on the 13th of June to HK$0.17. This will take the dividend yield from 7.8% to 7.8%, providing a nice boost to shareholder returns.

View our latest analysis for CITIC Telecom International Holdings

CITIC Telecom International Holdings' Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. The last payment made up 77% of earnings, but cash flows were much higher. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Over the next year, EPS is forecast to expand by 2.5%. If the dividend continues growing along recent trends, we estimate the payout ratio could reach 83%, which is on the higher side, but certainly still feasible.

CITIC Telecom International Holdings Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2012, the dividend has gone from HK$0.095 to HK$0.23. This means that it has been growing its distributions at 9.0% per annum over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

The Dividend's Growth Prospects Are Limited

The company's investors will be pleased to have been receiving dividend income for some time. However, CITIC Telecom International Holdings has only grown its earnings per share at 3.2% per annum over the past five years. Earnings are not growing quickly at all, and the company is paying out most of its profit as dividends. When the rate of return on reinvestment opportunities falls below a certain minimum level, companies often elect to pay a larger dividend instead. This is why many mature companies often have larger dividend yields.

Our Thoughts On CITIC Telecom International Holdings' Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. See if management have their own wealth at stake, by checking insider shareholdings in CITIC Telecom International Holdings stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1883

CITIC Telecom International Holdings

An investment holding company, engages in the provision of international telecommunications services in Hong Kong, China, Macau, Singapore, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success